The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Chemring Group PLC (LON:CHG) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Chemring Group's Net Debt?

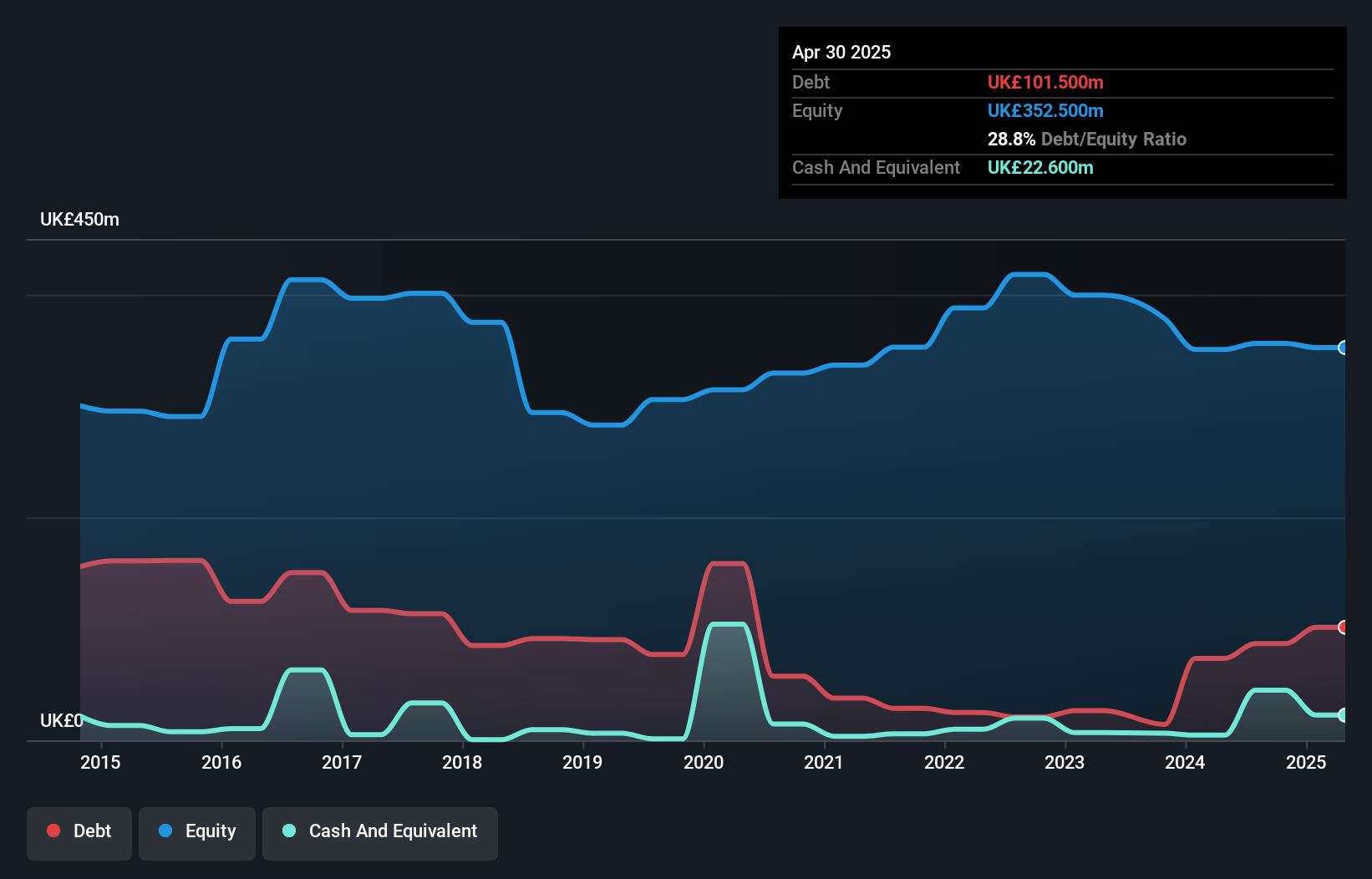

The image below, which you can click on for greater detail, shows that at April 2025 Chemring Group had debt of UK£101.5m, up from UK£73.5m in one year. However, it does have UK£22.6m in cash offsetting this, leading to net debt of about UK£78.9m.

How Strong Is Chemring Group's Balance Sheet?

We can see from the most recent balance sheet that Chemring Group had liabilities of UK£217.3m falling due within a year, and liabilities of UK£185.3m due beyond that. Offsetting these obligations, it had cash of UK£22.6m as well as receivables valued at UK£116.5m due within 12 months. So its liabilities total UK£263.5m more than the combination of its cash and short-term receivables.

Given Chemring Group has a market capitalization of UK£1.44b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

Check out our latest analysis for Chemring Group

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Chemring Group's net debt is only 0.86 times its EBITDA. And its EBIT easily covers its interest expense, being 12.4 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On the other hand, Chemring Group saw its EBIT drop by 6.3% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Chemring Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Chemring Group recorded free cash flow of 22% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

When it comes to the balance sheet, the standout positive for Chemring Group was the fact that it seems able to cover its interest expense with its EBIT confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to convert EBIT to free cash flow. Looking at all this data makes us feel a little cautious about Chemring Group's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Chemring Group insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CHG

Chemring Group

Provides countermeasures, sensors, information, and energetic products in the United States, the United Kingdom, Europe, the Asia pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives