- United Kingdom

- /

- Commercial Services

- /

- AIM:FRAN

UK Stocks Priced Below Estimated Fair Value In September 2024

Reviewed by Simply Wall St

The UK's FTSE 100 index has recently faced downward pressure, influenced by weak trade data from China and declining commodity prices, which have impacted key sectors. Despite these challenges, discerning investors can still find opportunities in undervalued stocks that may offer potential for growth and stability in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.40 | £0.76 | 47.1% |

| Topps Tiles (LSE:TPT) | £0.454 | £0.88 | 48.7% |

| GlobalData (AIM:DATA) | £2.08 | £3.71 | 44% |

| Victrex (LSE:VCT) | £9.26 | £17.26 | 46.3% |

| Redcentric (AIM:RCN) | £1.29 | £2.44 | 47% |

| Moonpig Group (LSE:MOON) | £2.07 | £3.70 | 44% |

| SysGroup (AIM:SYS) | £0.34 | £0.65 | 48.1% |

| Foxtons Group (LSE:FOXT) | £0.62 | £1.18 | 47.5% |

| Hochschild Mining (LSE:HOC) | £1.816 | £3.54 | 48.7% |

| Benchmark Holdings (AIM:BMK) | £0.4015 | £0.72 | 43.9% |

Here we highlight a subset of our preferred stocks from the screener.

Franchise Brands (AIM:FRAN)

Overview: Franchise Brands plc, with a market cap of £307.77 million, operates in franchising and related activities across the United Kingdom, North America, and Europe through its subsidiaries.

Operations: The company's revenue segments include Azura (£0.81 million), Pirtek (£60.78 million), B2C Division (£5.95 million), Filta International (£25.64 million), and Water & Waste Services (£49.17 million).

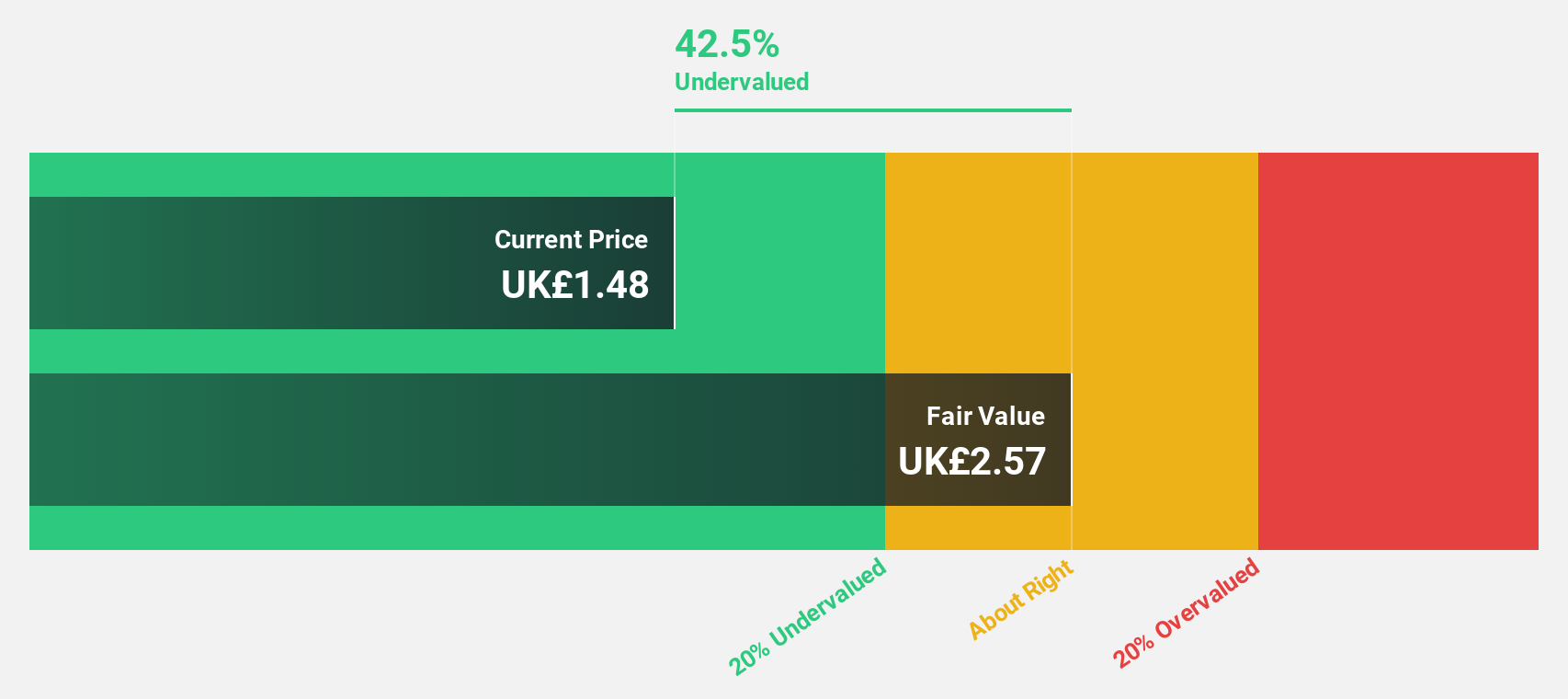

Estimated Discount To Fair Value: 40%

Franchise Brands (£1.6) is trading significantly below its estimated fair value of £2.67, representing a 40% discount. Analysts agree on a potential price rise of over 100%. The company's earnings grew by 82.8% last year and are forecast to grow at an annual rate of 44.22%, outpacing the UK market's expected growth (14.5%). Recent half-year results showed sales of £69.8 million and net income of £3.62 million, indicating strong financial health despite previous losses.

- Insights from our recent growth report point to a promising forecast for Franchise Brands' business outlook.

- Dive into the specifics of Franchise Brands here with our thorough financial health report.

Keywords Studios (AIM:KWS)

Overview: Keywords Studios plc, with a market cap of £1.95 billion, offers creative and technical services to the global video game industry.

Operations: Keywords Studios plc generates revenue from three main segments: Create (€365.56 million), Engage (€180.43 million), and Globalize (€261.61 million).

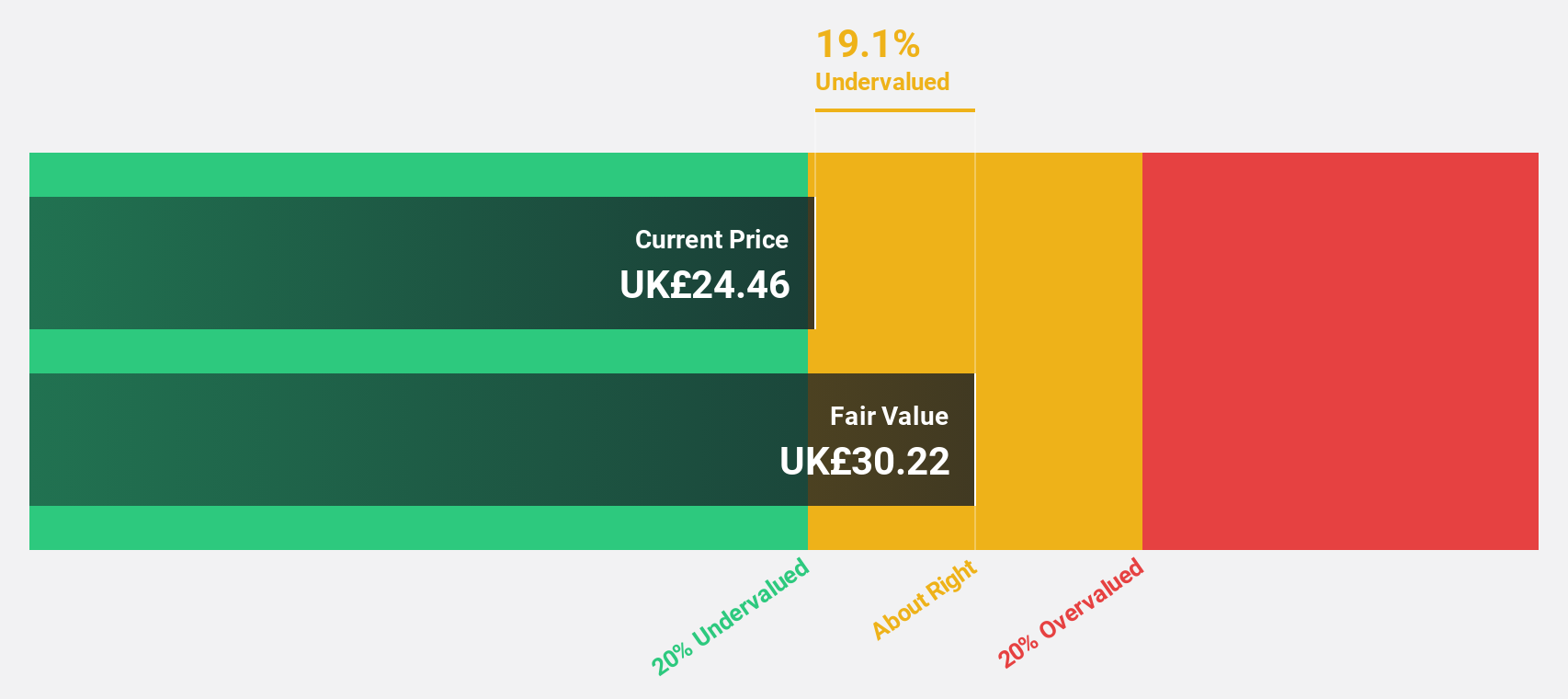

Estimated Discount To Fair Value: 20.1%

Keywords Studios (£24.28) is trading at a 20% discount to its estimated fair value of £30.39, reflecting significant undervaluation based on discounted cash flows. Despite reporting a net loss of €30.88 million for the half year ended June 2024, the company is forecast to become profitable within three years with earnings expected to grow by 59.13% annually. The recent acquisition agreement by Bidco values Keywords Studios at approximately £2 billion, further underscoring its potential value.

- The analysis detailed in our Keywords Studios growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Keywords Studios.

Rank Group (LSE:RNK)

Overview: The Rank Group Plc, with a market cap of £384.11 million, provides gaming services in Great Britain, Spain, and India through its subsidiaries.

Operations: The company's revenue segments include Digital (£226 million), Mecca Venues (£138.90 million), Enracha Venues (£38.50 million), and Grosvenor Venues (£331.30 million).

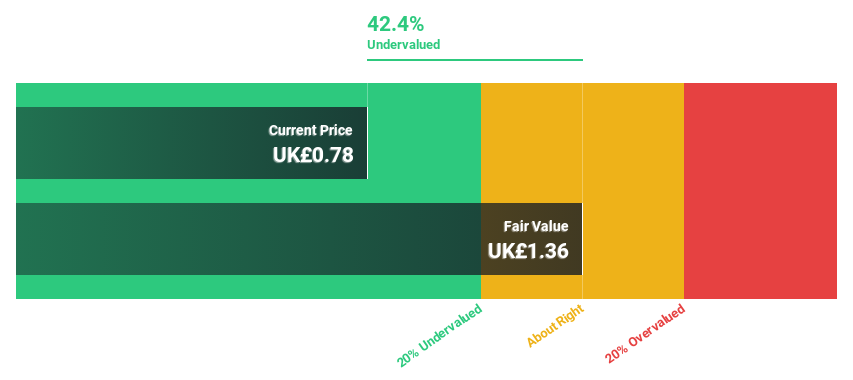

Estimated Discount To Fair Value: 39.1%

Rank Group (£0.82) is trading at 39.1% below its estimated fair value of £1.35, highlighting significant undervaluation based on discounted cash flows. The company reported a net income of £12.5 million for the year ended June 30, 2024, reversing a net loss from the previous year. Earnings are forecast to grow significantly at 35.68% per year, although revenue growth is expected to be moderate at 5.9% annually, which is still above market average projections.

- The growth report we've compiled suggests that Rank Group's future prospects could be on the up.

- Take a closer look at Rank Group's balance sheet health here in our report.

Taking Advantage

- Click through to start exploring the rest of the 54 Undervalued UK Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FRAN

Franchise Brands

Through its subsidiaries, engages in franchising and related activities in the United Kingdom, North America, and rest of Europe.

Good value with proven track record.