- United Kingdom

- /

- Trade Distributors

- /

- LSE:HWDN

Howden Joinery Group Plc's (LON:HWDN) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

Howden Joinery Group (LON:HWDN) has had a great run on the share market with its stock up by a significant 18% over the last month. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Specifically, we decided to study Howden Joinery Group's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Howden Joinery Group is:

22% = UK£249m ÷ UK£1.1b (Based on the trailing twelve months to December 2024).

The 'return' refers to a company's earnings over the last year. That means that for every £1 worth of shareholders' equity, the company generated £0.22 in profit.

See our latest analysis for Howden Joinery Group

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Howden Joinery Group's Earnings Growth And 22% ROE

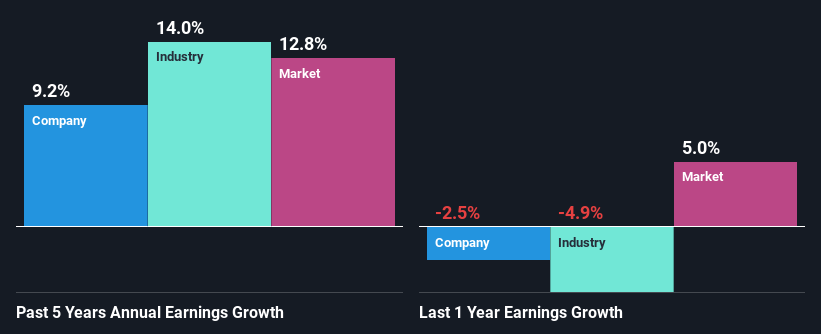

To begin with, Howden Joinery Group seems to have a respectable ROE. Further, the company's ROE compares quite favorably to the industry average of 13%. This probably laid the ground for Howden Joinery Group's moderate 9.2% net income growth seen over the past five years.

As a next step, we compared Howden Joinery Group's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 14% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. What is HWDN worth today? The intrinsic value infographic in our free research report helps visualize whether HWDN is currently mispriced by the market.

Is Howden Joinery Group Efficiently Re-investing Its Profits?

Howden Joinery Group has a three-year median payout ratio of 37%, which implies that it retains the remaining 63% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Besides, Howden Joinery Group has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 42%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 21%.

Summary

In total, we are pretty happy with Howden Joinery Group's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see a good amount of growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you're looking to trade Howden Joinery Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Howden Joinery Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HWDN

Howden Joinery Group

Supplies various kitchen, joinery, and hardware products in the United Kingdom, France, Belgium, and the Republic of Ireland.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives