- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BA.

BAE Systems (LSE:BA.) Valuation in Focus After Strong Year-to-Date Gains and Recent Share Pause

Reviewed by Kshitija Bhandaru

See our latest analysis for BAE Systems.

BAE Systems' impressive year-to-date share price return of nearly 72% has certainly outpaced recent short-term dips, with momentum still firmly on the company’s side. The strong 1-year total shareholder return of over 59% highlights both resilient fundamentals and ongoing investor confidence, even as the shares have taken a brief pause this week.

If you want to see how other aerospace and defense players are performing against a backdrop of robust sector activity, now is the time to discover See the full list for free.

With shares pausing after a remarkable run, investors now face a key question: does BAE Systems still have more value to unlock, or is the market already factoring in all the future growth prospects?

Most Popular Narrative: 4.4% Undervalued

Compared to the last closing price of £19.83, the most followed narrative puts BAE Systems' fair value at £20.75, offering a modest premium that keeps bullish investors interested. The current price sits just below this target, which anchors expectations for further upside if growth drivers play out as anticipated.

The company's order backlog has surged to £75 billion, with a pipeline of new opportunities partly fueled by higher defense spending commitments across NATO, the US, UK, Europe, and Indo-Pacific (for example, the UK targeting 2.5% of GDP on defense by 2035 and Japan doubling spending by 2027). This provides exceptional visibility on future revenues and underpins strong topline growth for multiple years.

Want to uncover the analyst consensus behind that higher price target? There's a bold growth path here, relying on ambitious sales and profit expansion. Which key assumptions drive these projections, and do they push valuation multiples into premium territory? Click through and see exactly how such a confident valuation comes together.

Result: Fair Value of £20.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain constraints or a sudden shift in global defense policies could quickly challenge BAE Systems' positive growth outlook.

Find out about the key risks to this BAE Systems narrative.

Another View: Price-Based Valuation Raises Questions

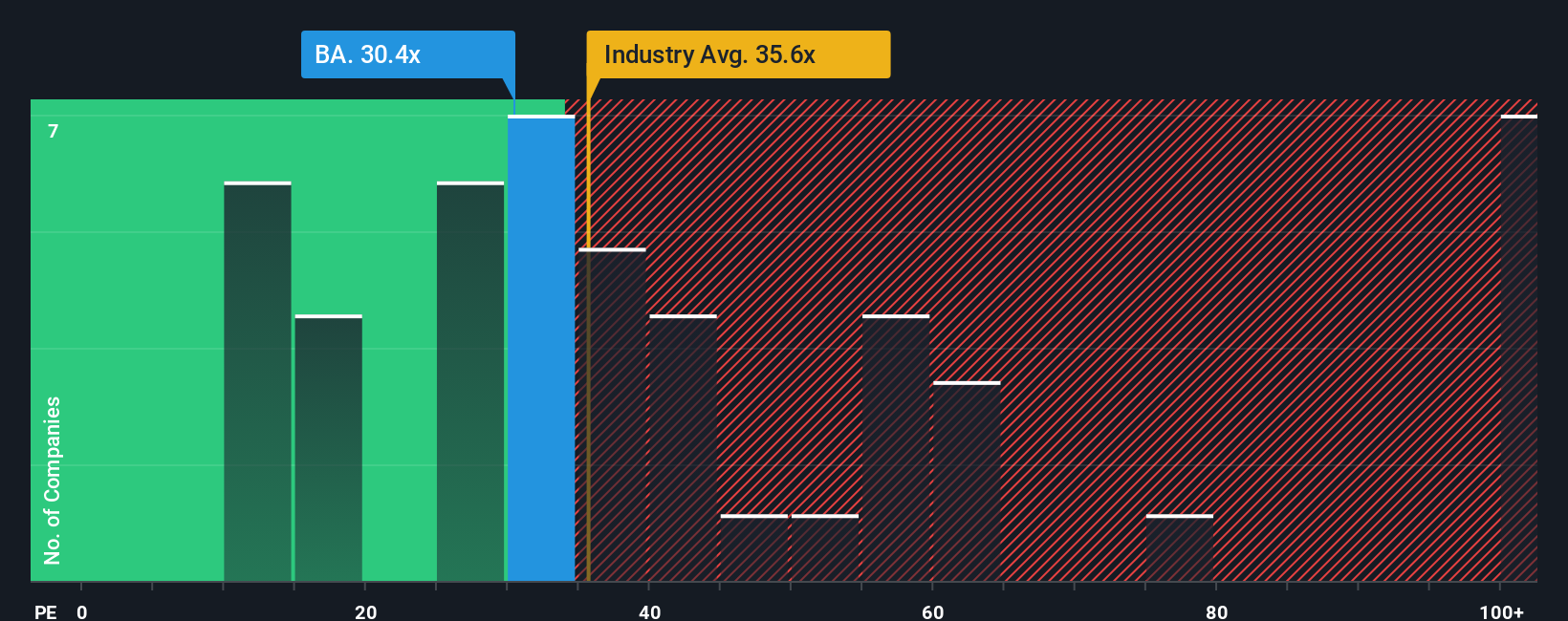

Looking through the lens of market ratios, BAE Systems is trading at 29.9 times earnings, which is higher than its UK peer average of 24.1 times, but comes in below the European sector average of 32.9 times. The fair ratio is estimated at 32.2 times. This places BAE in an interesting middle ground where valuation risk seems present, yet market optimism could still lift it higher. Does this suggest the shares are set for a rerating, or are they already priced for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BAE Systems Narrative

If these conclusions do not align with your perspective, or you would rather investigate the numbers personally, crafting your own take on BAE Systems is just a few minutes away with Do it your way.

A great starting point for your BAE Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a great opportunity slip by while the market evolves. Expand your horizons with investment themes that are shaping tomorrow's winners and building wealth for savvy investors.

- Capitalize on tomorrow’s breakthroughs by backing the innovators behind these 24 AI penny stocks who are poised to transform countless industries.

- Amplify your portfolio income by choosing from these 19 dividend stocks with yields > 3% with stable yields above 3% and steady cash flows.

- Ride the wave of blockchain advancements and financial innovation with these 79 cryptocurrency and blockchain stocks that are redefining how value moves globally.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BAE Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BA.

BAE Systems

Provides defense, aerospace, and security solutions in the United States, the United Kingdom, the Middle East, Australia, Japan, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives