- United Kingdom

- /

- Commercial Services

- /

- AIM:KINO

Here's Why We Think Kinovo (LON:KINO) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Kinovo (LON:KINO), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Kinovo

How Fast Is Kinovo Growing Its Earnings Per Share?

Over the last three years, Kinovo has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Kinovo's EPS catapulted from UK£0.016 to UK£0.045, over the last year. It's a rarity to see 187% year-on-year growth like that.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Kinovo is growing revenues, and EBIT margins improved by 3.9 percentage points to 6.3%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

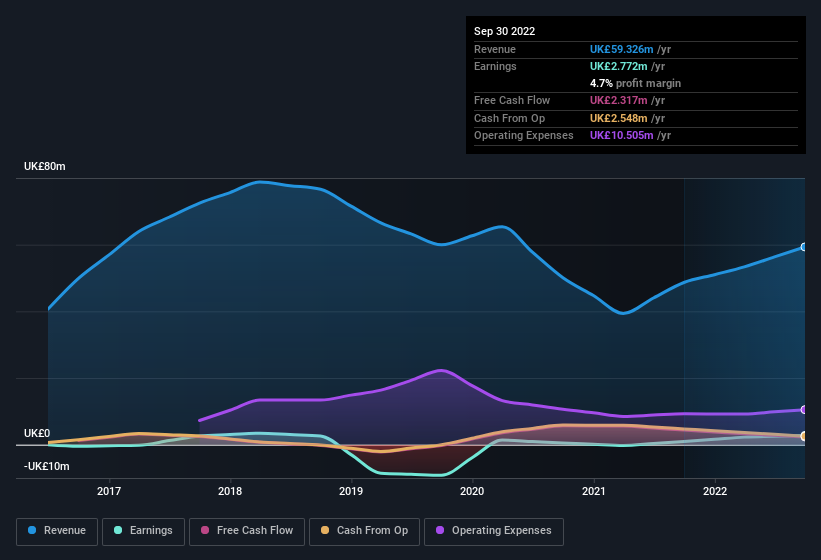

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Kinovo is no giant, with a market capitalisation of UK£26m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Kinovo Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Kinovo shareholders is that no insiders reported selling shares in the last year. Add in the fact that Lee Venables, the Chief Operating Officer of the company, paid UK£10.0k for shares at around UK£0.38 each. It seems that at least one insider is prepared to show the market there is potential within Kinovo.

Recent insider purchases of Kinovo stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, Kinovo has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to Kinovo, with market caps under UK£160m is around UK£279k.

Kinovo's CEO took home a total compensation package worth UK£229k in the year leading up to March 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Kinovo Deserve A Spot On Your Watchlist?

Kinovo's earnings per share growth have been climbing higher at an appreciable rate. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. It could be that Kinovo is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. Even so, be aware that Kinovo is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

The good news is that Kinovo is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kinovo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:KINO

Kinovo

Provides specialist property services to housing associations and local authorities, public buildings, industrial and commercial, and education and private sectors in the United Kingdom.

Undervalued with proven track record.