- United Kingdom

- /

- IT

- /

- LSE:KNOS

Top 3 UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has risen 1.1%, and in the past year, it has climbed 5.9%. With earnings forecasted to grow by 13% annually, identifying growth companies with high insider ownership can be a strategic approach for investors looking to capitalize on this positive trend.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 34.2% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 39.5% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Hochschild Mining (LSE:HOC) | 38.4% | 54.9% |

Here's a peek at a few of the choices from the screener.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £326.10 million.

Operations: The company's revenue segments are Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

Insider Ownership: 29.1%

Earnings Growth Forecast: 23.9% p.a.

Fintel's revenue is forecast to grow at 8.6% per year, outpacing the UK market's 3.5%. Earnings are projected to increase by 23.88% annually, significantly above the market average of 13.1%. Despite trading at an estimated 11.4% below fair value, Fintel has seen significant insider selling over the past three months and large one-off items impacting financial results. The company recently declared a final dividend of £0.0235 per share on May 21, 2024.

- Navigate through the intricacies of Fintel with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Fintel's current price could be inflated.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc offers digital technology services across the United Kingdom, Ireland, North America, Central Europe, and internationally with a market cap of approximately £1.42 billion.

Operations: Kainos Group's revenue segments include £213.10 million from Digital Services, £57.25 million from Workday Products, and £112.04 million from Workday Services.

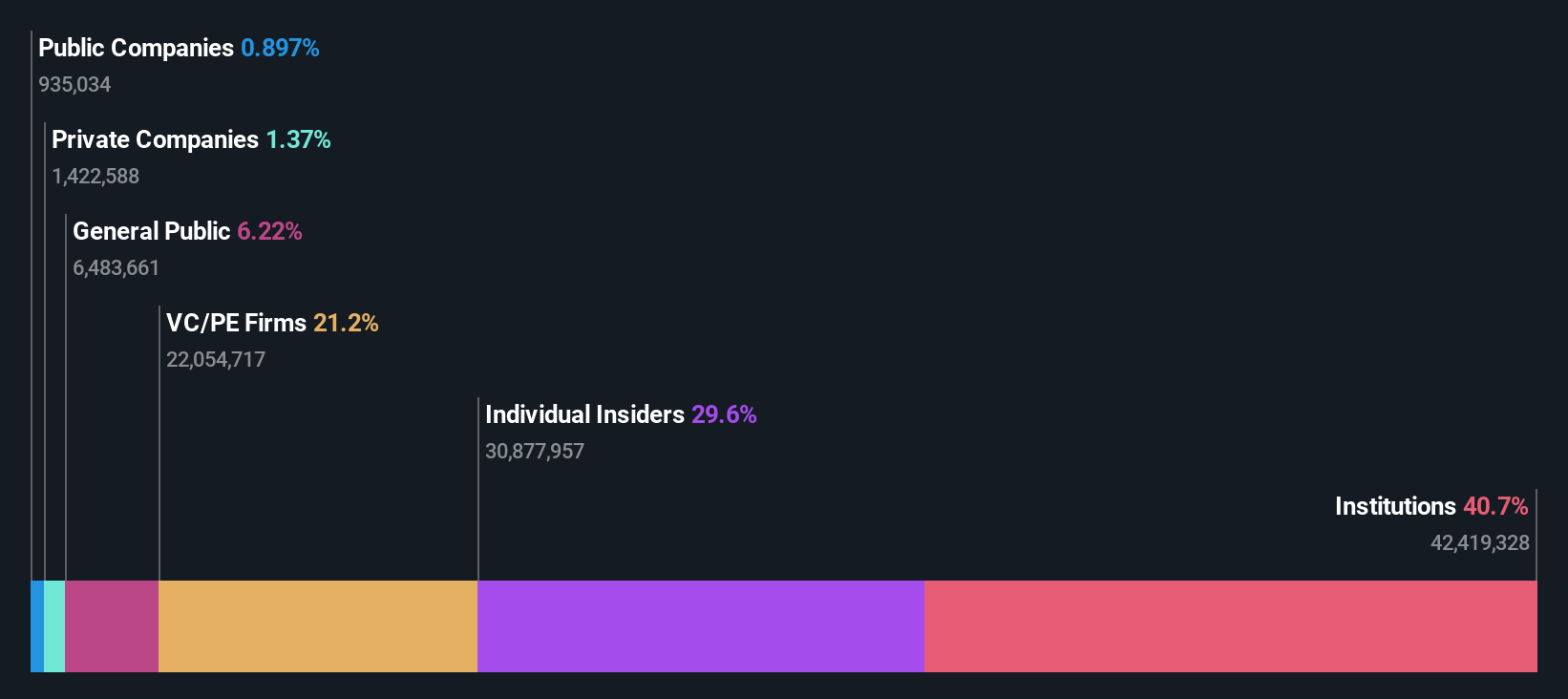

Insider Ownership: 23.3%

Earnings Growth Forecast: 13.1% p.a.

Kainos Group's recent strategic alliances with Workday and Pulsora highlight its commitment to growth and innovation. The partnership with Workday aims to scale app development, while the collaboration with Pulsora enhances ESG reporting capabilities. Despite a stable revenue increase to £382.39 million and net income rising to £48.72 million for the year ended March 31, 2024, Kainos' dividend track record remains unstable. Insider ownership is high but lacks significant recent insider trading activity.

- Click here to discover the nuances of Kainos Group with our detailed analytical future growth report.

- According our valuation report, there's an indication that Kainos Group's share price might be on the cheaper side.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.67 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company's revenue segments include banking, leasing, insurance, brokerage, and card processing services provided to corporate and individual customers across Georgia, Azerbaijan, and Uzbekistan.

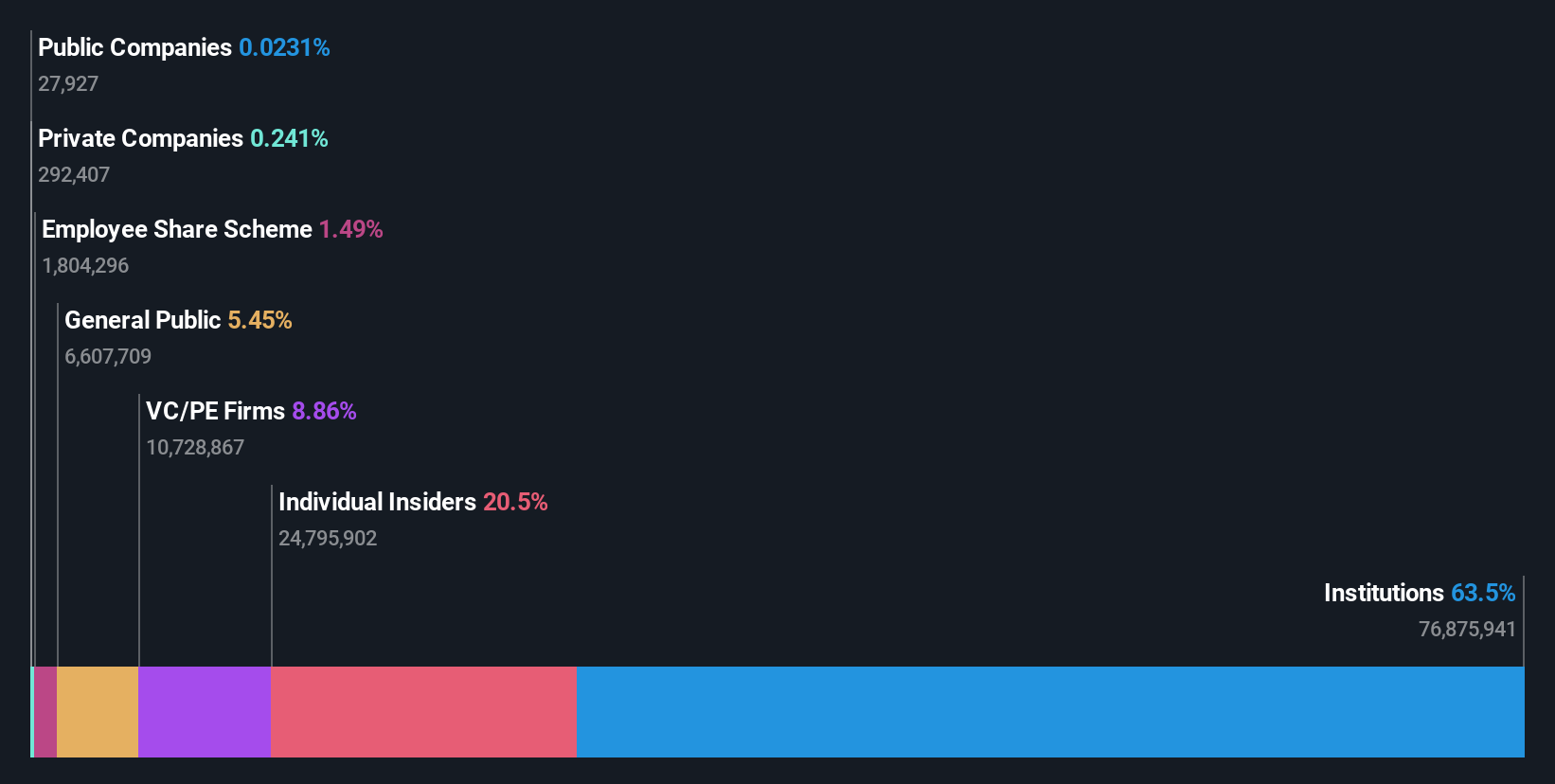

Insider Ownership: 17.7%

Earnings Growth Forecast: 14.9% p.a.

