- United Kingdom

- /

- Construction

- /

- LSE:MGNS

Macfarlane Group And 2 Other Leading Dividend Stocks On UK

Reviewed by Simply Wall St

In the last week, the United Kingdom market has been flat, though it has seen an 8.5% increase over the past year with earnings projected to grow by 15% annually in the coming years. In such a climate, identifying strong dividend stocks like Macfarlane Group can offer investors potential stability and income through regular payouts while benefiting from anticipated earnings growth.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.11% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.19% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.63% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.47% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.98% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.88% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.58% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.95% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.78% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.44% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Macfarlane Group (LSE:MACF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macfarlane Group PLC, with a market cap of £174.38 million, designs, manufactures, and distributes protective packaging products to businesses in the United Kingdom and Europe through its subsidiaries.

Operations: Macfarlane Group PLC generates its revenue primarily from two segments: Packaging Distribution, which accounts for £231.89 million, and Manufacturing Operations, contributing £42.06 million.

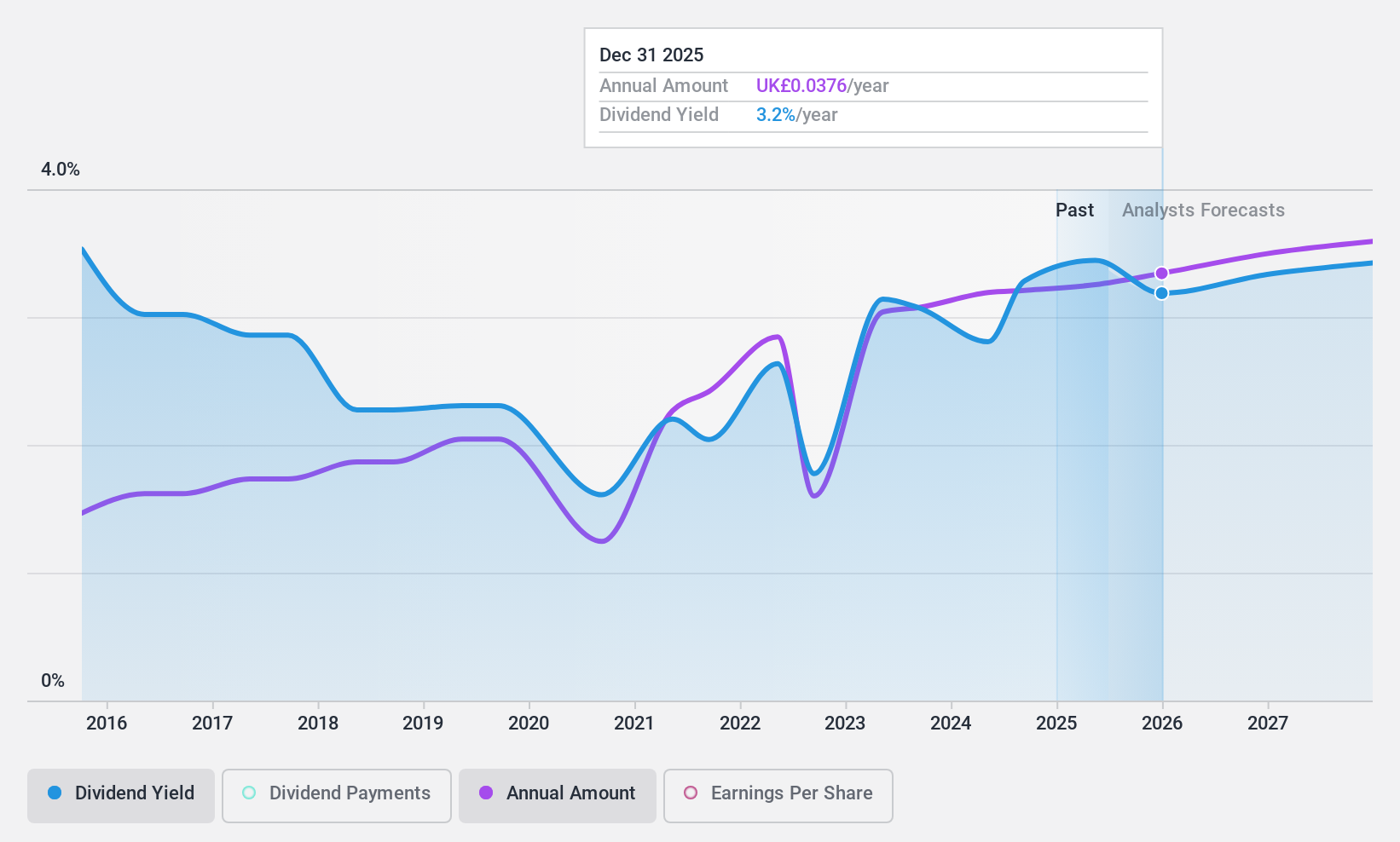

Dividend Yield: 3.3%

Macfarlane Group's dividend payments have increased over the past decade, yet they remain volatile with instances of significant annual drops. Despite this instability, dividends are well-covered by both earnings and cash flows, with a low payout ratio of 39% and a cash payout ratio of 22.8%. Trading at 33.9% below estimated fair value, Macfarlane offers potential for capital appreciation but its dividend yield is lower than the top UK payers at 3.28%.

- Navigate through the intricacies of Macfarlane Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Macfarlane Group's shares may be trading at a discount.

Morgan Sindall Group (LSE:MGNS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Sindall Group plc is a UK-based construction and regeneration company with a market cap of £1.80 billion.

Operations: Morgan Sindall Group plc generates revenue from several segments, including Fit Out (£1.24 billion), Construction (£1.02 billion), Infrastructure (£989.20 million), Property Services (£191.80 million), Urban Regeneration (£148.40 million), and Partnership Housing (£845.20 million).

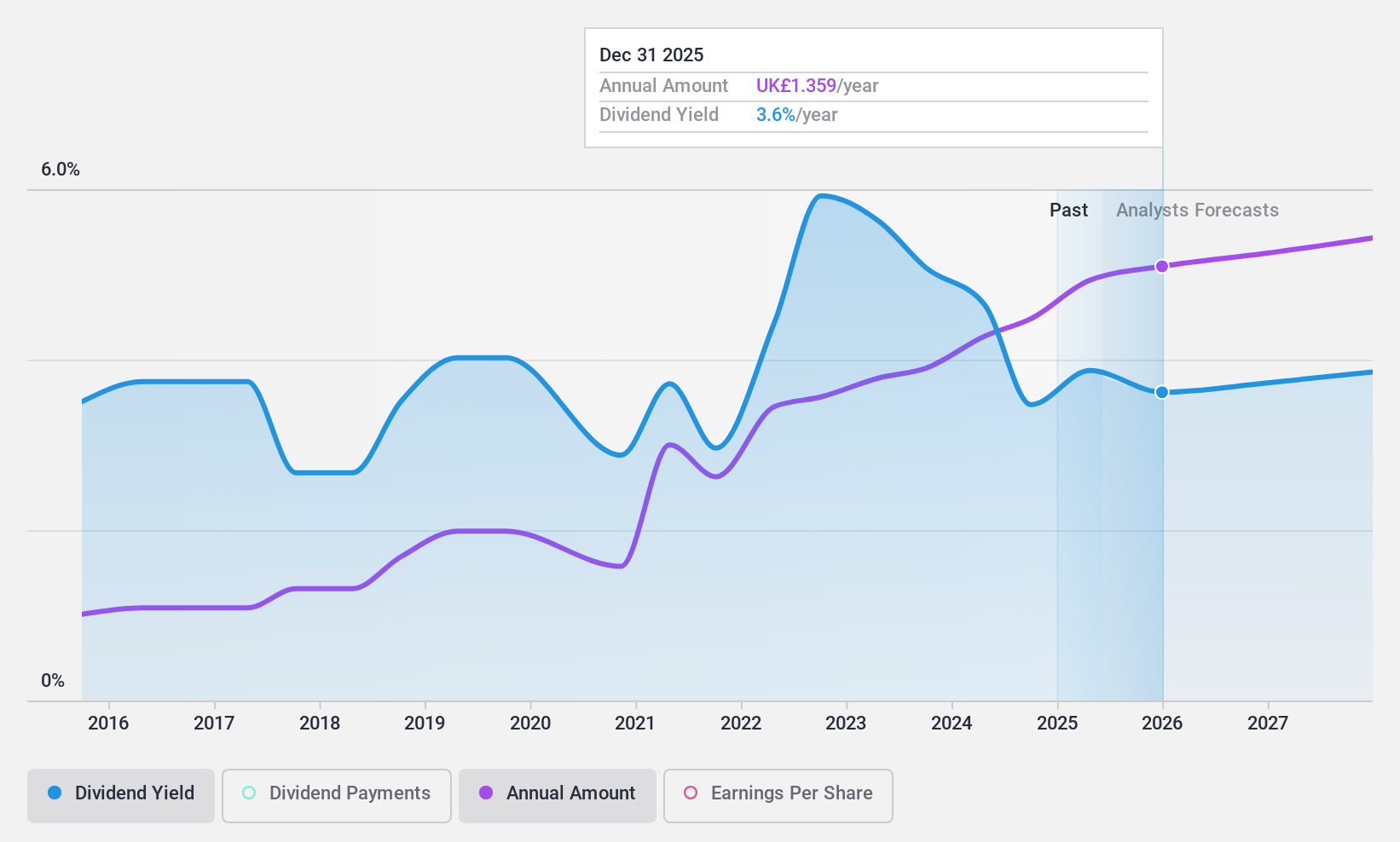

Dividend Yield: 3.1%

Morgan Sindall Group's dividends are well-covered by earnings and cash flows, with payout ratios of 44.7% and 33.4% respectively, indicating sustainability despite a volatile track record over the past decade. The dividend yield of 3.12% is below the UK's top payers, but recent guidance suggests earnings will exceed expectations for 2024, potentially enhancing future dividend stability. Trading at a discount to estimated fair value may offer some capital appreciation potential amidst significant insider selling recently.

- Get an in-depth perspective on Morgan Sindall Group's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Morgan Sindall Group is priced higher than what may be justified by its financials.

Spectris (LSE:SXS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Spectris plc offers precision measurement solutions globally and has a market cap of £2.59 billion.

Operations: Spectris plc's revenue is derived from its Spectris Dynamics segment, contributing £527.70 million, and the Spectris Scientific segment, which accounts for £643.10 million.

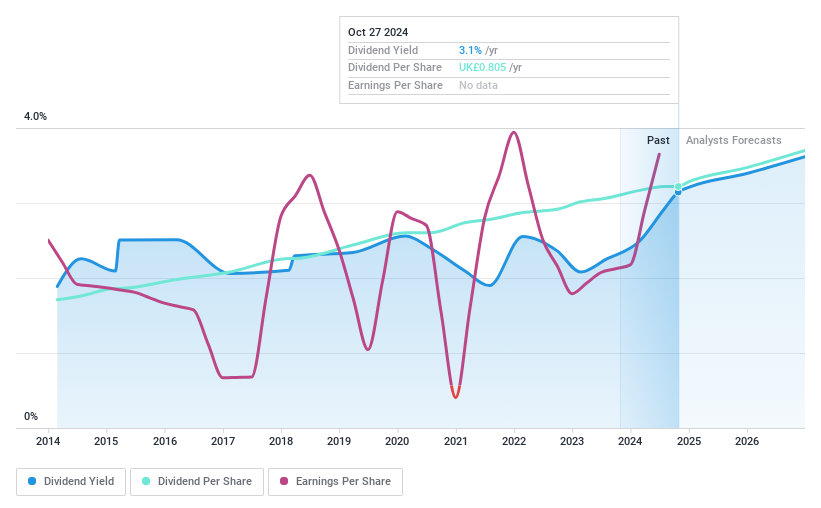

Dividend Yield: 3.1%

Spectris offers a reliable dividend yield of 3.07%, covered by earnings with a payout ratio of 29.9% and cash flows at 67.4%. Despite stable dividends over the past decade, its yield is below the UK market's top payers. Recent financials show a sales decline of £46.4 million in Q3 2024, impacting revenue due to foreign exchange and disposals. Trading below estimated fair value suggests potential for capital appreciation amidst forecasted earnings declines.

- Click here and access our complete dividend analysis report to understand the dynamics of Spectris.

- In light of our recent valuation report, it seems possible that Spectris is trading behind its estimated value.

Key Takeaways

- Discover the full array of 61 Top UK Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MGNS

Morgan Sindall Group

Operates as a construction and regeneration company in the United Kingdom.

Outstanding track record with excellent balance sheet and pays a dividend.