- United Kingdom

- /

- Commercial Services

- /

- AIM:MAI

Market Might Still Lack Some Conviction On Maintel Holdings Plc (LON:MAI) Even After 26% Share Price Boost

Despite an already strong run, Maintel Holdings Plc (LON:MAI) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 129% in the last year.

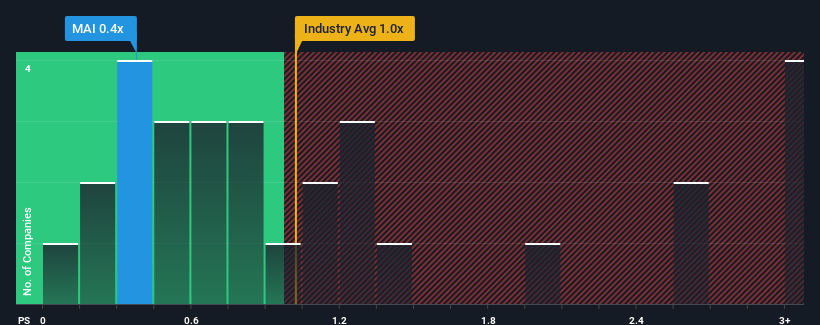

Although its price has surged higher, when close to half the companies operating in the United Kingdom's Commercial Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Maintel Holdings as an enticing stock to check out with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Maintel Holdings

What Does Maintel Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Maintel Holdings' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Maintel Holdings.Is There Any Revenue Growth Forecasted For Maintel Holdings?

In order to justify its P/S ratio, Maintel Holdings would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the one analyst following the company. With the industry predicted to deliver 11% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Maintel Holdings' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Maintel Holdings' P/S Mean For Investors?

Despite Maintel Holdings' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Maintel Holdings' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 2 warning signs for Maintel Holdings (1 is significant!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MAI

Maintel Holdings

Engages in the provision of managed services for the public and private sectors in the United Kingdom and Ireland.

Moderate growth potential and slightly overvalued.