- United Kingdom

- /

- Hospitality

- /

- LSE:TRN

3 UK Exchange Stocks Estimated To Be Up To 50% Undervalued

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, largely influenced by weak trade data from China and declining commodity prices. Despite these market challenges, identifying undervalued stocks can present significant opportunities for investors looking to capitalize on potential growth in a fluctuating economy.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £30.80 | £58.81 | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | US$0.378 | US$0.73 | 48.1% |

| Liontrust Asset Management (LSE:LIO) | £6.19 | £12.31 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.40 | £0.76 | 47.4% |

| Ricardo (LSE:RCDO) | £5.06 | £10.12 | 50% |

| Velocity Composites (AIM:VEL) | £0.42 | £0.82 | 48.9% |

| Foxtons Group (LSE:FOXT) | £0.62 | £1.21 | 48.6% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

| Franchise Brands (AIM:FRAN) | £1.85 | £3.60 | 48.5% |

| Forterra (LSE:FORT) | £1.766 | £3.48 | 49.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Franchise Brands (AIM:FRAN)

Overview: Franchise Brands plc, with a market cap of £355.61 million, operates through its subsidiaries in franchising and related activities across the United Kingdom, North America, and Europe.

Operations: The company's revenue segments include Azura (£0.75 million), Pirtek (£41.95 million), B2C Division (£6.11 million), Water & Waste (£48.88 million), and Filta International (£27.12 million).

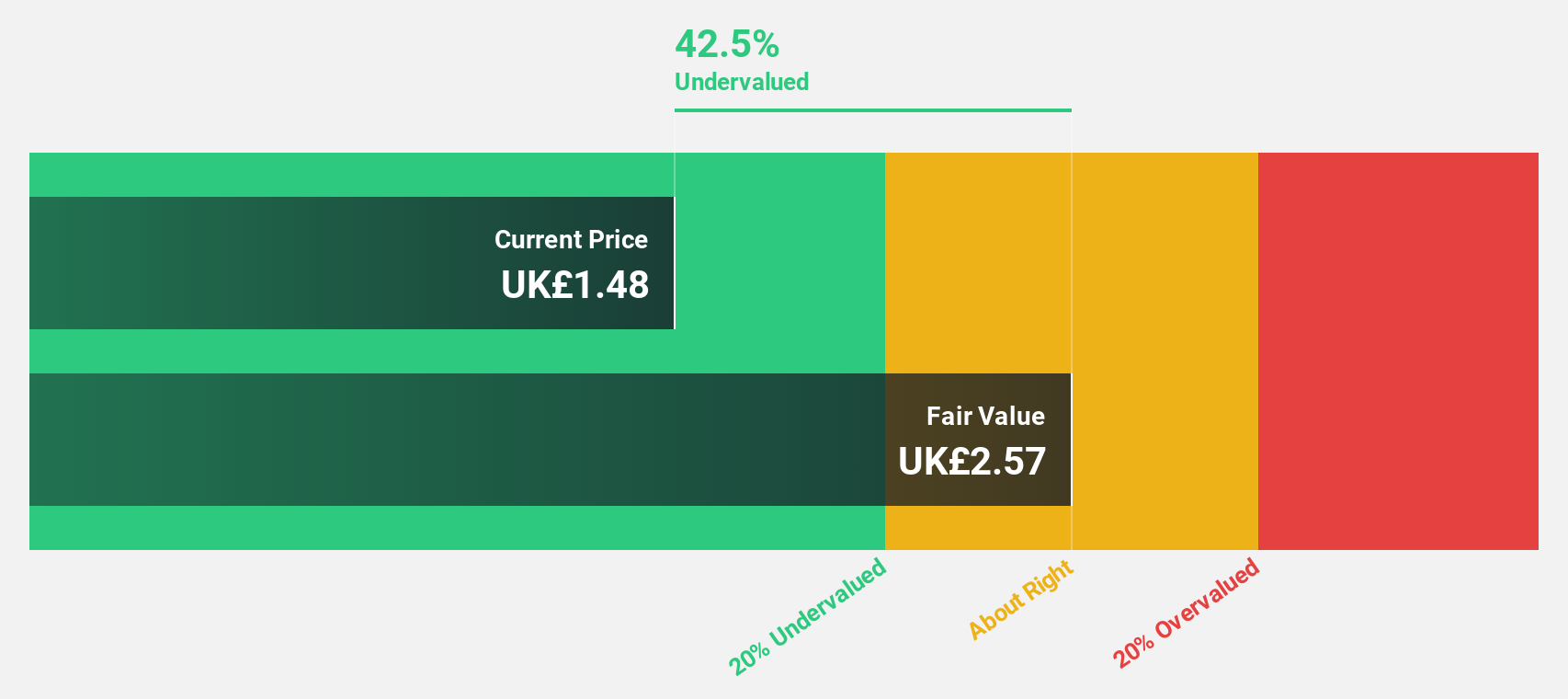

Estimated Discount To Fair Value: 48.5%

Franchise Brands plc, trading at £1.85 and significantly below its estimated fair value of £3.60, shows strong potential as an undervalued stock based on cash flows. Despite recent executive changes and a drop in net income from £8.13 million to £3.04 million for 2023, the company's revenue surged to £121.27 million from £69.84 million last year, with earnings forecasted to grow by 40.7% annually over the next three years—outpacing the UK market's growth rate of 14.3%.

- The growth report we've compiled suggests that Franchise Brands' future prospects could be on the up.

- Dive into the specifics of Franchise Brands here with our thorough financial health report.

Ricardo (LSE:RCDO)

Overview: Ricardo plc offers environmental, technical, and strategic consultancy services across various regions including the United Kingdom, Europe, North America, China, the rest of Asia, Australia, and internationally; it has a market cap of £314.81 million.

Operations: Ricardo's revenue segments include Rail (£75.90 million), Defense (£104.30 million), Performance Products (£84.70 million), Energy & Environment (£101.90 million), and Automotive and Industrial - Emerging (£68.60 million) and Established (£24.20 million).

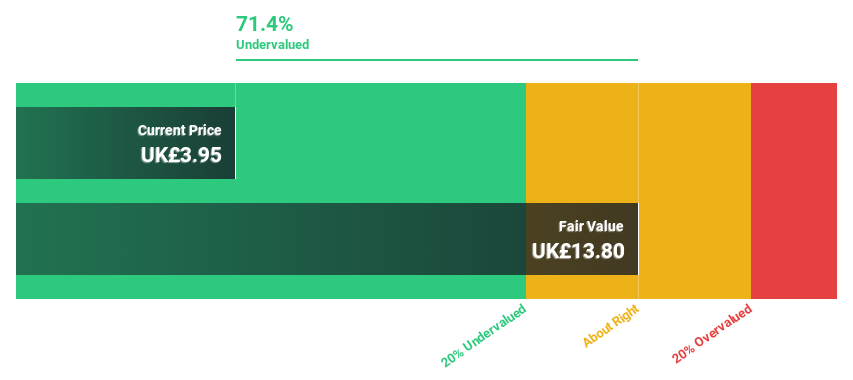

Estimated Discount To Fair Value: 50%

Ricardo plc, trading at £5.06 and estimated to be worth £10.12, is significantly undervalued based on discounted cash flow analysis. Despite a forecasted revenue growth of 4.9% per year, slower than the desired 20%, it still outpaces the UK market's 3.7%. Earnings are expected to grow by 57.8% annually and become profitable within three years, although its dividend yield of 2.45% is not well covered by earnings or free cash flows.

- Upon reviewing our latest growth report, Ricardo's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Ricardo's balance sheet by reading our health report here.

Trainline (LSE:TRN)

Overview: Trainline Plc operates an independent rail and coach travel platform selling tickets in the United Kingdom and internationally, with a market cap of £1.36 billion.

Operations: Trainline's revenue is derived from three main segments: Trainline Solutions (£134.76 million), International Consumer (£53.16 million), and United Kingdom Consumer (£208.80 million).

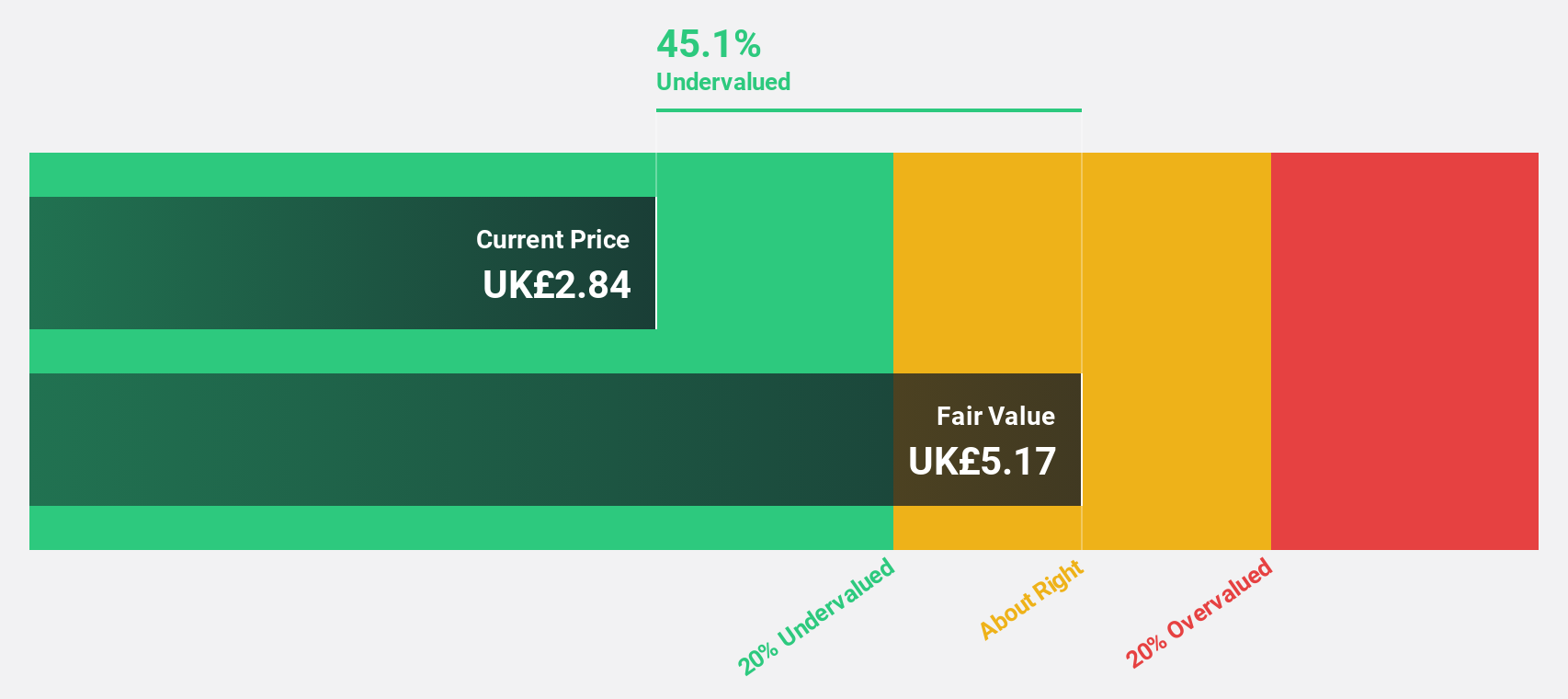

Estimated Discount To Fair Value: 35.1%

Trainline (£3.05) is trading at a 35.1% discount to its estimated fair value of £4.69, indicating it is highly undervalued based on discounted cash flow analysis. Earnings are projected to grow significantly at 21.91% per year, outpacing the UK market's 14.3%. Despite slower revenue growth of 6.6% annually, this still exceeds the UK market average of 3.7%. Analysts agree on a potential price increase of 34.5%, enhancing its investment appeal.

- Insights from our recent growth report point to a promising forecast for Trainline's business outlook.

- Navigate through the intricacies of Trainline with our comprehensive financial health report here.

Taking Advantage

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Undervalued UK Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trainline might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TRN

Trainline

Engages in the operation of an independent rail and coach travel platform that sells rail and coach tickets the United Kingdom and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives