- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BA.

BAE Systems (LSE:BA.) Valuation Check After Recent Share Price Pullback

Reviewed by Simply Wall St

BAE Systems (LSE:BA.) has pulled back over the past month, slipping about 8% after a strong year to date. That recent weakness is catching investors attention, especially given its solid earnings growth.

See our latest analysis for BAE Systems.

The recent slide comes after a strong run, with the year to date share price return still firmly positive and the one year total shareholder return comfortably ahead of the broader market. This suggests that momentum is pausing rather than breaking.

If you are exploring the wider defence theme, this could be a good moment to compare BAE with other aerospace and defense stocks that might benefit from similar long term spending trends.

With earnings still growing, a double digit discount to analyst targets and a strong multi year run behind it, investors now face a key question: is BAE undervalued or is future growth already fully priced in?

Most Popular Narrative: 21% Undervalued

With the narrative fair value sitting above BAE Systems last close of £16.65, the story leans toward upside, hinging on sustained defence led growth.

The company's order backlog has surged to £75 billion, with a pipeline of new opportunities partly fueled by higher defense spending commitments across NATO, the US, UK, Europe, and Indo-Pacific (for example, the UK targeting 2.5% of GDP on defense by 2035, and Japan planning to double spending by 2027). This provides visibility on future revenues and supports topline growth over multiple years.

Curious how multi year defence backlogs, expanding margins and a richer future earnings multiple combine into that higher fair value, and what assumptions really drive it? Read on to see the specific growth runway, profitability shift and valuation change this narrative is based on.

Result: Fair Value of $21.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution is not risk free, with political budget pressures and supply chain bottlenecks potentially delaying contracts and limiting how quickly backlog converts to earnings.

Find out about the key risks to this BAE Systems narrative.

Another Angle on Valuation

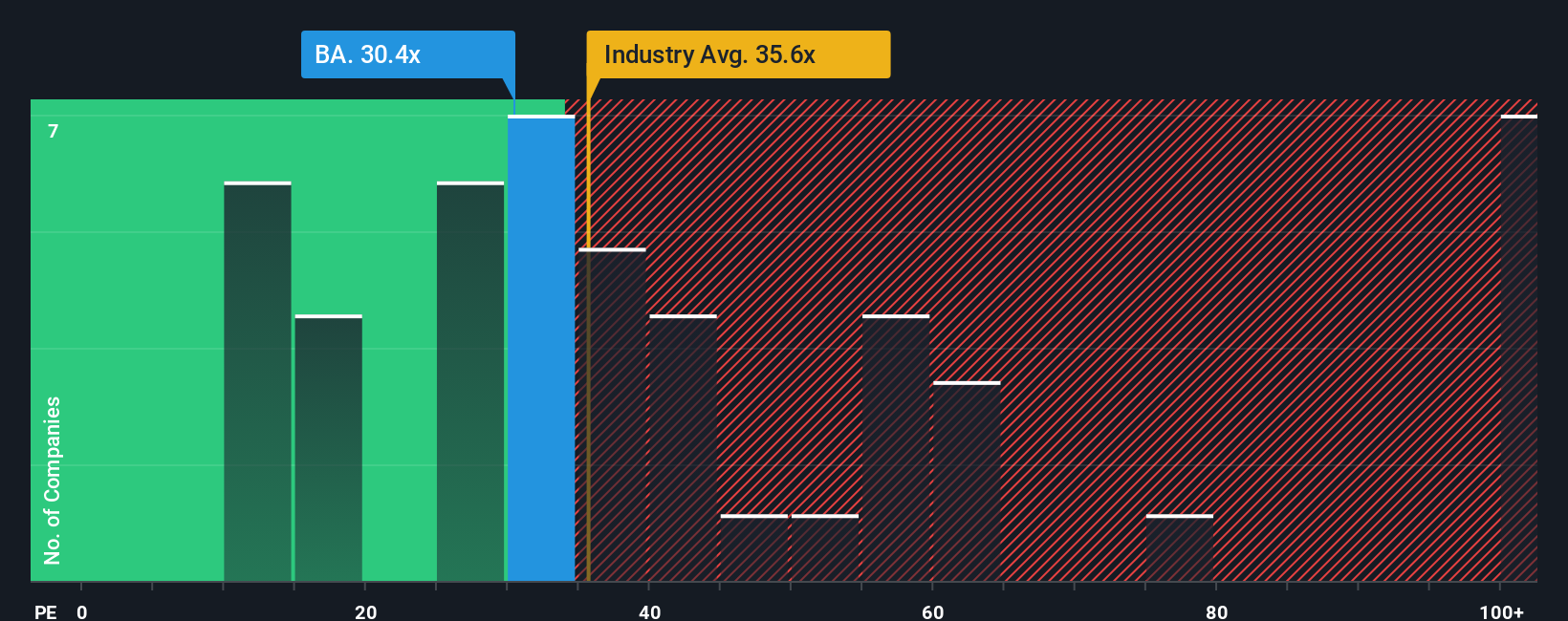

On earnings, BAE trades at about 25.1 times, cheaper than the wider European aerospace and defense sector at 30.4 times, yet slightly richer than its closest peers at 20.8 times. That mix of relative value and premium raises the question: how much rerating is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BAE Systems Narrative

If you are not fully convinced by this view or would rather dig into the numbers yourself, you can build a fresh narrative in minutes: Do it your way

A great starting point for your BAE Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If you stop at BAE, you might miss other opportunities, so use the Simply Wall St screener to uncover your next smart move in minutes.

- Capture potential multi baggers early by targeting these 3625 penny stocks with strong financials with solid balance sheets and room to scale before the crowd notices.

- Position yourself at the heart of the automation shift by zeroing in on these 25 AI penny stocks shaping data driven decision making and productivity gains.

- Seek income and stability by focusing on these 13 dividend stocks with yields > 3% that may support growing payouts throughout changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BAE Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BA.

BAE Systems

Provides defense, aerospace, and security solutions in the United States, the United Kingdom, the Middle East, Australia, Japan, Europe, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)