- United Kingdom

- /

- Capital Markets

- /

- AIM:BPM

Three Undiscovered Gems in the United Kingdom Market

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat, yet it has seen an impressive 11% rise over the past year with earnings forecasted to grow by 14% annually. In this environment, identifying stocks with strong fundamentals and growth potential can be crucial for investors seeking opportunities beyond the mainstream choices.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 24.01% | 24.81% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

Overview: B.P. Marsh & Partners PLC focuses on investing in early-stage financial services intermediary businesses both in the United Kingdom and internationally, with a market cap of £210.27 million.

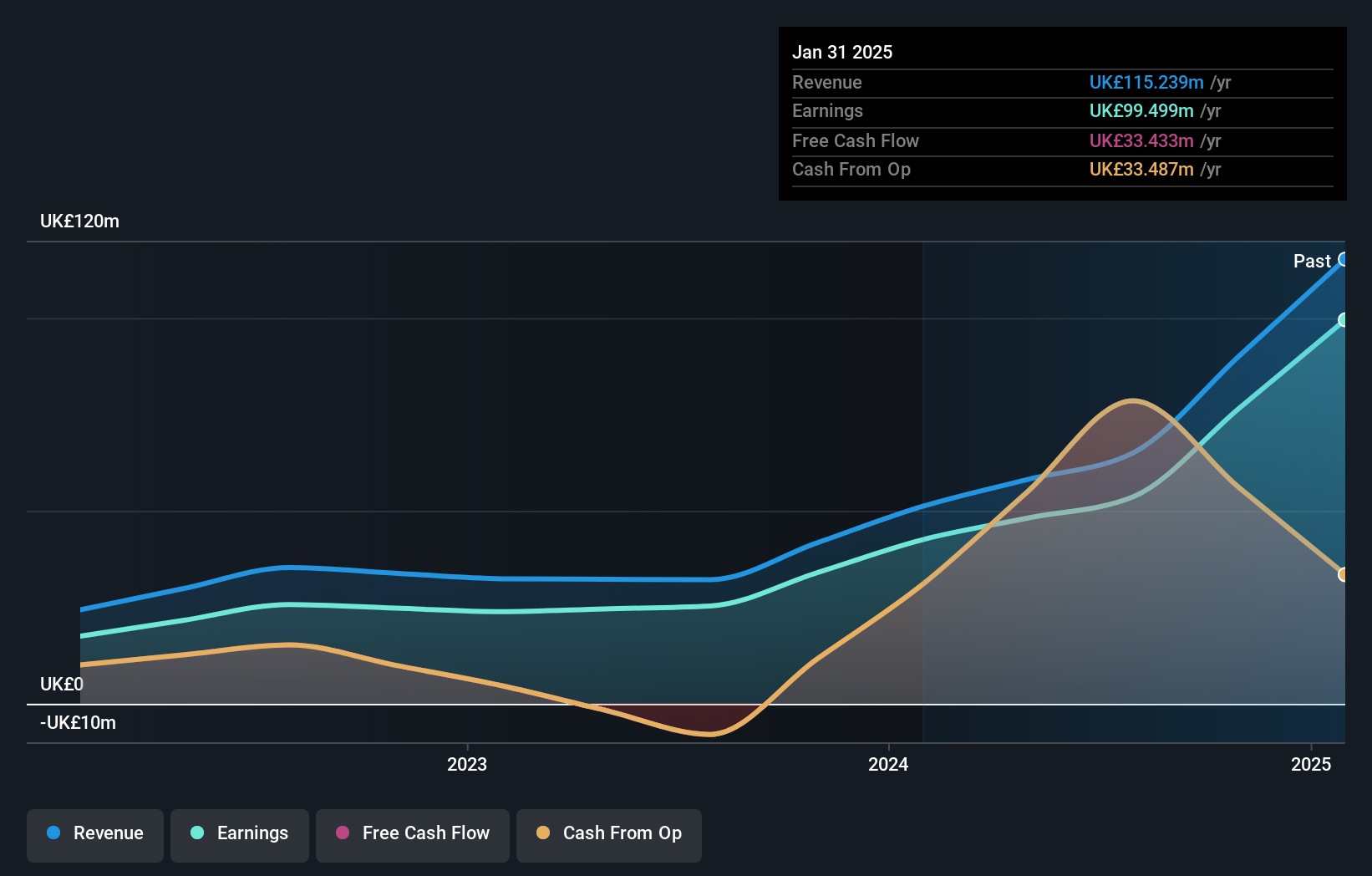

Operations: The primary revenue stream for B.P. Marsh & Partners comes from its provision of consultancy services and trading investments in financial services, generating £51.17 million. The company's market cap is valued at approximately £210.27 million.

B.P. Marsh & Partners, a financial services firm, stands out with its debt-free status and solid earnings growth of 78% over the past year, surpassing the industry average of 12%. Trading at 34% below estimated fair value suggests potential upside for investors. The recent executive change saw Jonathan Newman step down as CFO after 25 years, with Francesca Chappell taking over. Her familiarity with the company might ensure continuity in leadership. Despite these positives, investors should note that the company's buyback plan expired in July 2024 without renewal, which could affect future stock liquidity or price support strategies.

- Dive into the specifics of B.P. Marsh & Partners here with our thorough health report.

Understand B.P. Marsh & Partners' track record by examining our Past report.

Costain Group (LSE:COST)

Simply Wall St Value Rating: ★★★★★★

Overview: Costain Group PLC offers smart infrastructure solutions across the transportation, energy, water, and defense sectors in the United Kingdom with a market capitalization of £275.22 million.

Operations: The company generates revenue primarily from the transportation sector, contributing £900.30 million, and the natural resources segment, adding £406.60 million.

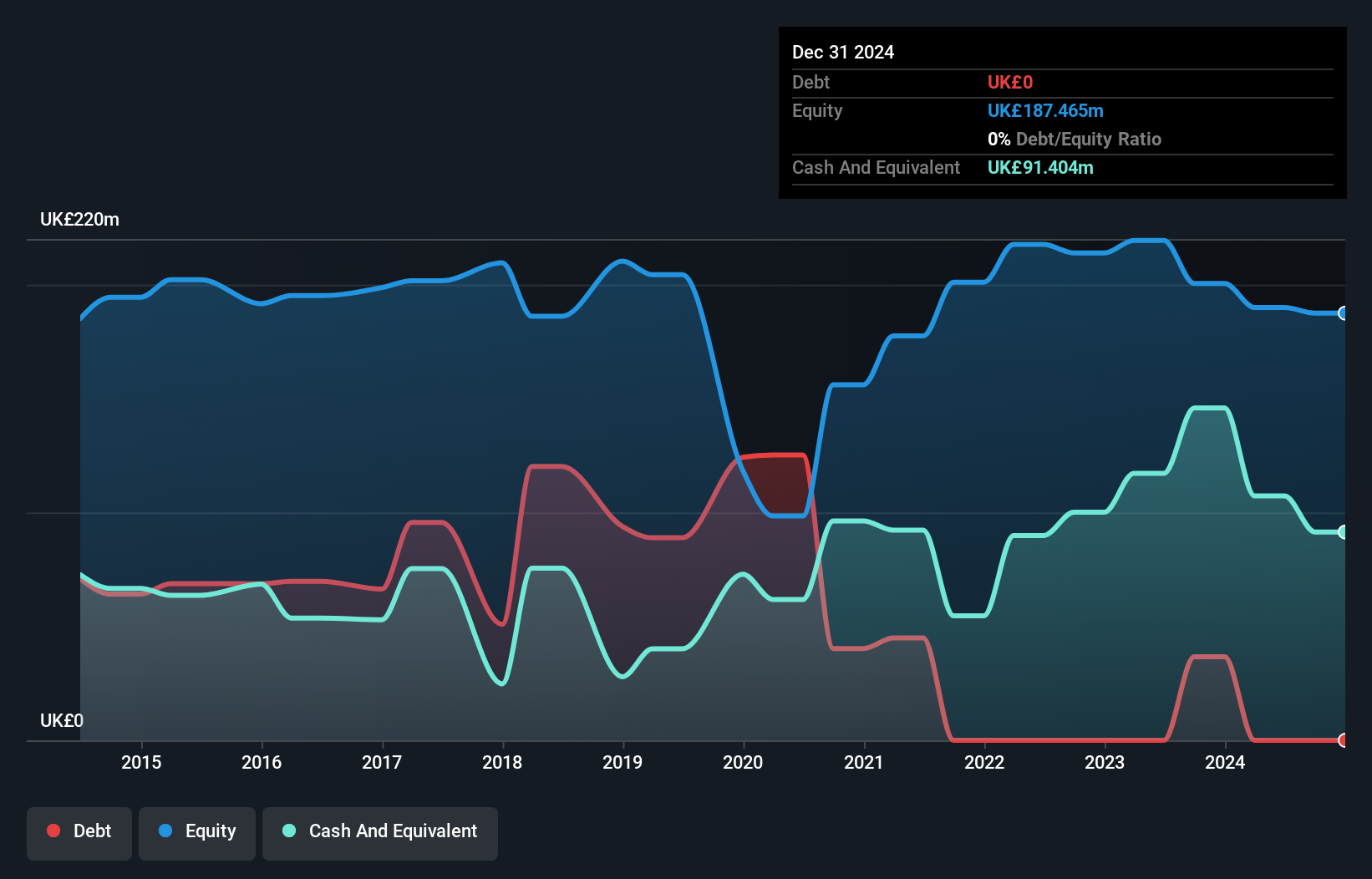

Costain Group, a UK construction firm, is trading at 51.7% below its estimated fair value, showcasing its potential as an undervalued opportunity. The company has demonstrated impressive earnings growth of 39.3% over the past year, outpacing the broader construction industry’s 18.7%. With no debt on its books now compared to a debt-to-equity ratio of 50.3% five years ago, Costain's financial health appears robust. Recent developments include being added to the S&P Global BMI Index and announcing a share repurchase program worth £10 million aimed at reducing share capital and enhancing shareholder value through increased earnings per share.

- Delve into the full analysis health report here for a deeper understanding of Costain Group.

Evaluate Costain Group's historical performance by accessing our past performance report.

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mears Group plc, along with its subsidiaries, delivers a range of outsourced services to both public and private sectors in the UK and has a market capitalization of £346.31 million.

Operations: The revenue streams for Mears Group primarily come from its Management segment at £591.63 million and Maintenance segment at £551.73 million. The company's net profit margin is 3.5%, reflecting its profitability after accounting for costs and expenses related to these services.

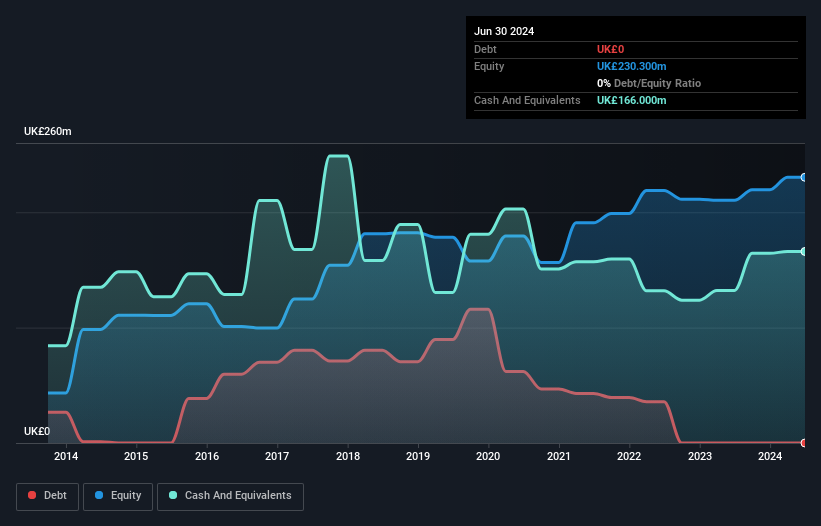

Mears Group, a notable player in the UK market, is showing robust financial health with high-quality earnings and no debt. The company has seen impressive earnings growth of 42.6% over the past year, outpacing the Commercial Services industry average of 20.7%. Trading at a price-to-earnings ratio of 8.4x, it offers good value compared to the UK market's 16.5x average. Recent buybacks include repurchasing 5,575,561 shares for £20 million between February and June 2024. For H1 2024, Mears reported sales of £580 million and net income of £22.73 million against last year's figures of £525 million and £16 million respectively.

- Navigate through the intricacies of Mears Group with our comprehensive health report here.

Gain insights into Mears Group's historical performance by reviewing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 81 UK Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B.P. Marsh & Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BPM

B.P. Marsh & Partners

Invests in early-stage financial services intermediary businesses in the United Kingdom and internationally.

Outstanding track record with flawless balance sheet.