- United Kingdom

- /

- Commercial Services

- /

- AIM:SFT

What Can We Learn About Grafenia's (LON:GRA) CEO Compensation?

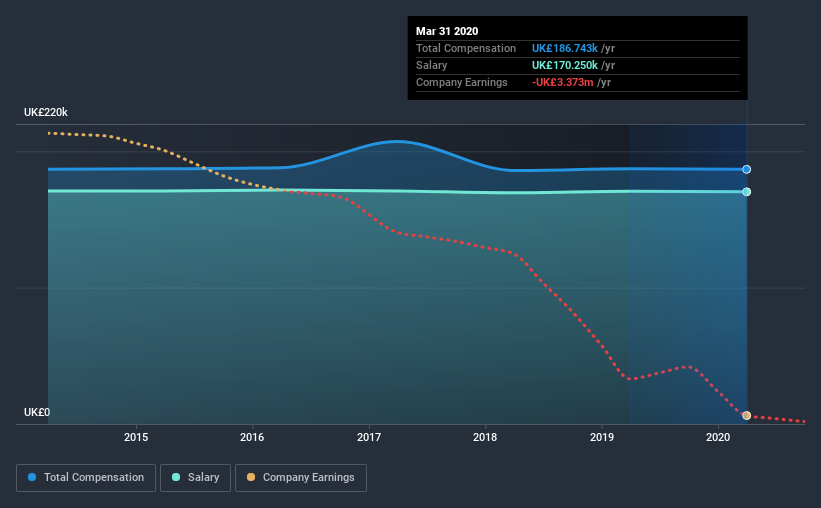

The CEO of Grafenia Plc (LON:GRA) is Peter Gunning, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Grafenia pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Grafenia

How Does Total Compensation For Peter Gunning Compare With Other Companies In The Industry?

Our data indicates that Grafenia Plc has a market capitalization of UK£5.7m, and total annual CEO compensation was reported as UK£187k for the year to March 2020. That is, the compensation was roughly the same as last year. In particular, the salary of UK£170.3k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under UK£150m, the reported median total CEO compensation was UK£242k. This suggests that Grafenia remunerates its CEO largely in line with the industry average. Moreover, Peter Gunning also holds UK£86k worth of Grafenia stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£170k | UK£171k | 91% |

| Other | UK£16k | UK£16k | 9% |

| Total Compensation | UK£187k | UK£187k | 100% |

On an industry level, around 56% of total compensation represents salary and 44% is other remuneration. It's interesting to note that Grafenia pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Grafenia Plc's Growth

Over the last three years, Grafenia Plc has shrunk its earnings per share by 16% per year. Its revenue is down 23% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Grafenia Plc Been A Good Investment?

Given the total shareholder loss of 54% over three years, many shareholders in Grafenia Plc are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, Grafenia Plc is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, EPS growth and shareholder returns have been in the red for the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for Grafenia you should be aware of, and 2 of them are a bit concerning.

Switching gears from Grafenia, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Grafenia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:SFT

Software Circle

Software Circle plc, together with its subsidiaries, licenses various software in the United Kingdom, Ireland, Europe, Belgium, the Netherlands, France, New Zealand, South Africa, and the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)