Mark Lawrence became the CEO of TClarke plc (LON:CTO) in 2010, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for TClarke.

View our latest analysis for TClarke

How Does Total Compensation For Mark Lawrence Compare With Other Companies In The Industry?

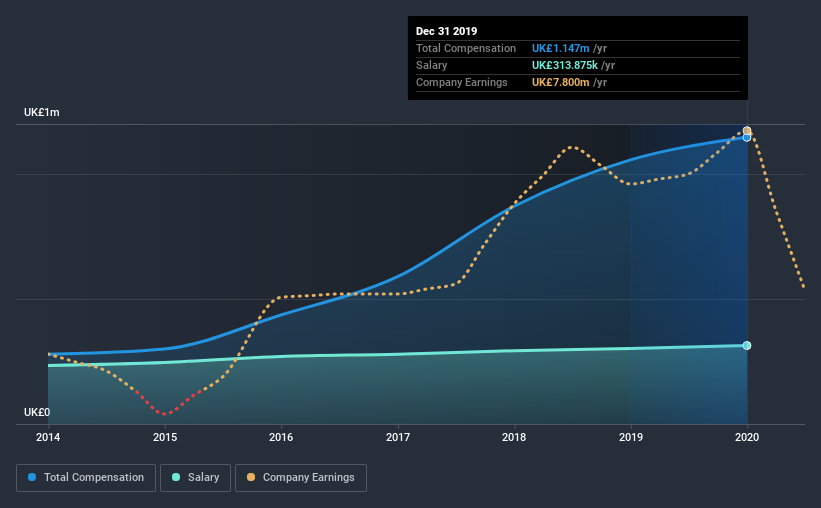

At the time of writing, our data shows that TClarke plc has a market capitalization of UK£40m, and reported total annual CEO compensation of UK£1.1m for the year to December 2019. That's a notable increase of 8.5% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£314k.

On comparing similar-sized companies in the industry with market capitalizations below UK£148m, we found that the median total CEO compensation was UK£424k. Hence, we can conclude that Mark Lawrence is remunerated higher than the industry median. What's more, Mark Lawrence holds UK£207k worth of shares in the company in their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£314k | UK£302k | 27% |

| Other | UK£833k | UK£755k | 73% |

| Total Compensation | UK£1.1m | UK£1.1m | 100% |

On an industry level, roughly 63% of total compensation represents salary and 37% is other remuneration. It's interesting to note that TClarke allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

TClarke plc's Growth

Over the last three years, TClarke plc has shrunk its earnings per share by 2.6% per year. It saw its revenue drop 22% over the last year.

The lack of EPS growth is certainly unimpressive. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has TClarke plc Been A Good Investment?

TClarke plc has generated a total shareholder return of 30% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As we noted earlier, TClarke pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Unfortunately, EPS has not grown in three years, failing to impress us. And shareholder returns are decent but not great. So you can understand why we do not think CEO compensation is particularly modest!

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 5 warning signs for TClarke that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade TClarke, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TClarke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CTO

TClarke

Engages in the design, installation, integration, and maintenance of the mechanical and electrical systems and technologies in the United Kingdom.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)