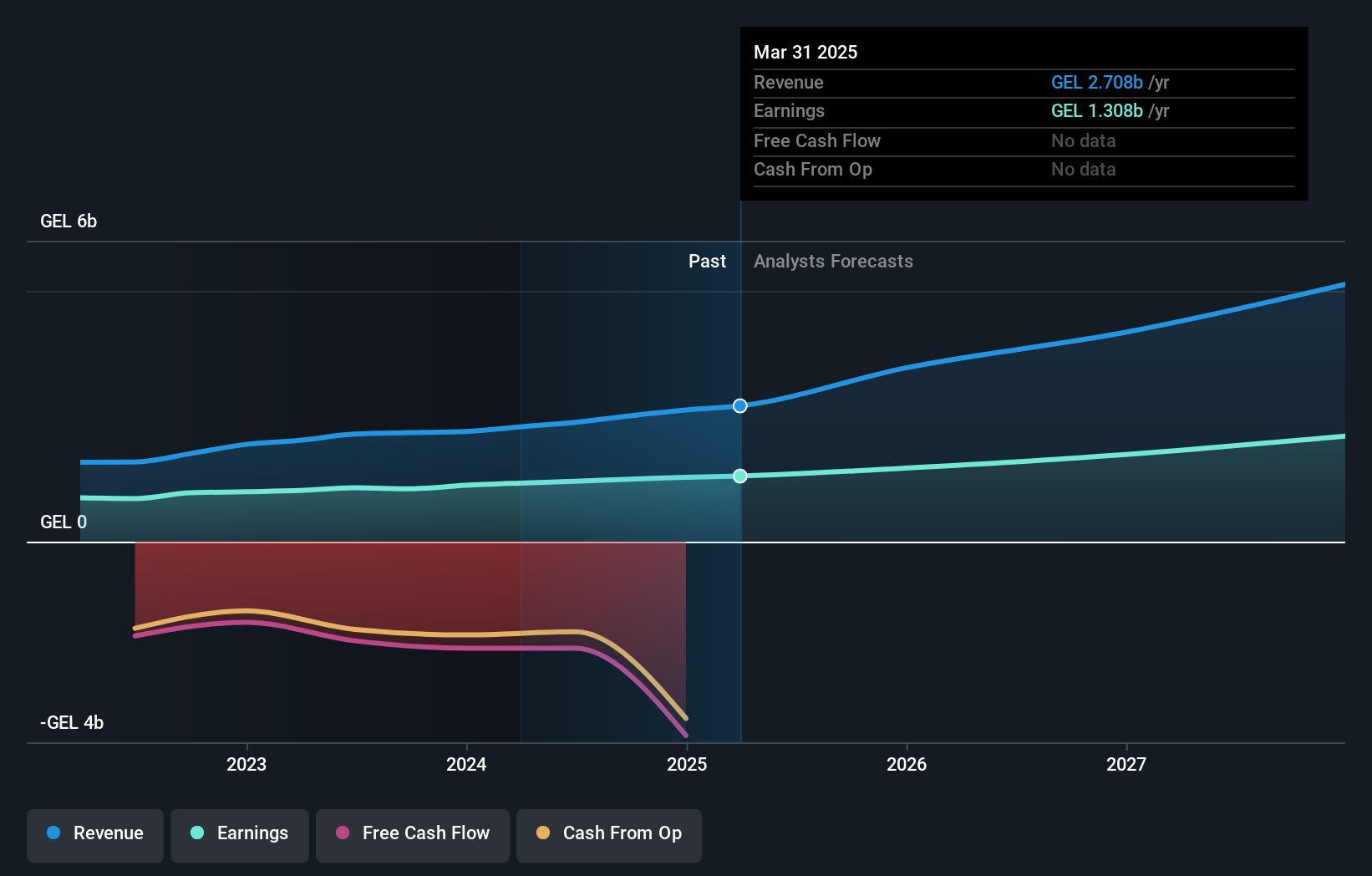

TBC Bank Group has shown strong growth, with earnings increasing by 14.6% over the past year and revenue forecast to grow at 18.5% annually, outpacing the UK market. Despite a high level of bad loans (2.1%) and volatile share price, it trades at good value compared to peers. Recent developments include appointing an AI head in Uzbekistan and initiating a GEL 75 million share repurchase program aimed at reducing share capital.

- Get an in-depth perspective on TBC Bank Group's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Where To Now?

- Unlock more gems! Our Fast Growing UK Companies With High Insider Ownership screener has unearthed 61 more companies for you to explore.Click here to unveil our expertly curated list of 64 Fast Growing UK Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kainos Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KNOS

Kainos Group

Engages in the provision of digital technology services in the United Kingdom, Ireland, North America, Central Europe, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives