- United Kingdom

- /

- Construction

- /

- AIM:NEXS

Nexus Infrastructure plc (LON:NEXS) Stock Rockets 79% As Investors Are Less Pessimistic Than Expected

Nexus Infrastructure plc (LON:NEXS) shareholders have had their patience rewarded with a 79% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.5% over the last year.

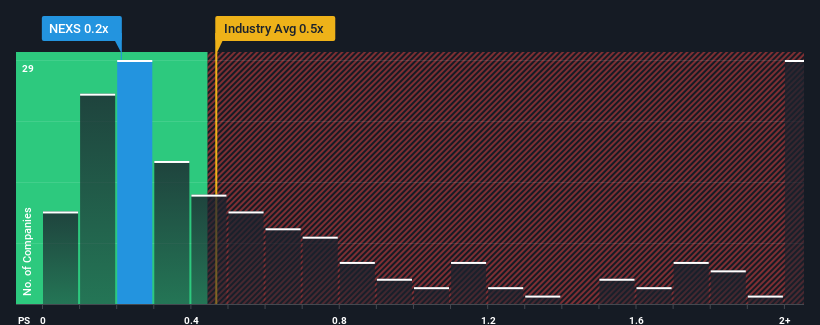

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Nexus Infrastructure's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Construction industry in the United Kingdom is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Nexus Infrastructure

How Has Nexus Infrastructure Performed Recently?

For instance, Nexus Infrastructure's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Nexus Infrastructure, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Nexus Infrastructure's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 38%. The last three years don't look nice either as the company has shrunk revenue by 40% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 6.5% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Nexus Infrastructure's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What Does Nexus Infrastructure's P/S Mean For Investors?

Its shares have lifted substantially and now Nexus Infrastructure's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We find it unexpected that Nexus Infrastructure trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you settle on your opinion, we've discovered 4 warning signs for Nexus Infrastructure (3 are potentially serious!) that you should be aware of.

If you're unsure about the strength of Nexus Infrastructure's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nexus Infrastructure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NEXS

Nexus Infrastructure

Offers infrastructure and civil engineering services to the housebuilding and commercial sectors in the United Kingdom.

Flawless balance sheet slight.