- United Kingdom

- /

- Software

- /

- LSE:AMOI

Undervalued Penny Stocks On UK Exchange For December 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid concerns over weak trade data from China and its impact on global markets. Despite these broader market pressures, investors can still find value by exploring smaller or less-established companies that may offer growth opportunities. Penny stocks, though an older term, continue to represent a segment where investors might uncover potential value in companies with solid financial foundations and promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.775 | £180.04M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.12 | £798.74M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.1775 | £100.6M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.298 | £200.19M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.23 | £420.7M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £1.15 | £87.09M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.455 | £313.69M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Samuel Heath & Sons (AIM:HSM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Samuel Heath & Sons plc, with a market cap of £9.12 million, is involved in the manufacture and marketing of builders' hardware and bathroom products in the United Kingdom.

Operations: The company generates £14.98 million in revenue from its operations in the builders' hardware and bathroom sector.

Market Cap: £9.12M

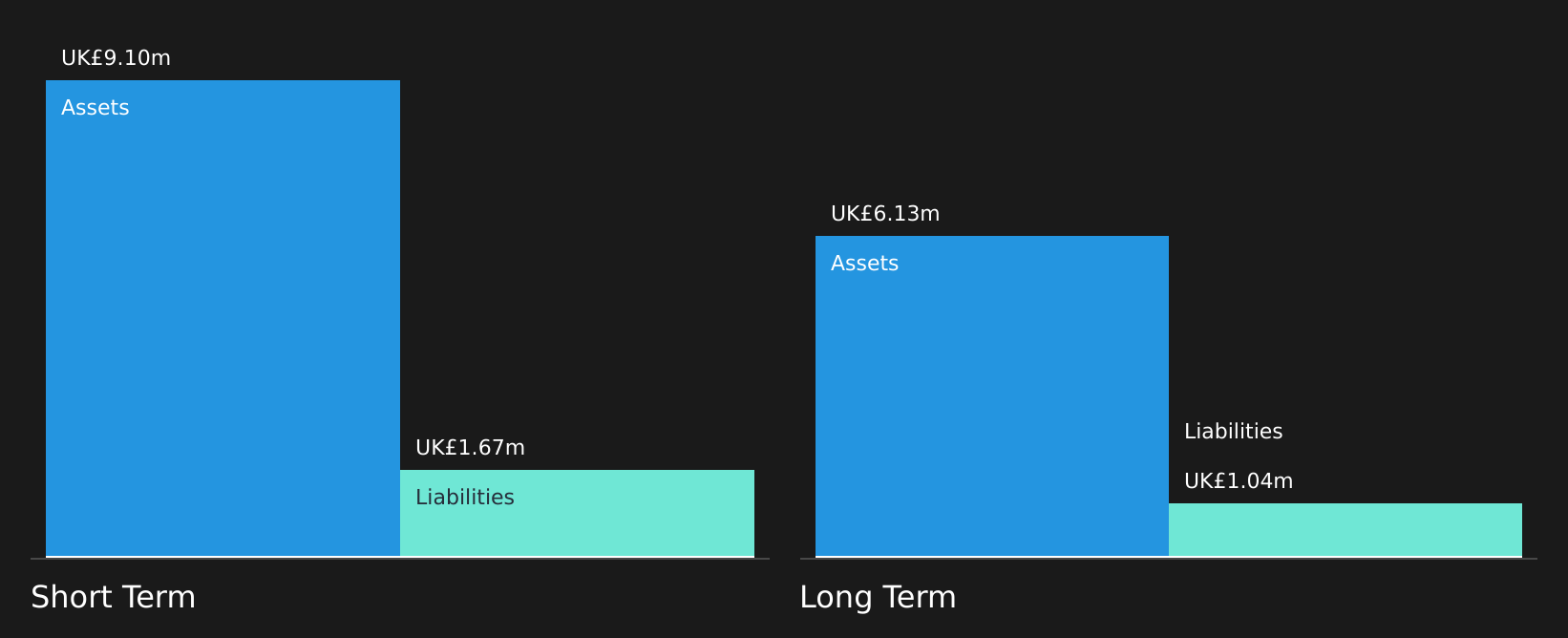

Samuel Heath & Sons plc, with a market cap of £9.12 million and revenue of £14.98 million, reported stable earnings for the half year ending September 30, 2024, with sales at £7.55 million and net income unchanged from the previous year at £0.411 million. The company has no debt and its short-term assets significantly exceed liabilities, indicating strong financial health despite a low return on equity of 6.1% and negative earnings growth over the past year (-10.1%). Its seasoned board suggests experienced governance; however, dividend sustainability remains unstable amidst high-quality earnings without shareholder dilution in the last year.

- Click here and access our complete financial health analysis report to understand the dynamics of Samuel Heath & Sons.

- Assess Samuel Heath & Sons' previous results with our detailed historical performance reports.

Science Group (AIM:SAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Science Group plc is a science, engineering, and technology company offering consultancy services and systems businesses across the UK, Europe, North America, Asia, and internationally with a market cap of £207.93 million.

Operations: The company generates revenue primarily from Consultancy Services (£75.51 million) and Freehold Properties (£3.98 million).

Market Cap: £207.93M

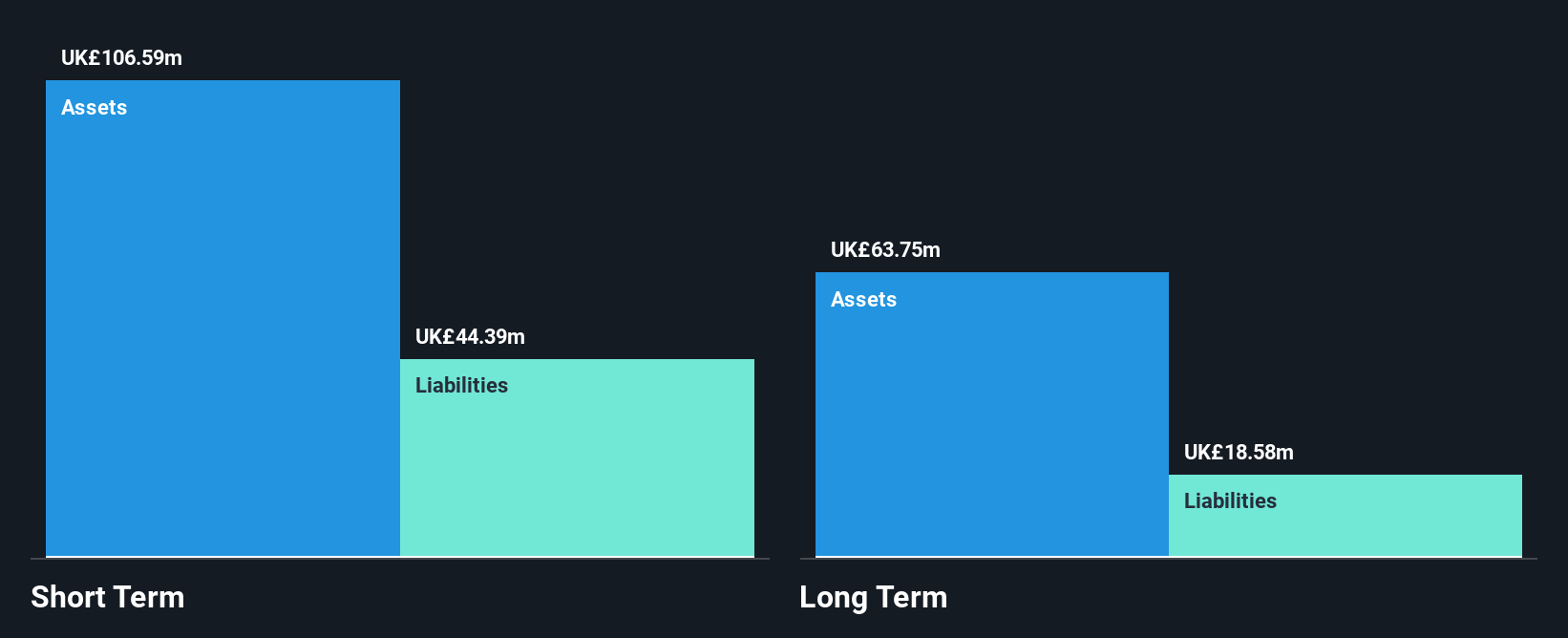

Science Group plc, with a market cap of £207.93 million, trades at 46.7% below estimated fair value and has stable weekly volatility (2%). Despite negative earnings growth (-46.6%) over the past year and decreased net profit margins (5.4% from 11.6%), its financial position is robust, with short-term assets (£65M) covering both short- (£32.4M) and long-term liabilities (£19.2M). The company holds more cash than debt, which is well covered by operating cash flow (80.7%). While Return on Equity is low at 7.1%, earnings are forecasted to grow by 18.31% annually, supported by an experienced board of directors.

- Click here to discover the nuances of Science Group with our detailed analytical financial health report.

- Assess Science Group's future earnings estimates with our detailed growth reports.

Anemoi International (LSE:AMOI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anemoi International Limited, with a market cap of £628,166, develops and sells software and digital solutions to small and medium-sized financial institutions.

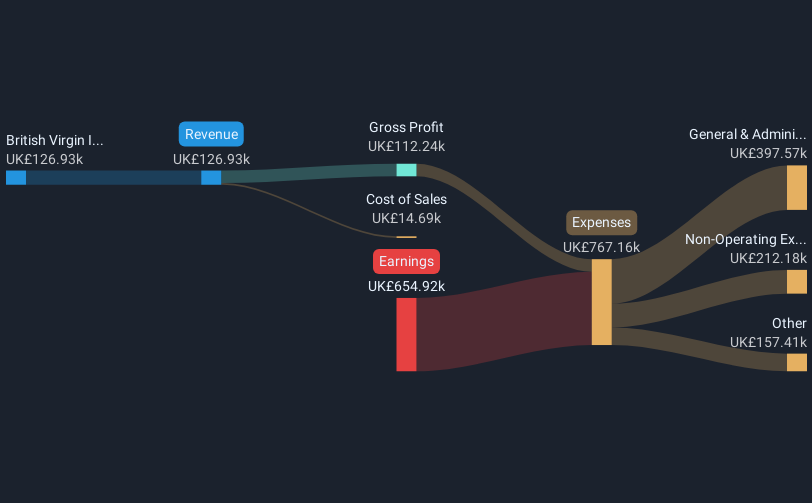

Operations: The company's revenue is primarily generated from the British Virgin Islands, amounting to £0.13 million.

Market Cap: £628.17k

Anemoi International, with a market cap of £628,166, is pre-revenue and unprofitable. Despite this, the company benefits from being debt-free and having short-term assets (£1.3M) that exceed its liabilities (£250.2K). The board is experienced with an average tenure of 3.2 years. Recent earnings for the half-year ended June 30, 2024, show a net loss reduction to £0.11 million from £0.35 million year-over-year alongside declining revenue (£0.072 million from £0.082 million). Anemoi has sufficient cash runway for over a year if current cash flow trends persist without significant shareholder dilution recently observed.

- Navigate through the intricacies of Anemoi International with our comprehensive balance sheet health report here.

- Gain insights into Anemoi International's past trends and performance with our report on the company's historical track record.

Where To Now?

- Access the full spectrum of 468 UK Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AMOI

Anemoi International

Develops and sells software and digital solutions to small and medium-size financial institutions.

Flawless balance sheet low.

Market Insights

Community Narratives