- United Kingdom

- /

- Medical Equipment

- /

- LSE:SN.

3 UK Stocks That May Be Undervalued By The Market

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and falling commodity prices affecting major companies. Amid these broader market pressures, investors may find opportunities in stocks that appear undervalued by the market, offering potential value based on their fundamentals and resilience in navigating current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| On the Beach Group (LSE:OTB) | £2.58 | £4.59 | 43.8% |

| Brickability Group (AIM:BRCK) | £0.60 | £1.05 | 42.7% |

| Gateley (Holdings) (AIM:GTLY) | £1.36 | £2.64 | 48.5% |

| Victrex (LSE:VCT) | £9.69 | £18.19 | 46.7% |

| Duke Capital (AIM:DUKE) | £0.3025 | £0.53 | 43.2% |

| Deliveroo (LSE:ROO) | £1.391 | £2.43 | 42.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| Nexxen International (AIM:NEXN) | £8.06 | £15.29 | 47.3% |

| Optima Health (AIM:OPT) | £1.74 | £3.30 | 47.3% |

| Melrose Industries (LSE:MRO) | £6.32 | £11.83 | 46.6% |

Let's explore several standout options from the results in the screener.

Deliveroo (LSE:ROO)

Overview: Deliveroo plc operates an online food delivery platform across several countries, including the UK and Ireland, with a market cap of £2.06 billion.

Operations: The company generates its revenue primarily from the operation of an on-demand food delivery platform, amounting to £2.04 billion.

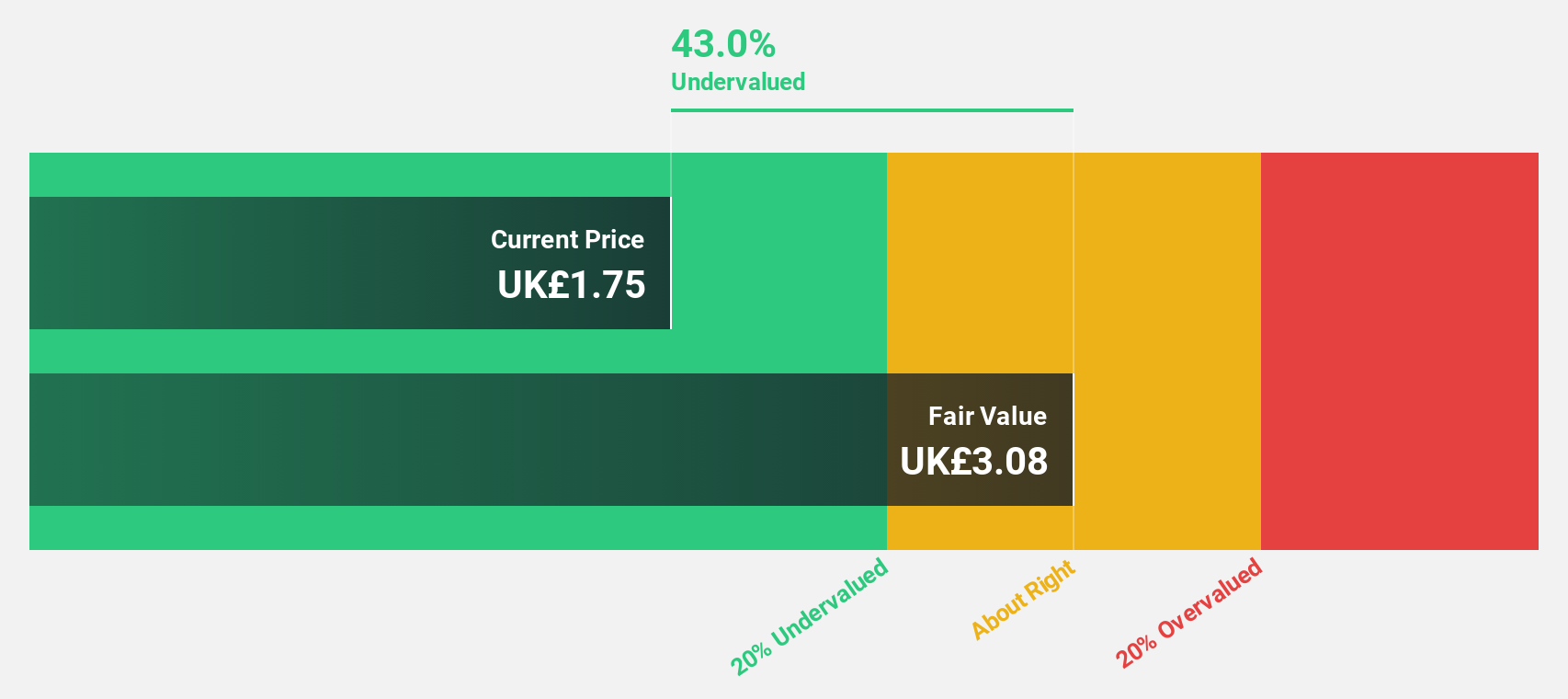

Estimated Discount To Fair Value: 42.8%

Deliveroo is trading at £1.39, significantly below its estimated fair value of £2.43, indicating it is undervalued based on discounted cash flow analysis. Recently added to several FTSE indices, Deliveroo's earnings are expected to grow at 50.6% annually, outpacing the UK market's 14.9%. Despite revenue growth being slower than 20% per year, it surpasses the UK average of 3.7%. Recent revenue increases and profitability support its potential as an undervalued stock based on cash flows.

- The growth report we've compiled suggests that Deliveroo's future prospects could be on the up.

- Get an in-depth perspective on Deliveroo's balance sheet by reading our health report here.

Smith & Nephew (LSE:SN.)

Overview: Smith & Nephew plc is a global medical devices company that develops, manufactures, markets, and sells its products and services in the UK and internationally, with a market cap of £8.94 billion.

Operations: The company's revenue segments include Orthopaedics at $2.26 billion, Sports Medicine & ENT at $1.77 billion, and Advanced Wound Management (AWM) at $1.61 billion.

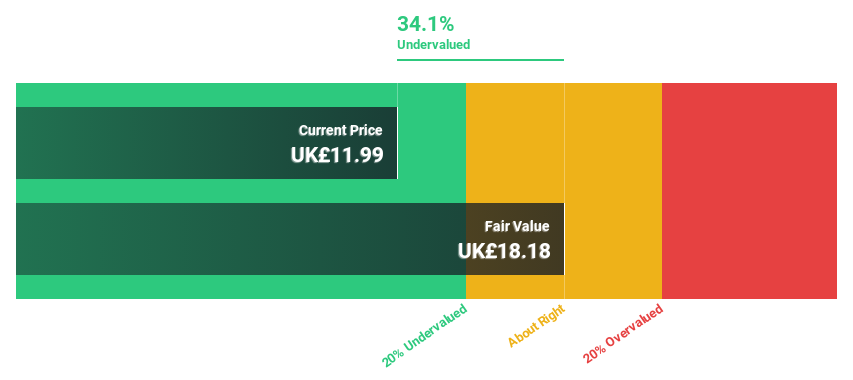

Estimated Discount To Fair Value: 36.4%

Smith & Nephew is trading at £10.26, well below its estimated fair value of £16.11, suggesting it is undervalued based on discounted cash flow analysis. Earnings are forecast to grow by 20% annually, outpacing the UK market's growth rate of 14.9%, although revenue growth lags behind a high threshold at 4.8% per year. Despite a high debt level and unsustainable dividend coverage, recent product advancements and executive changes may bolster long-term prospects.

- Insights from our recent growth report point to a promising forecast for Smith & Nephew's business outlook.

- Unlock comprehensive insights into our analysis of Smith & Nephew stock in this financial health report.

Senior (LSE:SNR)

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in aerospace, defense, land vehicle, and power and energy markets globally, with a market cap of £669.65 million.

Operations: The company's revenue segments include £651.10 million from Aerospace and £333 million from Flexonics.

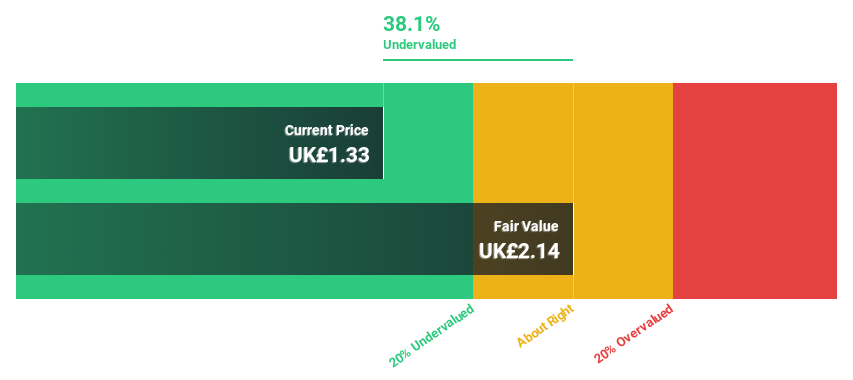

Estimated Discount To Fair Value: 17.5%

Senior is trading at £1.64, below its estimated fair value of £1.99, indicating undervaluation based on discounted cash flow analysis. Earnings are expected to grow significantly at 30.4% annually, surpassing the UK market's growth rate of 14.9%, although revenue growth is moderate at 5.7% per year. Despite a forecasted low return on equity and recent board changes with Susan Brennan's retirement, the stock presents potential for value investors focused on cash flow metrics.

- Our expertly prepared growth report on Senior implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Senior.

Where To Now?

- Click here to access our complete index of 54 Undervalued UK Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SN.

Smith & Nephew

Develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives