- United Kingdom

- /

- Building

- /

- AIM:TON

3 Promising UK Penny Stocks With Over £4M Market Cap

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, largely influenced by disappointing trade data from China, highlighting the interconnectedness of global markets. In such fluctuating market conditions, investors often seek opportunities in smaller or lesser-known companies that may offer potential for growth despite broader economic challenges. Penny stocks, though an older term, still represent these possibilities and can be appealing when they possess strong financial foundations and clear growth paths.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.295 | £864.67M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.70 | £198.24M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.45 | £355.58M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.885 | £67.03M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.25 | £106.71M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.308 | £201.73M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4295 | $249.68M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.47 | £444.03M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.35 | £207.28M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Shuka Minerals (AIM:SKA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shuka Minerals Plc is involved in the exploration, development, and mining of energy commodities in Africa with a market cap of £4.67 million.

Operations: No revenue segments have been reported.

Market Cap: £4.67M

Shuka Minerals Plc, with a market cap of £4.67 million, operates in the energy commodities sector and remains pre-revenue, reporting minimal sales of £2.33K for the half year ending June 2024. Despite being unprofitable, it has reduced its net loss from the previous year and maintained a debt-free status. The company's short-term assets exceed both its short- and long-term liabilities, offering some financial stability despite having less than a year's cash runway based on current free cash flow trends. Recent board changes aim to strengthen governance as Shuka navigates its strategic direction forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Shuka Minerals.

- Assess Shuka Minerals' previous results with our detailed historical performance reports.

Titon Holdings (AIM:TON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Titon Holdings Plc designs, manufactures, and markets ventilation products and door and window fittings across the United Kingdom, South Korea, the United States, and Europe with a market cap of £9.28 million.

Operations: The company's revenue is primarily generated from the United Kingdom (£13.93 million), followed by South Korea (£2.28 million) and North America (£1.02 million).

Market Cap: £9.28M

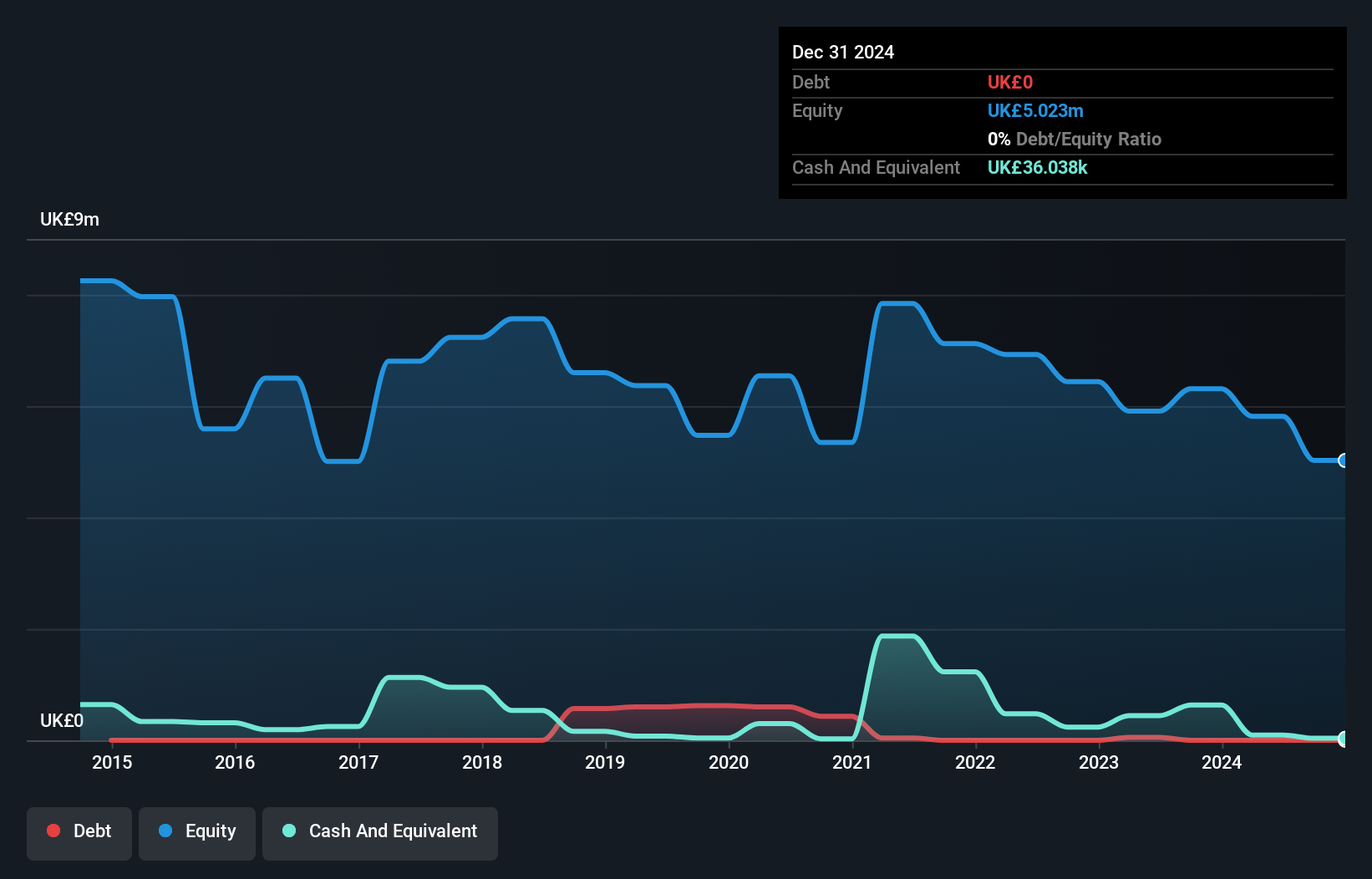

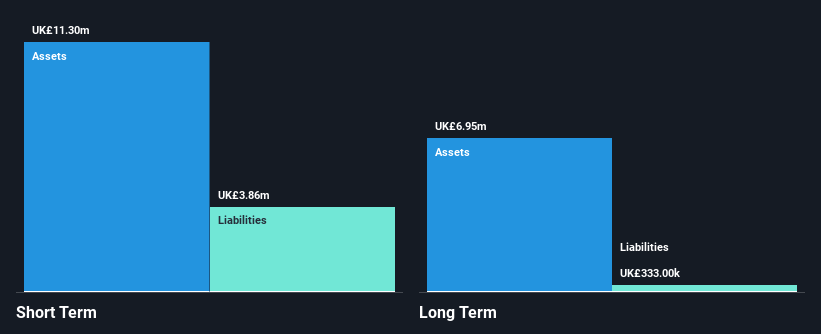

Titon Holdings Plc, with a market cap of £9.28 million, primarily generates revenue in the UK (£13.93 million) but remains unprofitable with increasing losses over the past five years. Despite no debt and short-term assets (£11.3M) exceeding liabilities, its negative return on equity (-8.67%) underscores financial challenges. Recent board changes include the departure of long-serving Non-Executive Director Nick Howlett without replacement plans, potentially impacting governance continuity as Titon navigates its strategic path amidst valuation concerns, trading significantly below estimated fair value while maintaining stable weekly volatility (4%).

- Navigate through the intricacies of Titon Holdings with our comprehensive balance sheet health report here.

- Gain insights into Titon Holdings' outlook and expected performance with our report on the company's earnings estimates.

Venture Life Group (AIM:VLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Venture Life Group plc develops and commercializes healthcare products across the UK, the Netherlands, China, Germany, Italy, Switzerland, and other international markets with a market cap of £53.68 million.

Operations: The company generates revenue from two main segments: Customer Brands, which contributed £24.66 million, and Venture Life Brands, which brought in £33.50 million.

Market Cap: £53.68M

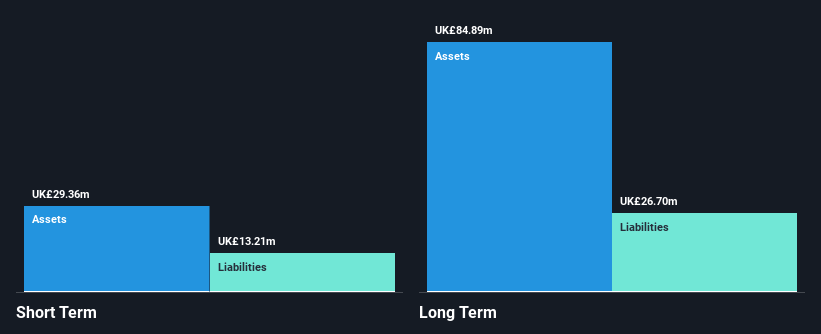

Venture Life Group plc, with a market cap of £53.68 million, operates in international healthcare markets and recently reported stable half-year sales of £23.45 million. Despite becoming profitable this year, the company posted a net loss of £1.69 million for H1 2024 due to significant one-off losses impacting results. Its short-term assets comfortably cover liabilities, and debt levels are satisfactory with a reduced debt-to-equity ratio over five years. However, interest coverage remains weak at 1.4 times EBIT, and return on equity is low at 1%. The stock trades significantly below its estimated fair value amidst forecasted earnings growth.

- Take a closer look at Venture Life Group's potential here in our financial health report.

- Learn about Venture Life Group's future growth trajectory here.

Key Takeaways

- Reveal the 467 hidden gems among our UK Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Titon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TON

Titon Holdings

Designs, manufactures, and markets ventilation products, and door and window fittings in the United Kingdom, South Korea, the United States, and Europe.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives