- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

UK Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the UK market grapples with the ripple effects of weak trade data from China, reflected in the recent declines of both the FTSE 100 and FTSE 250 indices, investors are increasingly looking for resilient opportunities amid global economic uncertainties. In such a climate, growth companies with high insider ownership can be particularly appealing, as they often signal strong internal confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35.1% | 26.6% |

| QinetiQ Group (LSE:QQ.) | 13.1% | 30.1% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| Judges Scientific (AIM:JDG) | 10.7% | 24.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 24.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.1% | 56.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, along with its subsidiaries, develops, licenses, and supports computer software for the healthcare industry in the United States and has a market cap of approximately £626.84 million.

Operations: The company's revenue primarily comes from its healthcare software segment, which generated $198.10 million.

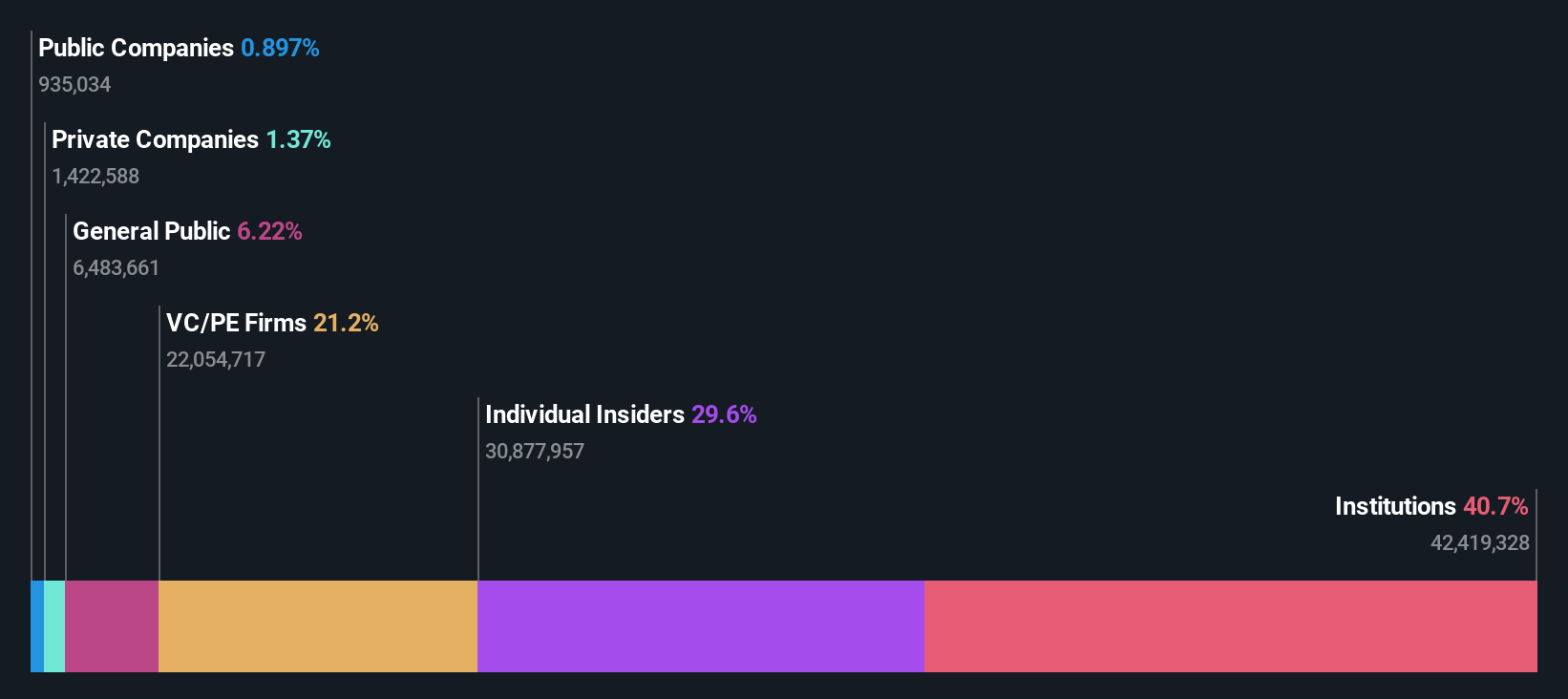

Insider Ownership: 16.6%

Earnings Growth Forecast: 23.9% p.a.

Craneware demonstrates strong growth potential with forecasted earnings growth of 23.9% per year, outpacing the UK market. Recent earnings reports show substantial improvement, with net income rising to US$7.24 million from US$4.06 million a year earlier, and revenue increasing to US$100.05 million. Insider buying has occurred recently, albeit in modest volumes, and analysts predict a 57% stock price increase while maintaining no significant insider selling activity over the past three months.

- Get an in-depth perspective on Craneware's performance by reading our analyst estimates report here.

- The analysis detailed in our Craneware valuation report hints at an inflated share price compared to its estimated value.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £275.07 million.

Operations: The company's revenue segments comprise £25.40 million from Research & Fintech, £23.80 million from Distribution Channels, and £29.10 million from Intermediary Services.

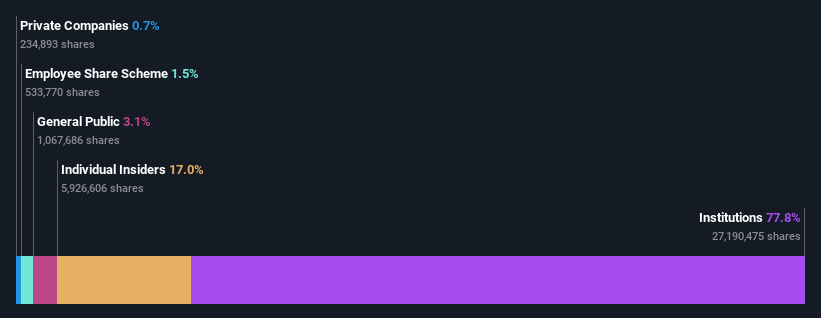

Insider Ownership: 30.5%

Earnings Growth Forecast: 30.2% p.a.

Fintel shows promising growth prospects with earnings expected to increase significantly at 30.2% annually, surpassing the UK market's growth rate. The stock trades at a substantial discount of 37.3% below its estimated fair value, and recent insider activity reveals significant buying with no major selling over the past three months. However, profit margins have declined from last year, and return on equity is forecasted to remain low at 14.5%. Recent executive changes include a new CEO appointment and board restructuring.

- Unlock comprehensive insights into our analysis of Fintel stock in this growth report.

- Upon reviewing our latest valuation report, Fintel's share price might be too optimistic.

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc, with a market cap of £232.42 million, operates as a betting and gaming company in the United Kingdom, Italy, Spain, Romania, Denmark, and other international markets.

Operations: The company's revenue segments include Retail (£506.10 million), UK&I Online (£693.20 million), and International (£555.20 million).

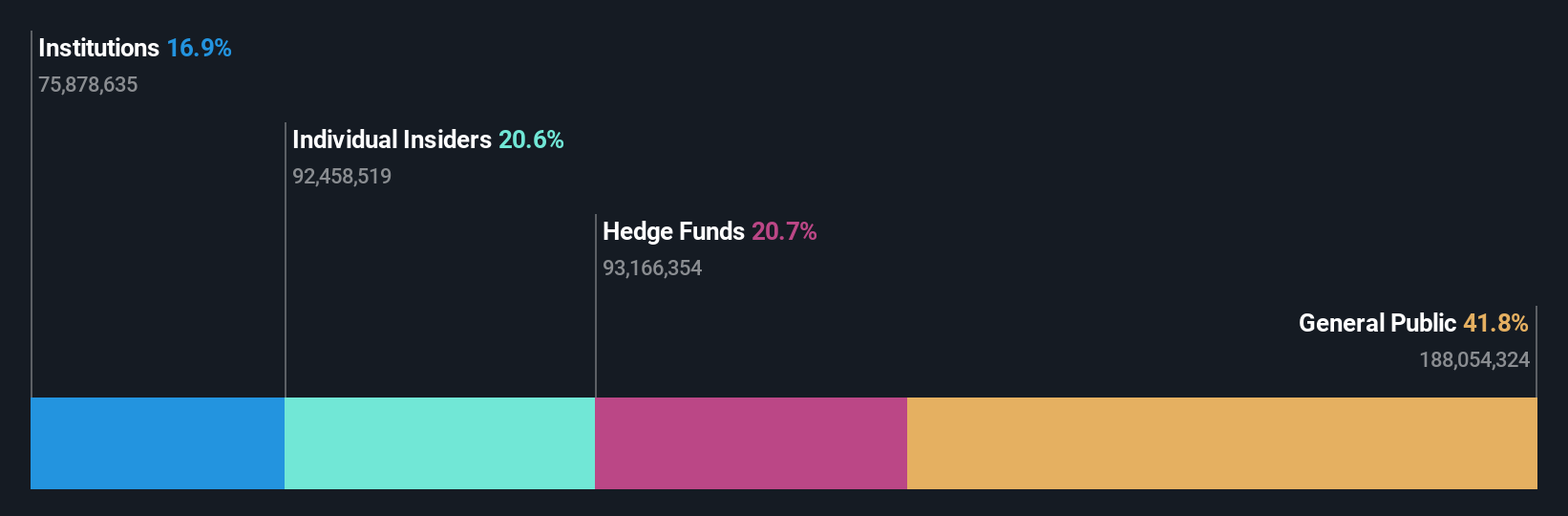

Insider Ownership: 20.5%

Earnings Growth Forecast: 84% p.a.

Evoke plc demonstrates strong growth potential with earnings forecasted to grow 84.04% annually, surpassing market expectations. The stock trades at a substantial discount of 89% below its estimated fair value, and insiders have significantly increased their holdings in the past three months without major sales. Despite high share price volatility, Evoke's return on equity is projected to be very high in three years. Recent revenue growth aligns with guidance, maintaining a positive outlook for future performance.

- Take a closer look at Evoke's potential here in our earnings growth report.

- According our valuation report, there's an indication that Evoke's share price might be on the cheaper side.

Turning Ideas Into Actions

- Reveal the 64 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Ready To Venture Into Other Investment Styles? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives