- United Kingdom

- /

- Building

- /

- AIM:JHD

UK Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices declining due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, investors often look to penny stocks as a potential area for growth and diversification. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer unique opportunities when they possess strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.645 | £520.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.25 | £181.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.115 | £15.34M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.545 | $316.82M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.51 | £257.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.465 | £70.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.08 | £172.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.745 | £10.26M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.38 | £72.51M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across the UK, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £610.59 million.

Operations: The company generates £261.97 million in revenue from the manufacture and distribution of flooring products.

Market Cap: £610.59M

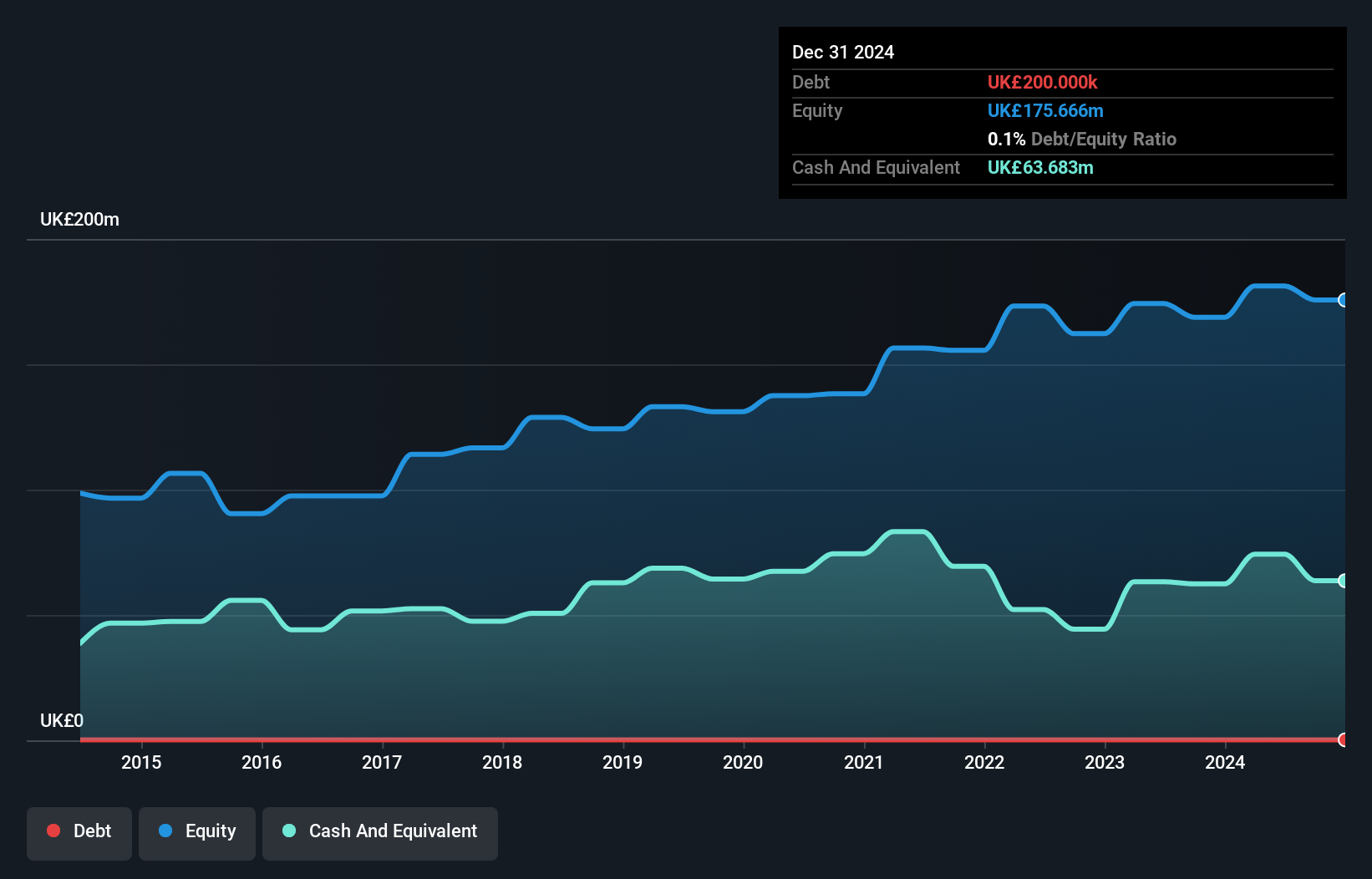

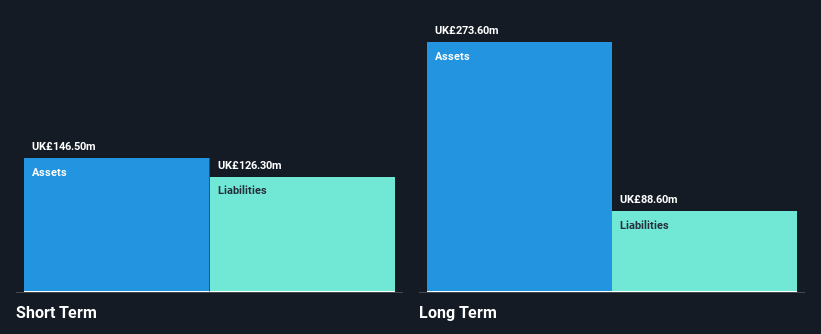

James Halstead plc, with a market cap of £610.59 million, demonstrates financial stability through its strong balance sheet and high-quality earnings. The company's Return on Equity stands at 22.3%, indicating efficient profit generation relative to shareholder equity. Despite a slight decline in sales and net income for the year ended June 30, 2025, James Halstead maintains a robust position with short-term assets exceeding both short-term and long-term liabilities. The dividend yield of 6.01% is not well covered by earnings or free cash flow but is supported by strong cash reserves and debt-free status, providing some reassurance to investors amidst recent negative earnings growth trends.

- Click to explore a detailed breakdown of our findings in James Halstead's financial health report.

- Gain insights into James Halstead's outlook and expected performance with our report on the company's earnings estimates.

NCC Group (LSE:NCC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market capitalization of approximately £483.57 million.

Operations: The company generates revenue through its Cyber Security segment, which accounts for £246.18 million, and its Escode segment, contributing £65.95 million.

Market Cap: £483.57M

NCC Group, with a market cap of £483.57 million, faces challenges as it is currently unprofitable and has a negative Return on Equity of -7.05%. Despite this, the company shows financial resilience with short-term assets exceeding both short-term (£121.7M) and long-term liabilities (£109.7M). Recent developments include a SEK 200 million project to construct a new swim center in Rödeby, Sweden, highlighting NCC's strategic partnerships and focus on infrastructure projects. Although its debt is not well covered by operating cash flow or EBIT for interest payments, NCC holds more cash than total debt and trades slightly below estimated fair value.

- Navigate through the intricacies of NCC Group with our comprehensive balance sheet health report here.

- Examine NCC Group's earnings growth report to understand how analysts expect it to perform.

QinetiQ Group (LSE:QQ.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: QinetiQ Group plc offers science and technology solutions in the defense, security, and infrastructure sectors across the UK, US, Australia, and globally with a market cap of £2.60 billion.

Operations: The company's revenue is divided into two main segments: EMEA Services, generating £1.48 billion, and Global Solutions, contributing £453.9 million.

Market Cap: £2.6B

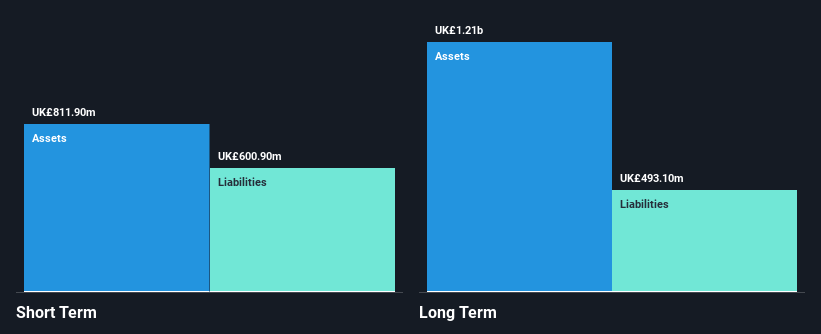

QinetiQ Group, with a market cap of £2.60 billion, is trading 8.3% below its estimated fair value and demonstrates strong financial metrics despite being unprofitable. The company’s short-term assets (£756.2M) exceed both long-term (£529.5M) and short-term liabilities (£672.4M), indicating solid liquidity management. Its debt levels are satisfactory, with a net debt to equity ratio of 7.5%, and interest payments are well covered by EBIT (9.4x). However, profitability remains a challenge as losses have increased over the past five years by 13.5% annually, compounded by an inexperienced management team averaging only 1.8 years in tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of QinetiQ Group.

- Understand QinetiQ Group's earnings outlook by examining our growth report.

Next Steps

- Get an in-depth perspective on all 295 UK Penny Stocks by using our screener here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives