- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Revenues Not Telling The Story For Rolls-Royce Holdings plc (LON:RR.) After Shares Rise 27%

Rolls-Royce Holdings plc (LON:RR.) shareholders have had their patience rewarded with a 27% share price jump in the last month. The annual gain comes to 173% following the latest surge, making investors sit up and take notice.

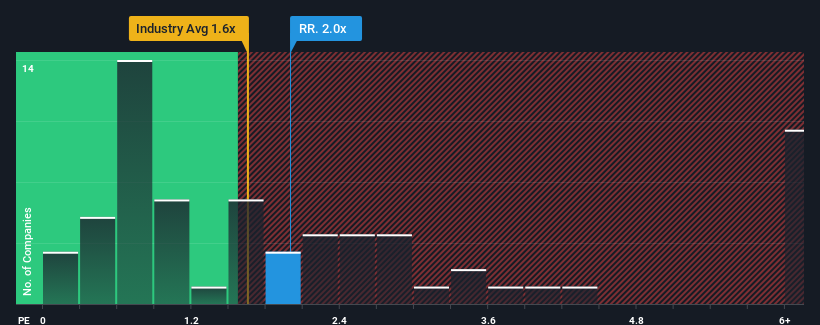

After such a large jump in price, you could be forgiven for thinking Rolls-Royce Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2x, considering almost half the companies in the United Kingdom's Aerospace & Defense industry have P/S ratios below 1.2x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Rolls-Royce Holdings

What Does Rolls-Royce Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Rolls-Royce Holdings has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Rolls-Royce Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Rolls-Royce Holdings?

Rolls-Royce Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 43% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.4% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 10% per annum, which is noticeably more attractive.

In light of this, it's alarming that Rolls-Royce Holdings' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Rolls-Royce Holdings' P/S Mean For Investors?

Rolls-Royce Holdings' P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Rolls-Royce Holdings, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Rolls-Royce Holdings (at least 2 which are concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives