- United Kingdom

- /

- Diversified Financial

- /

- AIM:MAB1

Top UK Dividend Stocks: Alumasc Group And 2 More

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100, influenced by weak trade data from China and its impact on global markets, investors in the United Kingdom are increasingly turning their attention to dividend stocks as a potential source of steady income. In such uncertain times, companies with a strong track record of paying dividends can offer stability and resilience, making them an attractive option for those looking to navigate the current market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.45% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.97% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.94% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.20% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.64% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.42% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.30% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.36% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.61% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.57% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc manufactures and sells building products, systems, and solutions across various regions including the UK, Europe, North America, the Middle East, and the Far East with a market cap of £120.82 million.

Operations: Alumasc Group's revenue is derived from three main segments: Water Management (£55.52 million), Building Envelope (£41.81 million), and Housebuilding Products (£16.08 million).

Dividend Yield: 3.3%

Alumasc Group offers a mixed dividend profile, with recent earnings growth supporting its ability to cover dividends through both earnings and cash flows. The proposed final dividend of £0.076 per share reflects a sustainable payout ratio, though the yield is below top-tier UK payers. Despite an increase in dividends over the past decade, their volatility raises concerns about reliability. Recent leadership changes may impact future strategy execution and dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Alumasc Group.

- According our valuation report, there's an indication that Alumasc Group's share price might be on the cheaper side.

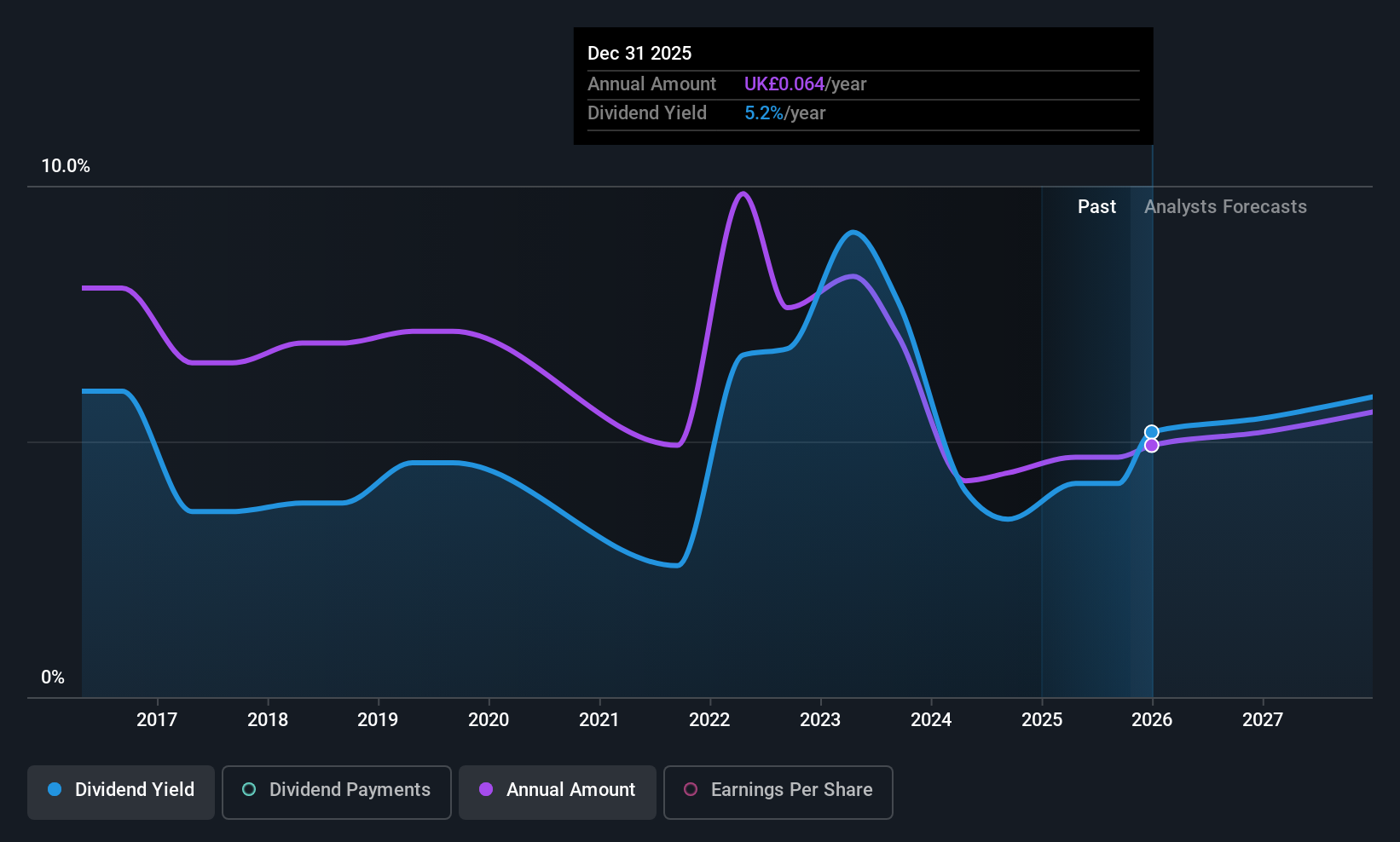

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services in the United Kingdom and has a market capitalization of £395.27 million.

Operations: Mortgage Advice Bureau (Holdings) plc generates revenue of £289.64 million from its financial services offerings in the United Kingdom.

Dividend Yield: 3.2%

Mortgage Advice Bureau (Holdings) shows a complex dividend profile, with earnings growth of 77.1% supporting dividend coverage through both earnings and cash flows, evidenced by a payout ratio of 67% and cash payout ratio of 43.5%. However, dividends have been volatile over the past decade. The recent interim dividend decreased to £0.072 per share from £0.134 previously, aligning with its strategy to distribute half-year profits while maintaining a conservative approach amidst market conditions.

- Click to explore a detailed breakdown of our findings in Mortgage Advice Bureau (Holdings)'s dividend report.

- Our valuation report unveils the possibility Mortgage Advice Bureau (Holdings)'s shares may be trading at a premium.

Eurocell (LSE:ECEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eurocell plc manufactures, distributes, and recycles PVC building products such as windows, doors, and roofline items in the UK and Ireland, with a market cap of £123.87 million.

Operations: Eurocell plc's revenue is primarily generated from its Profiles segment at £208.80 million and Building Plastics segment at £211.40 million in the UK and Ireland markets.

Dividend Yield: 4.9%

Eurocell plc's dividend profile is marked by a recent increase in interim dividends to 2.3 pence per share, reflecting a 5% rise from the previous year. The company's dividends are well-covered by cash flows, with a low cash payout ratio of 21.5%, though earnings coverage is tighter at an 83.1% payout ratio. Despite trading at good value and recent inclusion in the S&P Global BMI Index, Eurocell's dividend history has been volatile over the past decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Eurocell.

- The analysis detailed in our Eurocell valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Embark on your investment journey to our 49 Top UK Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MAB1

Mortgage Advice Bureau (Holdings)

Provides mortgage advice services in the United Kingdom.

Outstanding track record with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives