- United Kingdom

- /

- Machinery

- /

- LSE:BOY

If EPS Growth Is Important To You, Bodycote (LON:BOY) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Bodycote (LON:BOY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Bodycote

Bodycote's Improving Profits

Bodycote has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Bodycote boosted its trailing twelve month EPS from UK£0.39 to UK£0.46, in the last year. There's little doubt shareholders would be happy with that 18% gain.

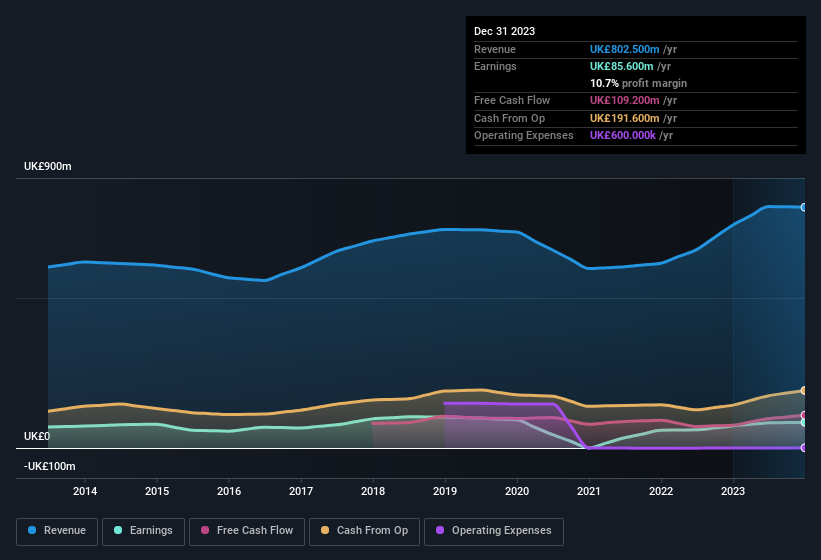

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Bodycote achieved similar EBIT margins to last year, revenue grew by a solid 7.9% to UK£803m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Bodycote's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Bodycote Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Bodycote will be more than happy to see insiders committing themselves to the company, spending UK£175k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was Independent Non-Executive Chair Daniel Dayan who made the biggest single purchase, worth UK£98k, paying UK£6.15 per share.

Should You Add Bodycote To Your Watchlist?

One positive for Bodycote is that it is growing EPS. That's nice to see. Not every business can grow its EPS, but Bodycote certainly can. The real kicker is that insiders have been accumulating, suggesting that those who understand the company best see some potential. Still, you should learn about the 1 warning sign we've spotted with Bodycote.

Keen growth investors love to see insider buying. Thankfully, Bodycote isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bodycote might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BOY

Bodycote

Provides heat treatment and thermal processing services worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives