- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BAB

After Leaping 26% Babcock International Group PLC (LON:BAB) Shares Are Not Flying Under The Radar

The Babcock International Group PLC (LON:BAB) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

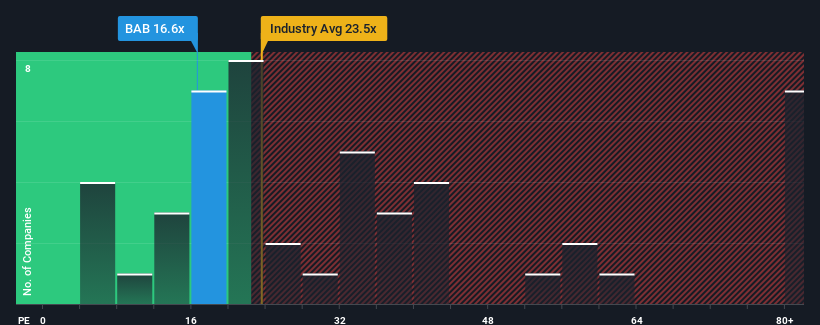

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Babcock International Group's P/E ratio of 16.6x, since the median price-to-earnings (or "P/E") ratio in the United Kingdom is also close to 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Babcock International Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Babcock International Group

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Babcock International Group would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 487%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the eight analysts watching the company. With the market predicted to deliver 14% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Babcock International Group's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Babcock International Group appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Babcock International Group maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Babcock International Group with six simple checks.

Of course, you might also be able to find a better stock than Babcock International Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Babcock International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BAB

Babcock International Group

Engages in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security in the United Kingdom, rest of Europe, Africa, North America, Australasia, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives