- United Kingdom

- /

- Capital Markets

- /

- LSE:TMI

Epwin Group And 2 Other UK Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market concerns, penny stocks continue to capture investor interest as they often represent smaller or newer companies with unique growth potential. While the term "penny stocks" might seem outdated, their relevance persists for those seeking opportunities beyond well-known names; this article will explore three such stocks that stand out for their financial resilience and potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.19 | £825.11M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.69 | £70.37M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.275 | £425.17M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.12M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.00 | £75.73M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.407 | $236.6M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.25 | £202.69M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.35 | £77.01M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Epwin Group (AIM:EPWN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, Europe, and internationally, with a market cap of £150.86 million.

Operations: The company generates revenue through its Extrusion and Moulding segment, which accounts for £233.30 million, and its Fabrication and Distribution segment, contributing £130.40 million.

Market Cap: £150.86M

Epwin Group Plc, with a market cap of £150.86 million, demonstrates solid financial health for a penny stock. Its net debt to equity ratio is satisfactory at 17.3%, and its debt is well covered by operating cash flow, indicating prudent financial management. Although earnings growth has been robust at 11% last year, surpassing the industry average, the company's return on equity remains low at 8.9%. Recent developments include an increased share buyback plan and a modest dividend increase to 2.10 pence per share, reflecting confidence in its ongoing operations despite slight declines in sales and net income for H1 2024 compared to the previous year.

- Click to explore a detailed breakdown of our findings in Epwin Group's financial health report.

- Assess Epwin Group's future earnings estimates with our detailed growth reports.

TPXimpact Holdings (AIM:TPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TPXimpact Holdings plc, along with its subsidiaries, offers digital native technology services across various countries including the United Kingdom, Norway, Switzerland, Germany, the United States, and Malaysia, with a market cap of £34.70 million.

Operations: TPXimpact Holdings plc does not have any reported revenue segments.

Market Cap: £34.7M

TPXimpact Holdings plc, with a market cap of £34.70 million, is trading at a substantial discount to its estimated fair value, presenting potential value for investors. Despite being unprofitable and experiencing increased losses over the past five years, the company has maintained positive free cash flow and sufficient cash runway for over three years. Recent earnings showed a reduced net loss compared to the previous year, indicating some operational improvements. The company's short-term assets exceed both its short-term and long-term liabilities, suggesting sound liquidity management amidst executive changes aimed at enhancing financial performance.

- Get an in-depth perspective on TPXimpact Holdings' performance by reading our balance sheet health report here.

- Learn about TPXimpact Holdings' future growth trajectory here.

Taylor Maritime Investments (LSE:TMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taylor Maritime Investments Limited is an investment company focused on acquiring, managing, and operating dry bulk ships, with a market cap of $304.72 million.

Operations: The company's revenue segment involves generating investment returns through shipping vessels, with a focus on capital reservation, amounting to -$42.33 million.

Market Cap: $304.72M

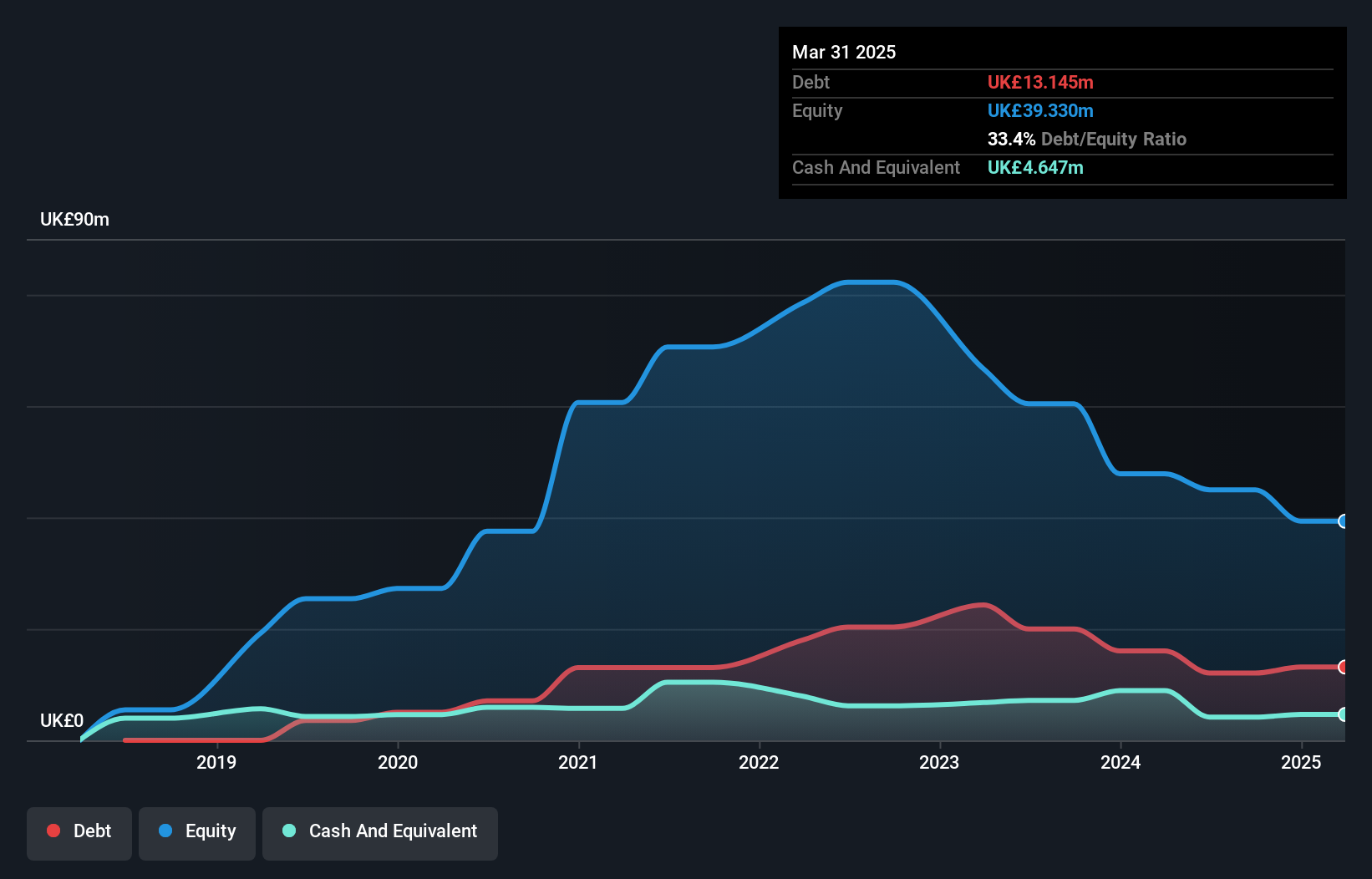

Taylor Maritime Investments Limited, with a market cap of US$304.72 million, operates in the dry bulk shipping sector but is currently pre-revenue, generating less than US$1 million. The company remains debt-free and maintains sufficient short-term assets (US$4.6M) to cover its liabilities (US$3.4M). Despite being unprofitable and having a negative return on equity (-11.03%), TMI recently declared an interim dividend of 2 US cents per share, though its sustainability is questionable due to insufficient earnings or free cash flow coverage. Recent board changes reflect efforts to bolster strategic direction amidst ongoing financial challenges.

- Click here to discover the nuances of Taylor Maritime Investments with our detailed analytical financial health report.

- Understand Taylor Maritime Investments' track record by examining our performance history report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 465 UK Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Maritime Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TMI

Taylor Maritime Investments

An investment company, engages in the acquisition, management, and operation of dry bulk ships.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives