- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BA.

Does BAE Systems (LON:BA.) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like BAE Systems (LON:BA.), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

BAE Systems' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, BAE Systems has grown EPS by 5.9% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

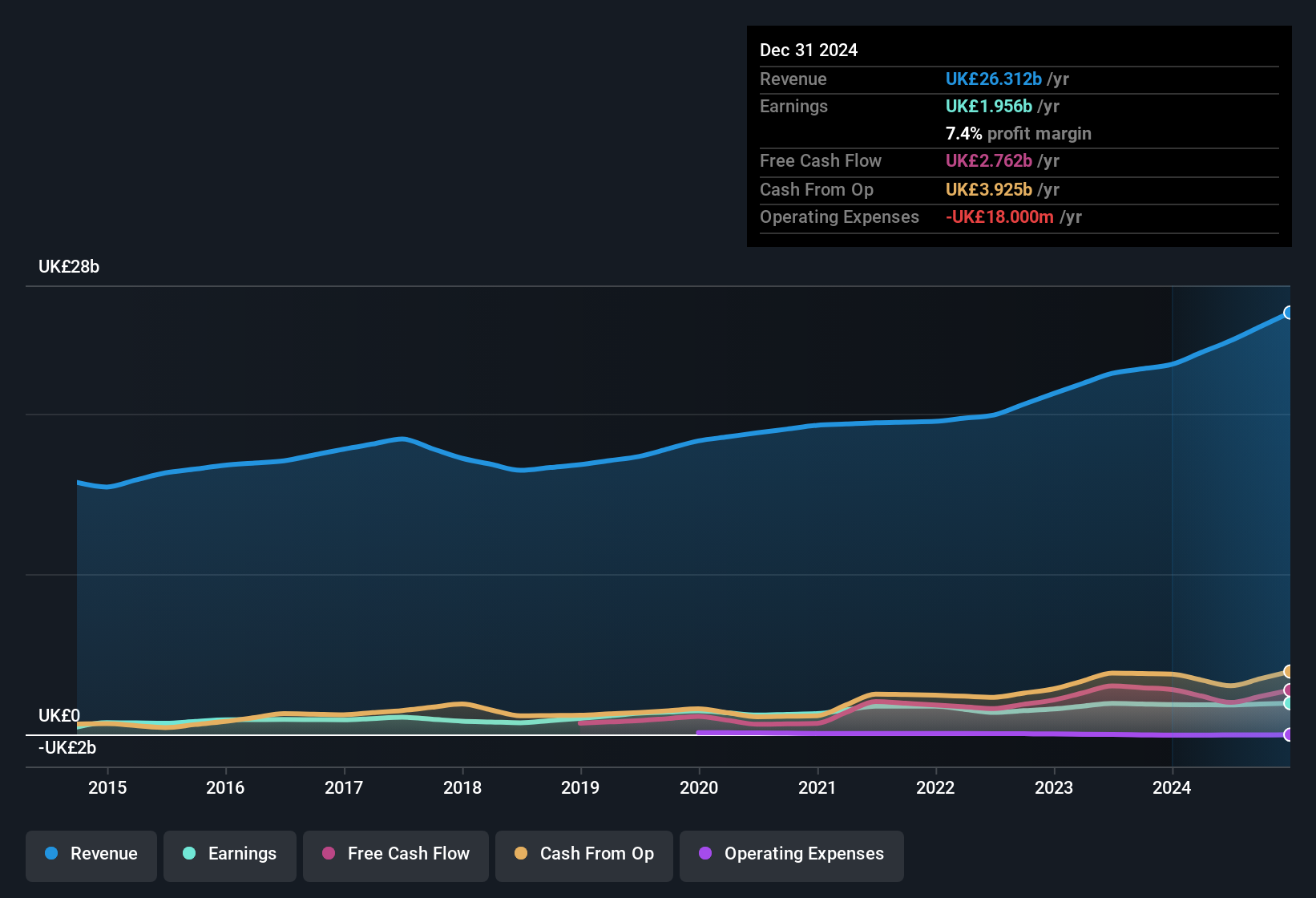

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for BAE Systems remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 14% to UK£26b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for BAE Systems

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of BAE Systems' forecast profits?

Are BAE Systems Insiders Aligned With All Shareholders?

Since BAE Systems has a market capitalisation of UK£55b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. With a whopping UK£50m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Should You Add BAE Systems To Your Watchlist?

One positive for BAE Systems is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. What about risks? Every company has them, and we've spotted 1 warning sign for BAE Systems you should know about.

Although BAE Systems certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of British companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BAE Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BA.

BAE Systems

Provides defense, aerospace, and security solutions in the United States, the United Kingdom, the Middle East, Australia, Japan, Europe, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026