- United Kingdom

- /

- Medical Equipment

- /

- LSE:SN.

3 UK Stocks Estimated To Be Trading At Discounts Of Up To 38.7%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced declines, influenced by weak trade data from China that highlights ongoing challenges in global economic recovery. In this environment, identifying undervalued stocks can be particularly appealing as investors seek opportunities in companies trading below their intrinsic value, potentially offering long-term growth despite current market headwinds.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ASA International Group (LSE:ASAI) | £0.745 | £1.45 | 48.5% |

| TBC Bank Group (LSE:TBCG) | £31.00 | £59.47 | 47.9% |

| Fevertree Drinks (AIM:FEVR) | £7.09 | £13.12 | 46% |

| GlobalData (AIM:DATA) | £1.88 | £3.73 | 49.6% |

| Victorian Plumbing Group (AIM:VIC) | £1.085 | £2.02 | 46.3% |

| Brickability Group (AIM:BRCK) | £0.682 | £1.27 | 46.2% |

| Informa (LSE:INF) | £8.338 | £15.82 | 47.3% |

| BATM Advanced Communications (LSE:BVC) | £0.18675 | £0.37 | 49.5% |

| Andrada Mining (AIM:ATM) | £0.02525 | £0.046 | 45.3% |

| Videndum (LSE:VID) | £2.56 | £4.73 | 45.9% |

Let's explore several standout options from the results in the screener.

Phoenix Group Holdings (LSE:PHNX)

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement business in Europe, with a market cap of £5.17 billion.

Operations: The company's revenue segments include Retirement Solutions at £2.01 billion, with With-profits at -£1.56 billion, Europe & Other at -£891 million, and Pensions & Savings at -£418 million.

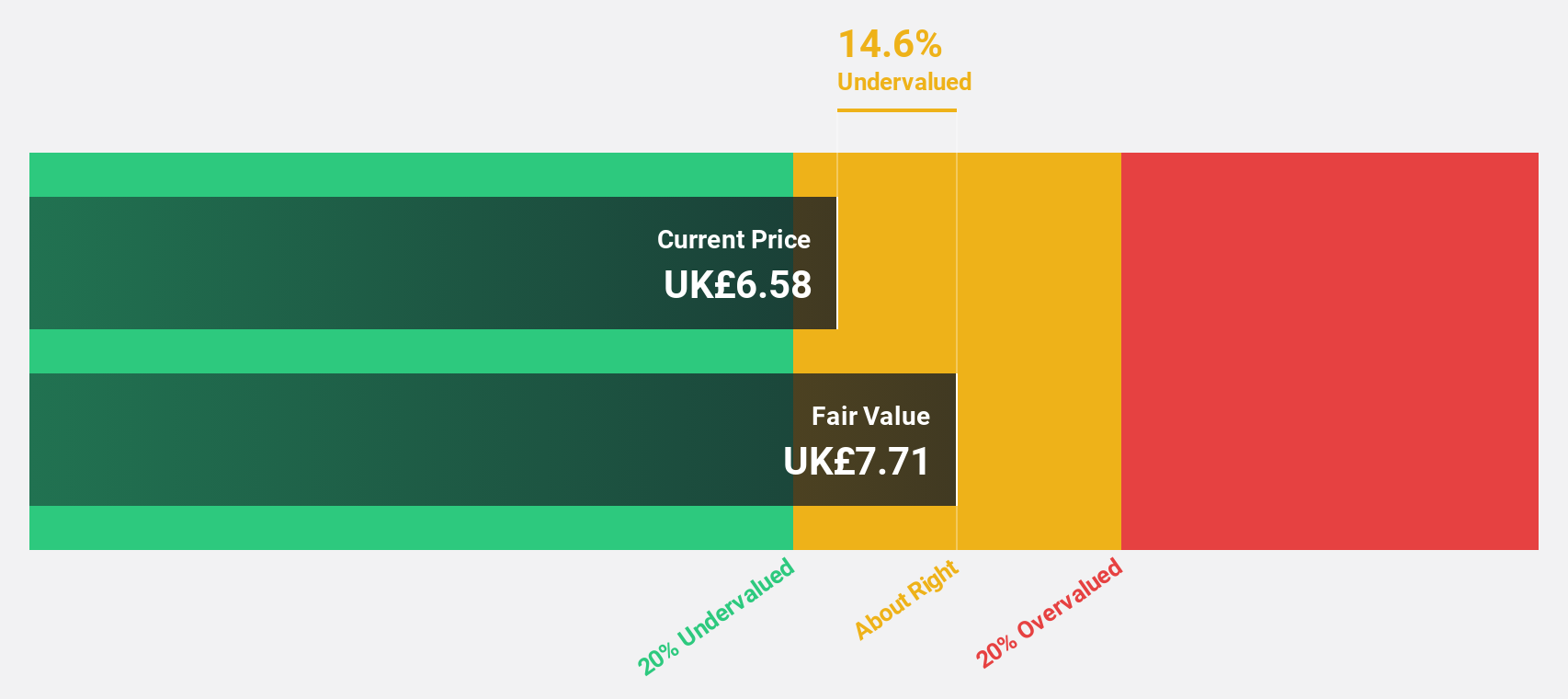

Estimated Discount To Fair Value: 16.5%

Phoenix Group Holdings is trading at £5.18, below its estimated fair value of £6.21, indicating potential undervaluation based on cash flows. Despite forecasted revenue decline of 27.6% annually over the next three years, earnings are expected to grow 75% per year, with profitability anticipated within this period. However, the dividend yield of 10.29% isn't well covered by earnings. Recent leadership changes include appointing Nic Nicandrou as CFO and Mark Gregory as Risk Committee Chair.

- Our growth report here indicates Phoenix Group Holdings may be poised for an improving outlook.

- Click here to discover the nuances of Phoenix Group Holdings with our detailed financial health report.

Smith & Nephew (LSE:SN.)

Overview: Smith & Nephew plc, with a market cap of £8.70 billion, develops, manufactures, markets, and sells medical devices and services both in the United Kingdom and internationally.

Operations: Smith & Nephew's revenue segments include Orthopaedics at $2.26 billion, Sports Medicine & ENT at $1.77 billion, and Advanced Wound Management (AWM) at $1.61 billion.

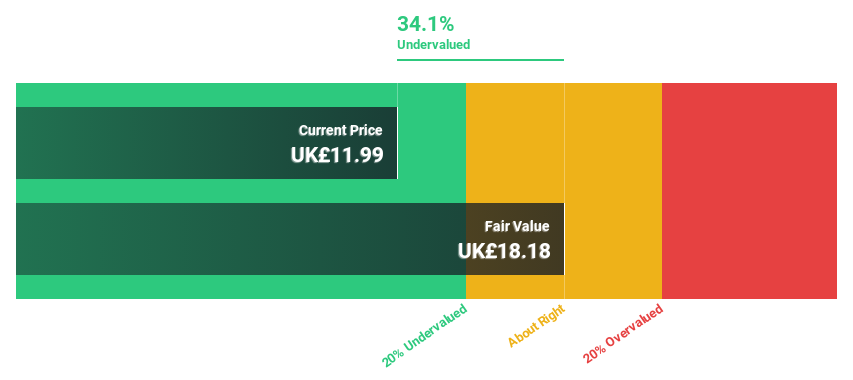

Estimated Discount To Fair Value: 38.7%

Smith & Nephew is trading at £9.98, significantly below its estimated fair value of £16.29, suggesting it may be undervalued based on cash flows. The company's earnings are projected to grow 22.7% annually over the next three years, outpacing the UK market average of 14.8%. However, challenges include a dividend yield of 2.98% not well supported by earnings or free cash flows and a high debt level impacting financial stability.

- According our earnings growth report, there's an indication that Smith & Nephew might be ready to expand.

- Click to explore a detailed breakdown of our findings in Smith & Nephew's balance sheet health report.

Senior (LSE:SNR)

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets globally, with a market cap of approximately £637 million.

Operations: The company's revenue is derived from two main segments: Aerospace, contributing £651.10 million, and Flexonics, generating £333 million.

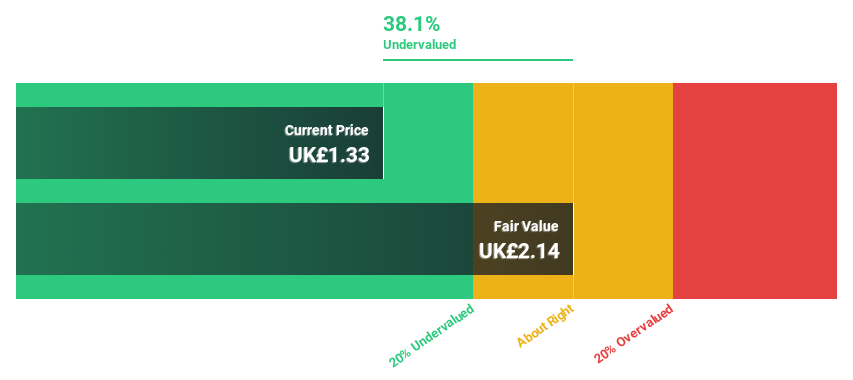

Estimated Discount To Fair Value: 26.6%

Senior plc is trading at £1.56, approximately 26.6% below its estimated fair value of £2.13, highlighting potential undervaluation based on cash flows. The company's earnings have grown by 40.1% over the past year and are forecast to grow significantly at 31.5% annually, surpassing UK market averages. Despite a low future return on equity forecast of 9%, revenue growth is expected to outpace the broader market at 5.7% per year, supported by strategic leadership changes with Alpna Amar's upcoming CFO appointment in May 2025.

- Insights from our recent growth report point to a promising forecast for Senior's business outlook.

- Get an in-depth perspective on Senior's balance sheet by reading our health report here.

Make It Happen

- Click here to access our complete index of 57 Undervalued UK Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SN.

Smith & Nephew

Develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally.

Good value with reasonable growth potential.