- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Can Rolls-Royce’s Soaring Run Continue After Nuclear Funding Talks in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Rolls-Royce Holdings stock? You are in good company. The company has seen a jaw-dropping rally in recent years, leaving many investors wondering if there is still room to run or if now is the moment to act cautiously. Over the last three years, the stock price has soared an eye-watering 1,417.8%, putting most blue-chip names to shame. Even just in the past year, shares are up almost 97%. That kind of return could tempt even the most patient investor to jump in or at least to stop and pay attention.

So why the strength? To start, excitement around Rolls-Royce's strategic moves, such as exploring funding options for its small nuclear reactor unit, has fueled optimism about the company’s growth potential and innovation outside its traditional core. Meanwhile, news that competitors like Boeing are making big moves to catch up in their own businesses only reinforces the perception that Rolls-Royce is perched in a strong position within its sector.

Still, there are signs of volatility to keep in mind. Over the past thirty days, the stock slipped by 1.2%, and in the last week, it fell by 3.1%. While that barely dents the gigantic multi-year run, it nudges investors to think carefully about what comes next, especially with a value score of 3 out of 6, indicating the company is undervalued by half of the metrics typically used by analysts.

So is the stock undervalued or fairly priced after such a dramatic climb? Let’s dig into the different valuation approaches the market uses to make sense of Rolls-Royce’s share price. Stay tuned, because at the end of the article we will also explore a smarter way to understand what valuation really means here.

Approach 1: Rolls-Royce Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today’s values. For Rolls-Royce Holdings, this means taking predictions for billions in future cash flow and translating them into what those streams are worth right now.

Currently, Rolls-Royce is generating Free Cash Flow (FCF) of about £3.27 billion. Analysts project continued growth, with FCF expected to reach around £4.48 billion by 2029. Further out, using Simply Wall St’s for additional extrapolations past analyst forecasts, the company's cash flows are modeled to keep rising, although these later projections become less certain.

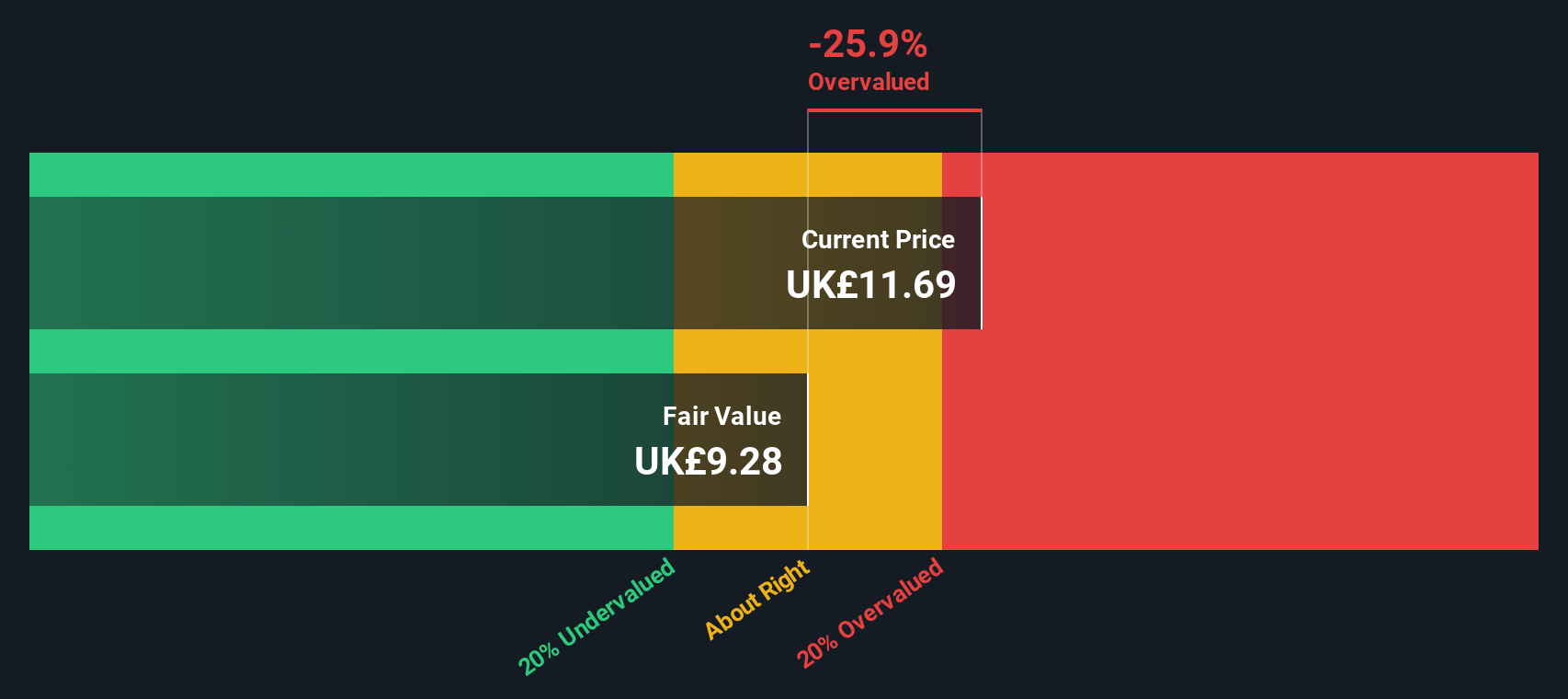

After crunching all those numbers and discounting future flows appropriately, the DCF model calculates an intrinsic or “fair” value of £9.16 per share for Rolls-Royce. However, with the shares trading 20.4% above this model estimate, the signal is clear: the stock appears overvalued by this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rolls-Royce Holdings may be overvalued by 20.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rolls-Royce Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a classic tool investors use to evaluate profitable companies like Rolls-Royce Holdings. It compares the company's share price to its earnings per share, allowing investors to quickly see what the market is willing to pay for current profits. This makes it especially useful if earnings are consistent and growing.

Growth expectations and risk levels both play big roles in what counts as a "normal" or "fair" PE ratio. Fast-growing firms and those with strong prospects typically fetch higher PEs, while more established or riskier companies generally trade at lower multiples. A high PE can reflect confidence in future growth, but it might also signal excessive optimism.

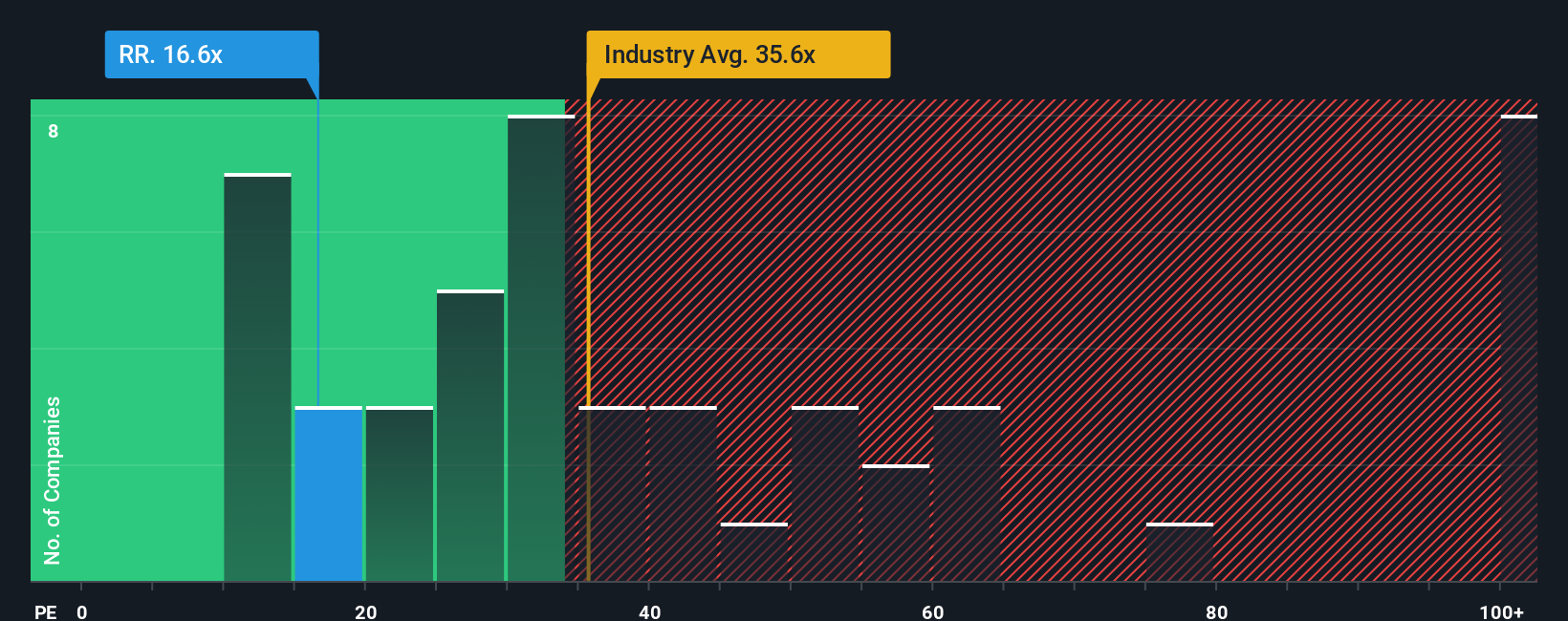

Right now, Rolls-Royce trades at a PE ratio of 16x. That is well below the Aerospace & Defense industry average of 46x and also comfortably under the peer group average of 26x. At first glance, this could make the shares look attractively valued compared with similar stocks in the sector.

However, Simply Wall St’s “Fair Ratio” approach is designed to go deeper by calculating the PE multiple a business deserves based on its unique earnings growth, profit margins, market cap, industry, and risk profile. This tailored method gives a more holistic picture than the simple peer or industry comparisons most investors rely on. For Rolls-Royce, the Fair Ratio comes out at 19.5x, a number reflecting all those underlying factors.

Since the current PE of 16x is slightly below the Fair Ratio, it suggests there could still be some value left on the table. The difference is not substantial, placing Rolls-Royce’s valuation just about where it should be using this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rolls-Royce Holdings Narrative

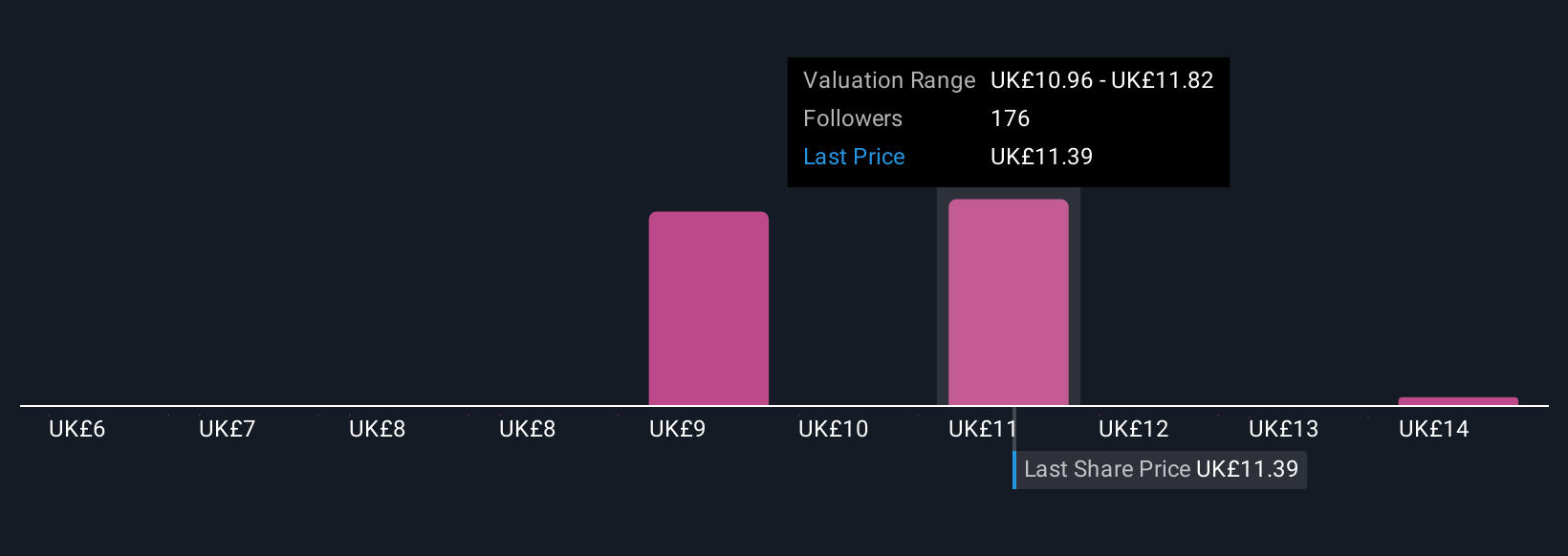

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or outlook for a company, connecting what you believe about Rolls-Royce Holdings’ future, such as its revenue growth, margins, and earnings potential, to a financial forecast and a resulting fair value.

This innovative approach, available to millions of investors on Simply Wall St’s Community page, makes it easy for you to translate your opinions or new information into actionable investment insights. By comparing your Narrative’s Fair Value with the current share price, you can decide whether to buy, hold, or sell with far greater context than numbers alone can provide.

Importantly, Narratives update automatically as market events, news, or company results change, meaning your investment view always stays relevant. For example, among Rolls-Royce investors today, the most optimistic Narrative forecasts a fair value as high as £14.40 per share, driven by expectations for sustained AI-driven demand and margin expansion, while the most cautious puts fair value at just £2.40, reflecting concern about execution risks, supply chain issues, and slowing revenue growth. Where your perspective fits on this spectrum is up to you, and Narratives let you make it part of your investment strategy in minutes.

Do you think there's more to the story for Rolls-Royce Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)