- United Kingdom

- /

- Trade Distributors

- /

- LSE:DNA2

Doric Nimrod Air Two's (LON:DNA2) Earnings Offer More Than Meets The Eye

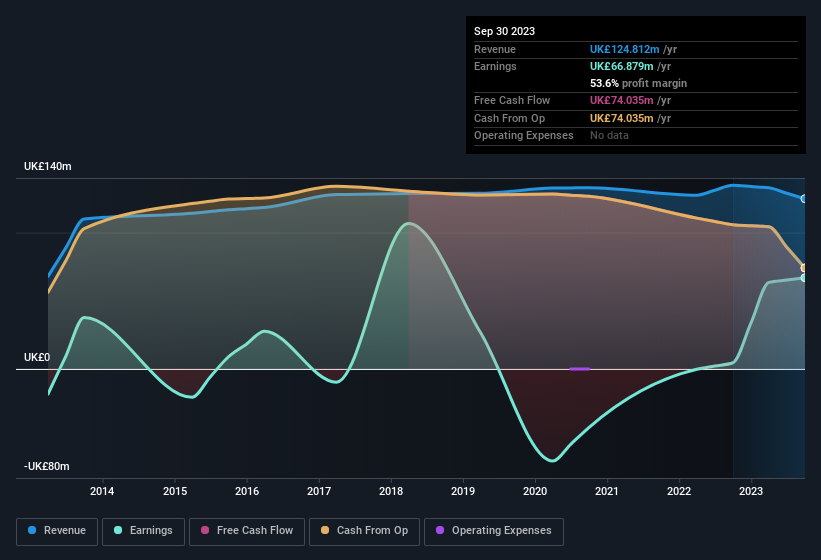

The recent earnings posted by Doric Nimrod Air Two Limited (LON:DNA2) were solid, but the stock didn't move as much as we expected. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

View our latest analysis for Doric Nimrod Air Two

Our Take On Doric Nimrod Air Two's Profit Performance

Therefore, it seems possible to us that Doric Nimrod Air Two's true underlying earnings power is actually less than its statutory profit. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Doric Nimrod Air Two you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DNA2

Doric Nimrod Air Two

Engages in the acquiring, leasing, and selling aircraft.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives