It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Renold (LON:RNO). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Renold

Renold's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Renold has grown EPS by 44% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

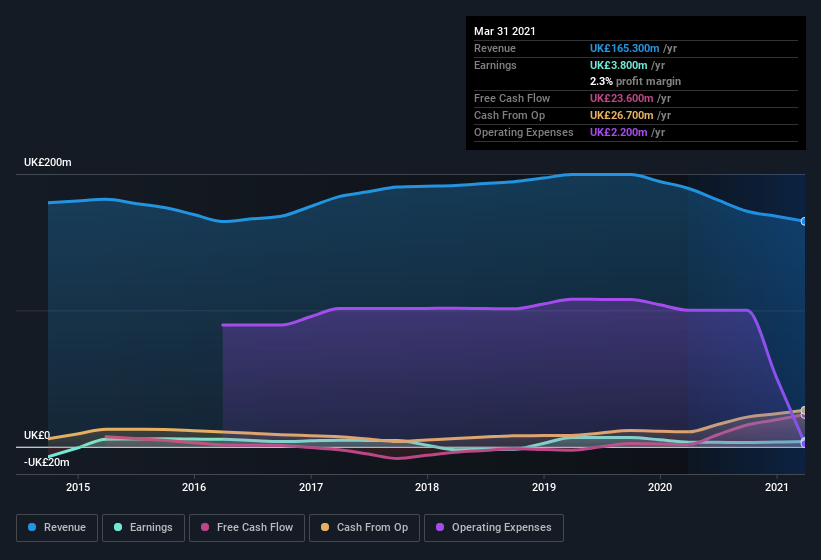

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Renold may have maintained EBIT margins over the last year, revenue has fallen. Suffice it to say that is not a great sign of growth.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Renold is no giant, with a market capitalization of UK£46m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Renold Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Renold insiders spent UK£67k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Chief Executive & Executive Director Robert Purcell for UK£37k worth of shares, at about UK£0.096 per share.

Does Renold Deserve A Spot On Your Watchlist?

Renold's earnings per share have taken off like a rocket aimed right at the moon. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Renold on your watchlist. Even so, be aware that Renold is showing 4 warning signs in our investment analysis , and 1 of those is concerning...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Renold, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Renold, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:RNO

Renold

Engages in the manufacture and sale of high precision engineered products and solutions in the United Kingdom, rest of Europe, the United States, Canada, Australasia, China, India, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives