- United Kingdom

- /

- Food

- /

- AIM:MPE

Exploring Undiscovered Gems in the United Kingdom This July 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences a downturn due to weak trade data from China, investors are keenly observing how broader market sentiment and economic indicators impact small-cap companies. In such a climate, identifying promising stocks often involves seeking out those with robust fundamentals and resilience to global economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.15% | 50.88% | 67.63% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

M.P. Evans Group (AIM:MPE)

Simply Wall St Value Rating: ★★★★★★

Overview: M.P. Evans Group PLC, with a market cap of £642.11 million, operates through its subsidiaries to own and develop oil palm plantations in Indonesia and Malaysia.

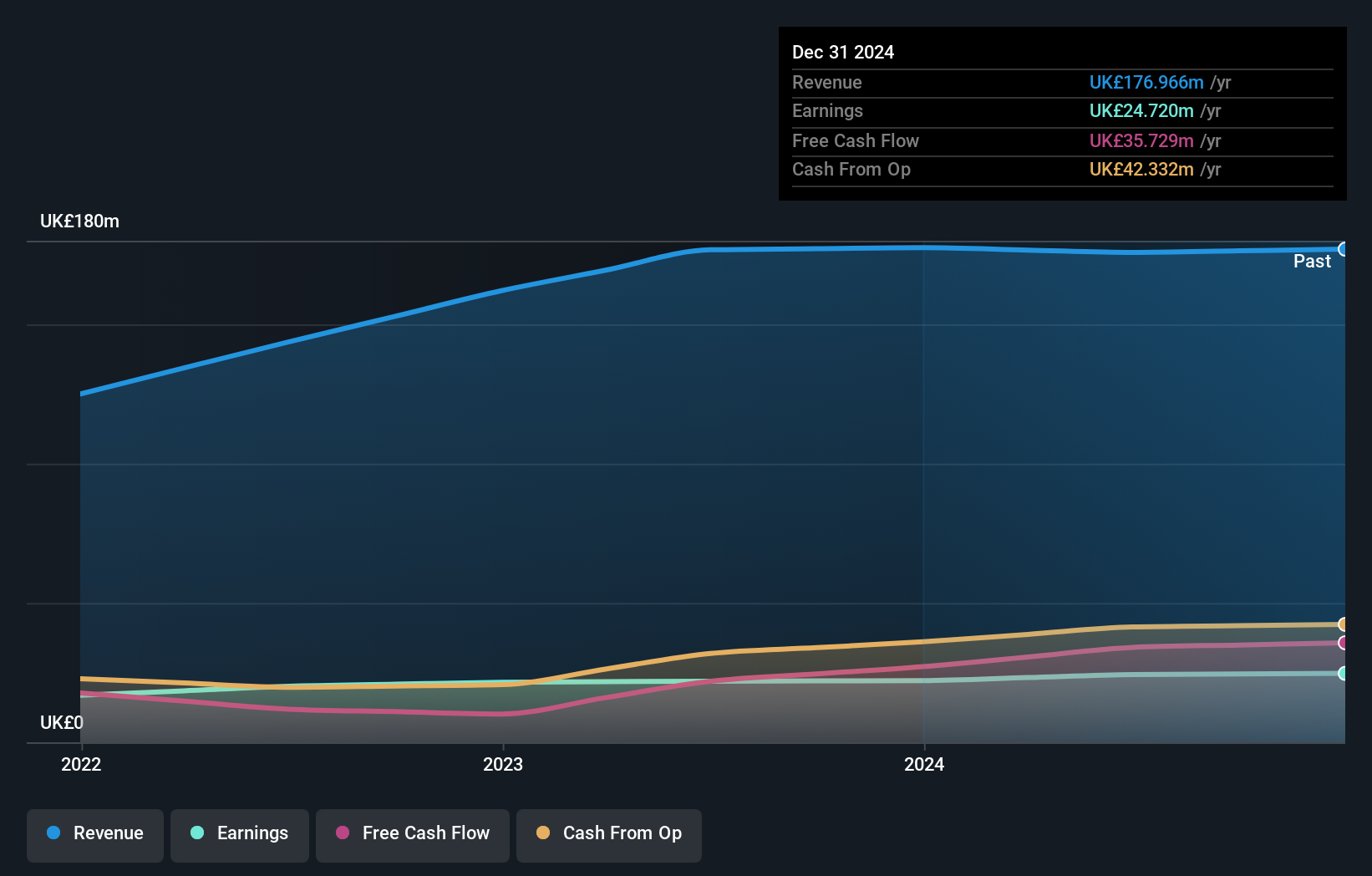

Operations: The primary revenue stream for M.P. Evans Group comes from its plantation operations in Indonesia, generating $352.84 million.

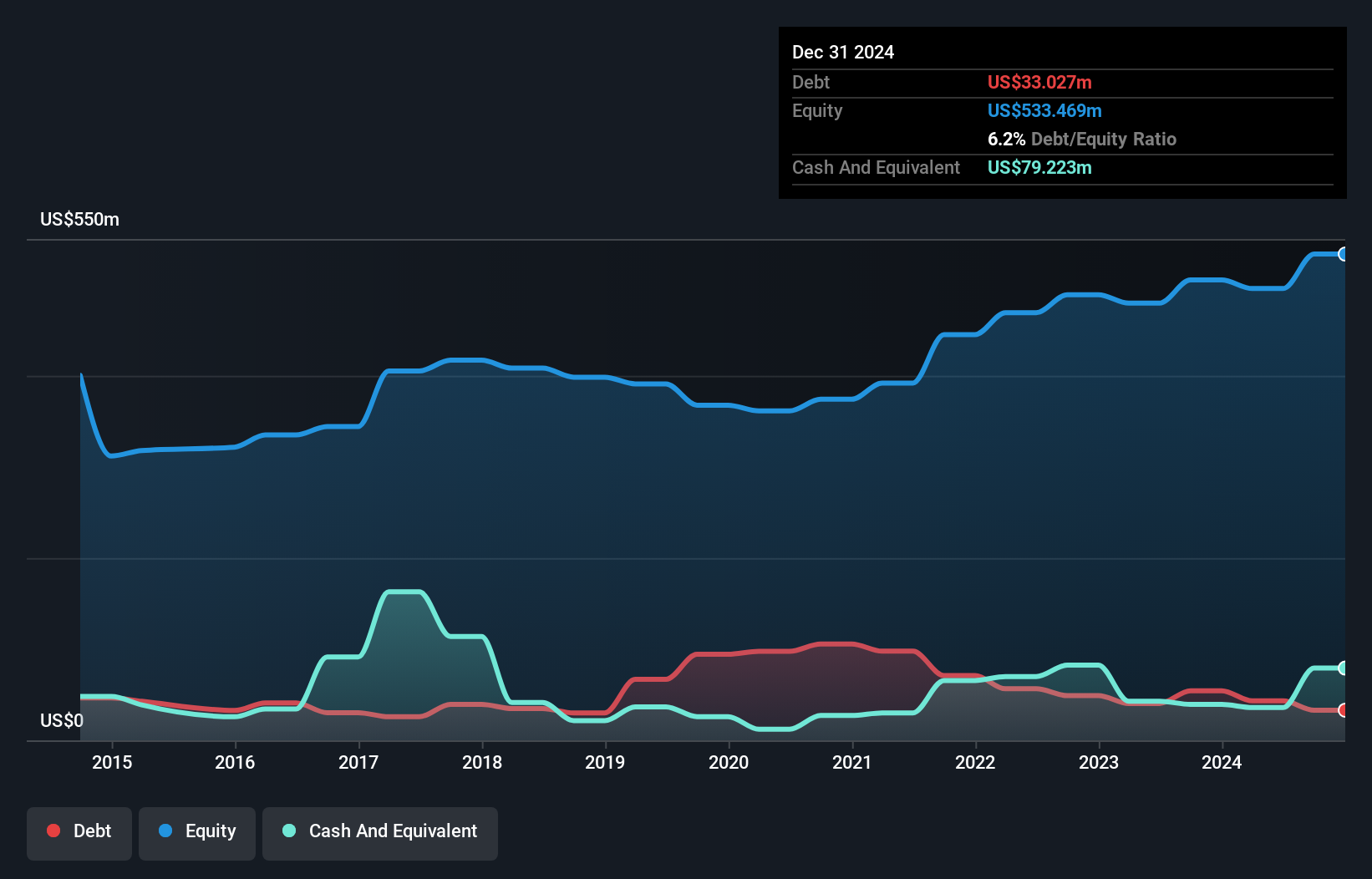

M.P. Evans Group, a small player in the UK market, has shown impressive earnings growth of 67% over the past year, significantly outpacing the food industry's average of 11%. The company's debt to equity ratio has improved from 25.7% to 6.2% over five years, and its interest payments are well covered by EBIT at a robust 52 times coverage. Trading at approximately 61% below estimated fair value and offering high-quality earnings, M.P. Evans seems undervalued compared to peers. Recent board changes signal a focus on enhanced corporate governance as it continues expanding operations in Indonesia amidst environmental risks and tax challenges.

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc is a company that designs, manufactures, and supplies professional lighting equipment across various international markets, with a market capitalization of £395.29 million.

Operations: Revenue streams for FW Thorpe include Thorlux at £105.34 million, Zemper Group at £20.63 million, and Netherlands Companies contributing £36.63 million. The net profit margin is a key financial metric to consider when evaluating the company's profitability trends over time.

FW Thorpe, a smaller player in the UK lighting industry, showcases promising financial health and growth potential. Over the past year, its earnings grew by 11.7%, outpacing the broader Electrical industry. Trading at 49% below its estimated fair value suggests potential undervaluation. The company’s debt to equity ratio has risen slightly to 2.9% over five years, yet it maintains more cash than total debt, indicating solid financial footing. With high-quality earnings and positive free cash flow of £34 million as of September 2024, FW Thorpe seems well-positioned for future opportunities in energy-efficient lighting solutions.

- Dive into the specifics of FW Thorpe here with our thorough health report.

Examine FW Thorpe's past performance report to understand how it has performed in the past.

LSL Property Services (LSE:LSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders, with a market cap of £313.97 million.

Operations: LSL Property Services generates revenue primarily from three segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency (£26.96 million). The Surveying and Valuation segment contributes the largest share to the company's revenue stream.

LSL Property Services, a notable player in the UK real estate sector, has demonstrated impressive earnings growth of 119% over the past year, outpacing its industry peers. With its stock trading at 48% below estimated fair value, LSL presents an attractive opportunity for investors seeking undervalued assets. The company maintains a strong financial position with more cash than total debt and positive free cash flow. Despite a rise in the debt-to-equity ratio from 33.9 to 38.6 over five years, interest coverage remains solid. Recently approved dividends and extended buyback plans further underscore shareholder value focus.

Make It Happen

- Click through to start exploring the rest of the 57 UK Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

Through its subsidiaries, owns and develops oil palm plantations in Indonesia and Malaysia.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives