- United Kingdom

- /

- Construction

- /

- LSE:COST

Undiscovered Gems in the United Kingdom for November 2024

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces challenges from weak trade data out of China, impacting sectors closely tied to global economic health, investors may find opportunities in lesser-known stocks that are less dependent on international market fluctuations. In this environment, identifying companies with strong domestic fundamentals and innovative strategies could be key to uncovering potential growth prospects amidst broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Globaltrans Investment | 8.54% | 5.28% | 22.11% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Costain Group (LSE:COST)

Simply Wall St Value Rating: ★★★★★★

Overview: Costain Group PLC offers smart infrastructure solutions across the transportation, energy, water, and defense sectors in the UK with a market capitalization of £286.74 million.

Operations: Costain Group generates revenue primarily from its transportation and natural resources segments, contributing £900.30 million and £406.60 million, respectively.

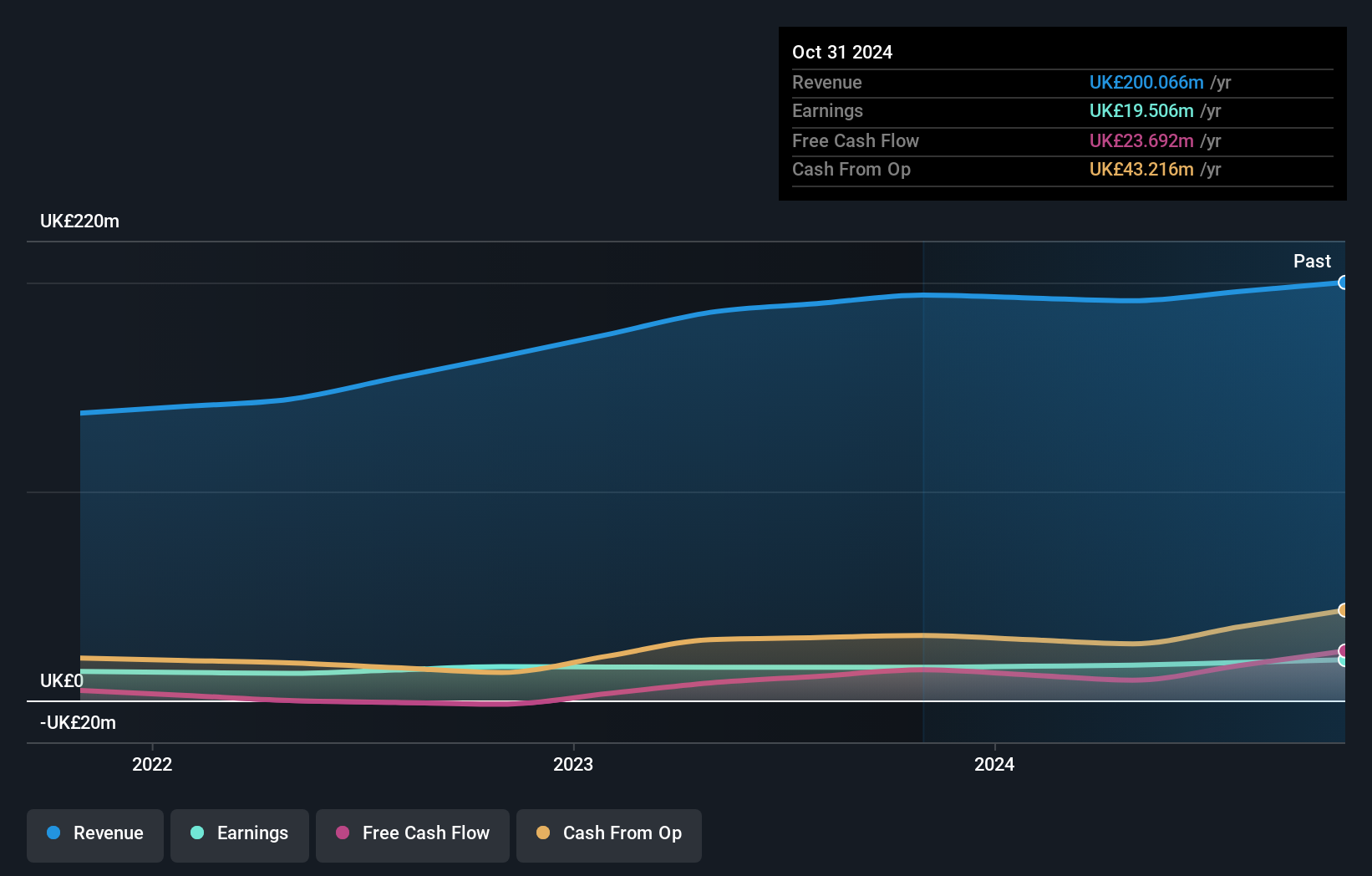

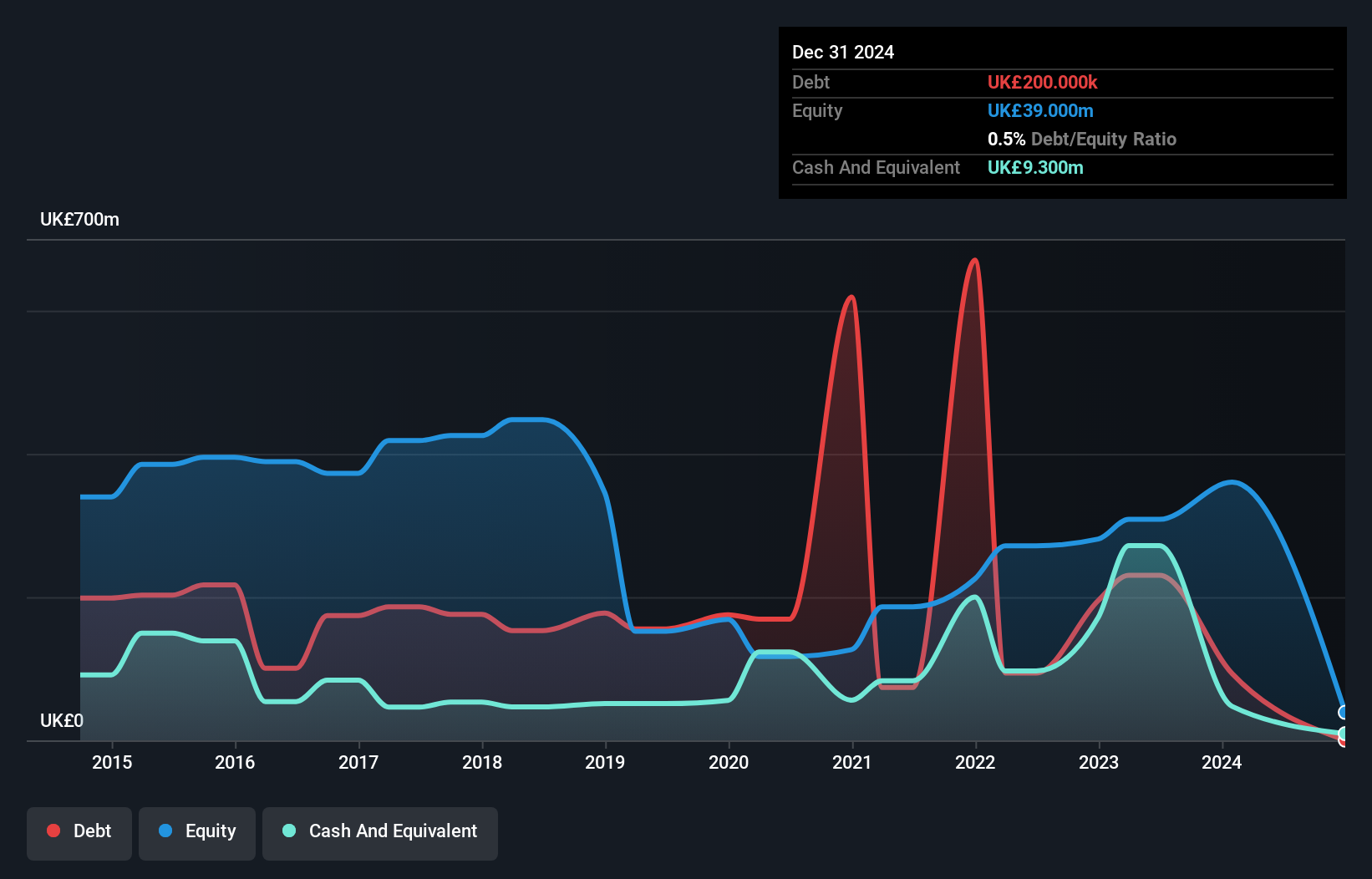

Costain Group, a notable player in the UK construction sector, has shown impressive earnings growth of 39.3% over the past year, outpacing the industry's 31.7%. This debt-free company is currently trading at about 48.3% below its estimated fair value, highlighting its potential attractiveness compared to peers. Recently added to the S&P Global BMI Index, Costain also announced a private placement raising £37.92 million and initiated a share buyback program worth up to £10 million to enhance shareholder value and support strategic growth initiatives while maintaining financial flexibility.

- Click here to discover the nuances of Costain Group with our detailed analytical health report.

Understand Costain Group's track record by examining our Past report.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Goodwin PLC, along with its subsidiaries, offers mechanical and refractory engineering solutions across various regions including the United Kingdom, Europe, the United States, and the Pacific Basin, with a market capitalization of £524.17 million.

Operations: Goodwin PLC generates revenue primarily through its Mechanical Engineering segment (£156.94 million) and Refractory Engineering segment (£75.86 million).

Goodwin, a promising name in the UK market, has shown resilience with earnings growth of 6.3% over the past year, outpacing its Machinery industry peers who faced an 8.8% downturn. The company's net debt to equity ratio stands at a satisfactory 25.9%, indicating prudent financial management despite an increase from 26.2% to 52.2% over five years. With interest payments well-covered by EBIT at a robust 9.8x, Goodwin's financial health appears sound. Recent board appointment of Christine McNamara as Non-Executive Director could bolster strategic direction given her extensive experience in energy and power sectors globally.

- Delve into the full analysis health report here for a deeper understanding of Goodwin.

Gain insights into Goodwin's past trends and performance with our Past report.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider offering solutions to the automotive industry in the United Kingdom and internationally, with a market cap of £280.11 million.

Operations: Pinewood generates revenue primarily from its software segment, which accounts for £22.62 million. The company's focus on cloud-based solutions contributes to its financial performance.

Pinewood Technologies Group, a nimble player in the UK tech scene, has been making waves with its recent 5-year contract with Marshall Motor Group, marking a significant milestone as it expands its reach. Despite facing an earnings dip of 81.6% over the past year, Pinewood's debt situation looks promising with a reduction from 65.6% to 25.9% in its debt-to-equity ratio over five years and an EBIT covering interest payments by 100 times. Trading at about 37.5% below estimated fair value, it presents potential opportunities for investors eyeing undervalued stocks in the market.

Make It Happen

- Embark on your investment journey to our 73 UK Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COST

Costain Group

Provides smart infrastructure solutions for the transportation, energy, water, and defense markets in the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives