- United Kingdom

- /

- IT

- /

- LSE:CCC

3 UK Dividend Stocks Yielding Up To 7.2%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, largely influenced by weak trade data from China, which has impacted companies with significant exposure to the Chinese market. In such a volatile environment, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns amidst broader market uncertainties.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.54% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.81% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.78% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.74% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.68% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.86% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.63% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.01% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.24% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.38% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

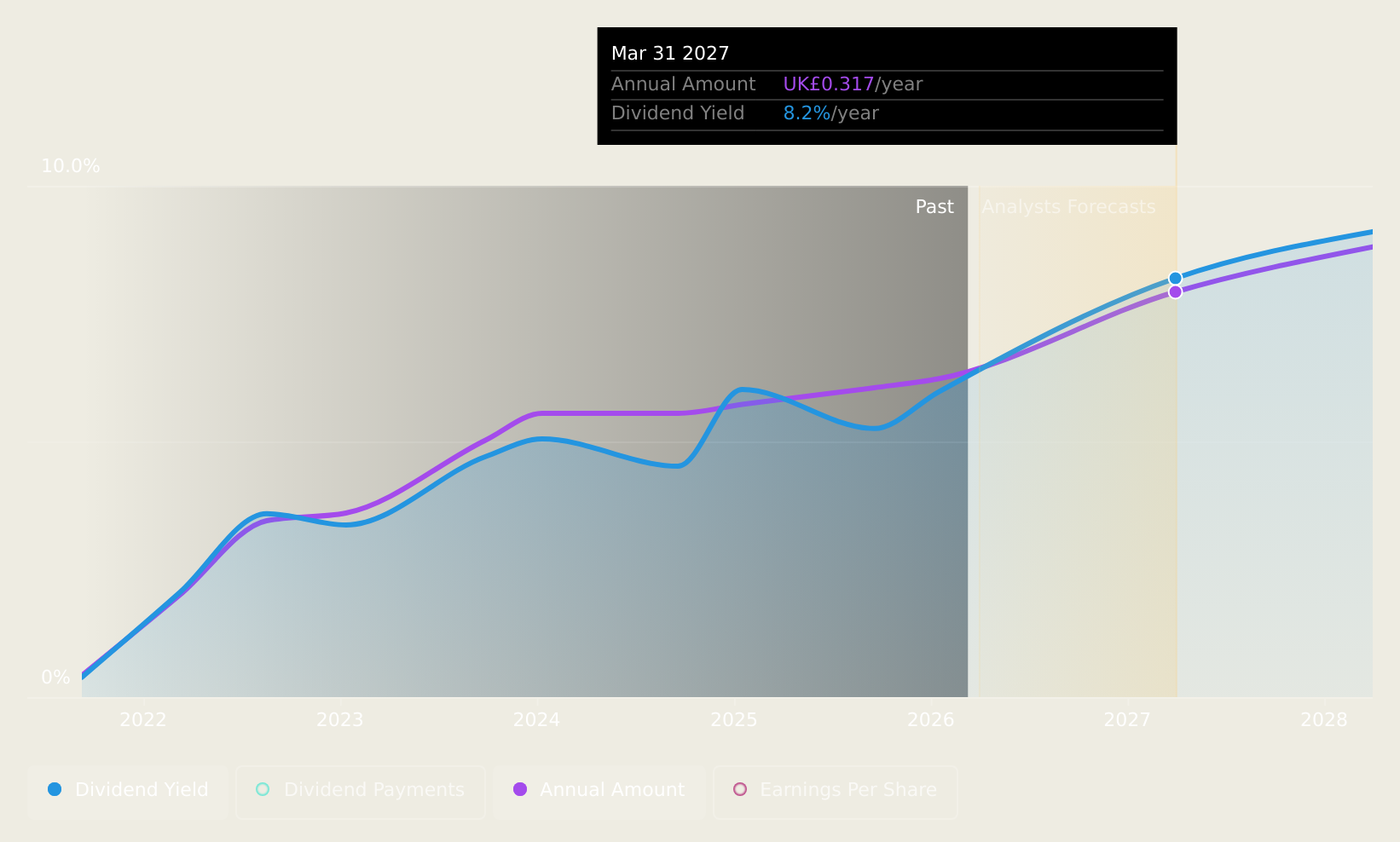

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Latham plc, with a market cap of £217.57 million, imports and distributes timbers, panels, and decorative surfaces across the United Kingdom, the Republic of Ireland, Europe, and internationally.

Operations: James Latham plc generates its revenue primarily from the timber importing and distribution segment, which accounts for £362.22 million.

Dividend Yield: 7.2%

James Latham offers a dividend yield of 7.24%, placing it in the top 25% of UK dividend payers. While dividends have grown steadily over the past decade, they are not well covered by cash flows, with a high cash payout ratio of 107%. Despite stable earnings coverage with a payout ratio of 33.4%, recent earnings reports show declining sales and net income, potentially impacting future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of James Latham.

- According our valuation report, there's an indication that James Latham's share price might be on the cheaper side.

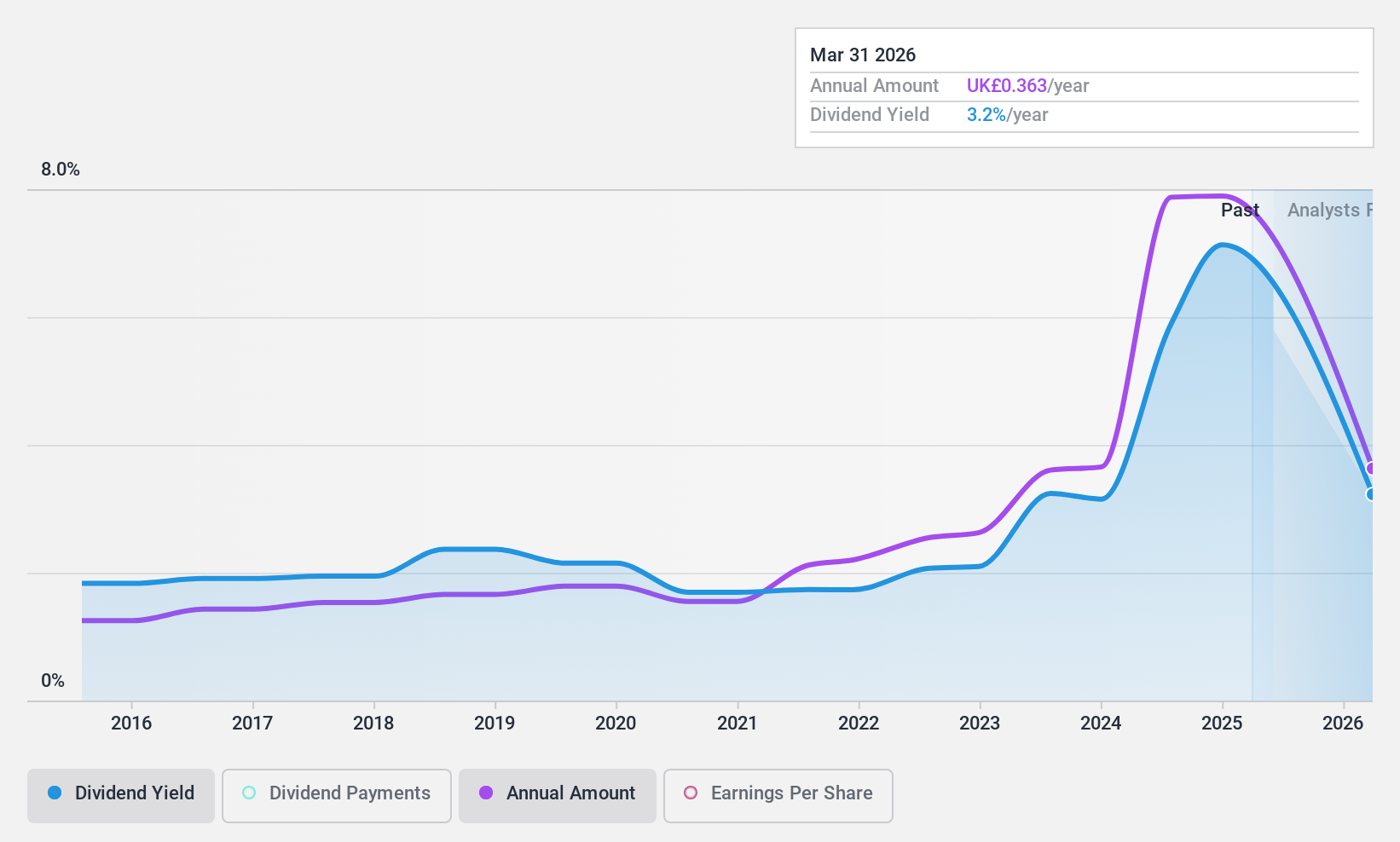

Computacenter (LSE:CCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computacenter plc delivers technology and services to corporate and public sector organizations across the United Kingdom, Germany, France, North America, and internationally, with a market cap of £2.33 billion.

Operations: Computacenter plc's revenue from Computer Services amounts to £6.44 billion.

Dividend Yield: 3.2%

Computacenter's dividend payments have been volatile over the past decade, though they are well covered by earnings and cash flows, with payout ratios of 46.8% and 28.2%, respectively. Despite this coverage, the dividend yield of 3.18% is lower than the top UK payers. Recent board changes include Simon McNamara joining as a non-executive director, which may influence future strategic decisions but does not directly impact dividend stability or growth prospects.

- Take a closer look at Computacenter's potential here in our dividend report.

- Our expertly prepared valuation report Computacenter implies its share price may be lower than expected.

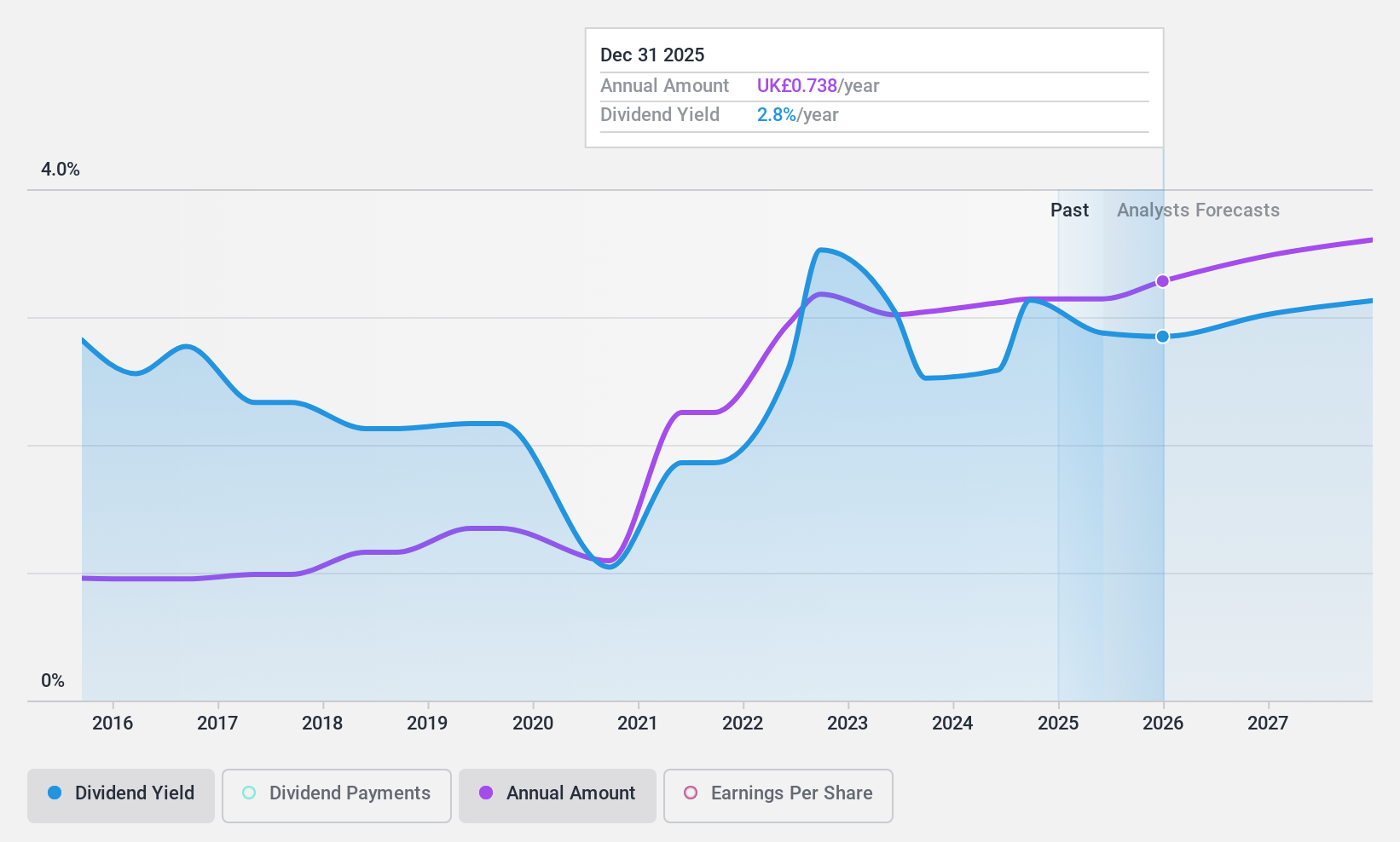

Foresight Group Holdings (LSE:FSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £459.09 million.

Operations: Foresight Group Holdings Limited generates revenue through its segments of Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Dividend Yield: 5.7%

Foresight Group Holdings' dividend yield is in the top 25% of UK payers, supported by earnings and cash flows with payout ratios of 86.6% and 68.3%, respectively. Despite only a four-year dividend history, payments have been stable and growing. Recent earnings growth, highlighted by a net income rise to £12.65 million for H1 2025, supports future payouts. The company expanded its buyback plan by £5 million to £15 million, potentially enhancing shareholder value further.

- Navigate through the intricacies of Foresight Group Holdings with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Foresight Group Holdings' share price might be too pessimistic.

Summing It All Up

- Explore the 59 names from our Top UK Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CCC

Computacenter

Provides technology and services to corporate and public sector organizations in the United Kingdom, Germany, France, North America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives