- United Kingdom

- /

- Oil and Gas

- /

- AIM:DELT

3 UK Penny Stocks With Market Caps Under £200M To Consider

Reviewed by Simply Wall St

The UK stock market has recently experienced fluctuations, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market uncertainties, penny stocks remain an intriguing investment area for those seeking potential growth opportunities. While the term "penny stock" might seem outdated, it still applies to smaller or newer companies that can offer significant value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.055 | £774.25M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.52M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.445 | £312.41M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.43 | $249.97M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Deltic Energy (AIM:DELT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Deltic Energy Plc is a natural resources investing company focused on the exploration, evaluation, and development of gas and oil licenses in the Southern and Central North Sea, with a market cap of £5.35 million.

Operations: Deltic Energy Plc does not report any specific revenue segments.

Market Cap: £5.35M

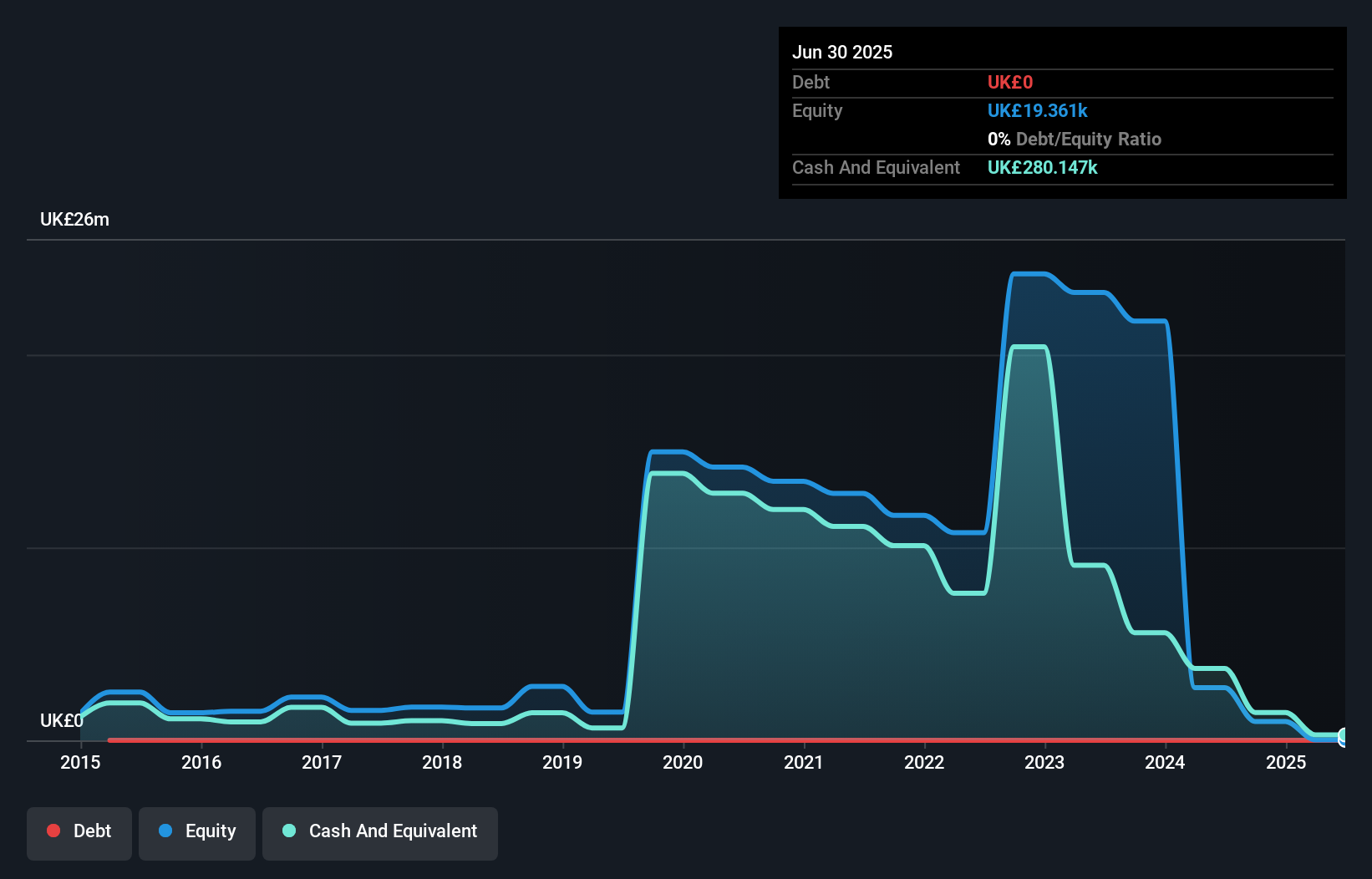

Deltic Energy, with a market cap of £5.35 million, remains pre-revenue and unprofitable but has recently confirmed a gas discovery at its Selene prospect in the North Sea. The company benefits from experienced leadership and no debt liabilities, though it faces political and fiscal challenges in the UK that have prompted a strategic shift towards international opportunities. Deltic's short-term assets exceed liabilities, yet its cash runway is limited to just over a year. The recent Selene discovery offers potential development without further drilling, possibly enhancing future cash flows if regulatory conditions stabilize.

- Unlock comprehensive insights into our analysis of Deltic Energy stock in this financial health report.

- Assess Deltic Energy's future earnings estimates with our detailed growth reports.

Epwin Group (AIM:EPWN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, Europe, and internationally, with a market capitalization of £133.29 million.

Operations: The company's revenue is derived from two main segments: Extrusion and Moulding, which generated £233.30 million, and Fabrication and Distribution, contributing £130.40 million.

Market Cap: £133.29M

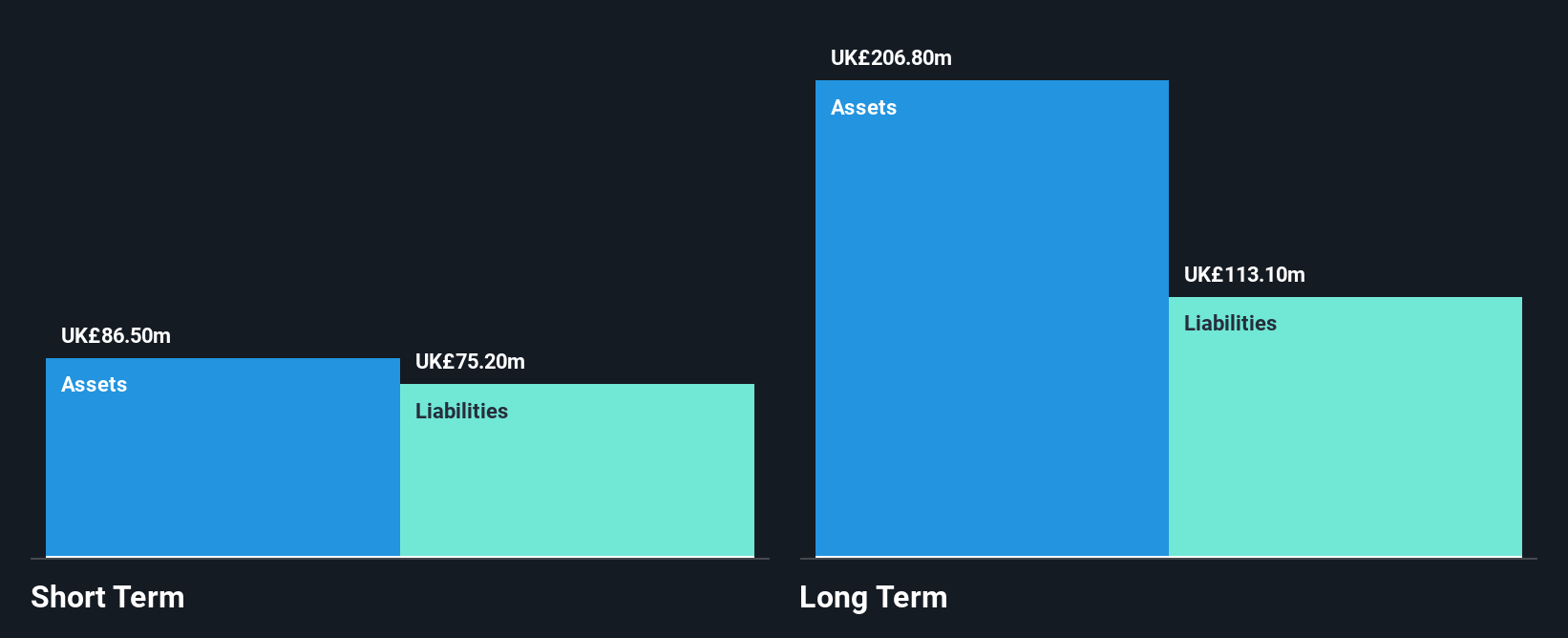

Epwin Group, with a market cap of £133.29 million, demonstrates financial stability through well-covered debt by operating cash flow and a satisfactory net debt to equity ratio of 17.3%. Its earnings have grown steadily, outpacing the industry average, with an 11% increase over the past year and forecasted growth of 15.23% annually. The company offers high-quality earnings but faces challenges like low return on equity at 8.9% and an unstable dividend history. While short-term assets cover immediate liabilities, they fall short against long-term obligations; however, management's seasoned experience provides strategic oversight amidst these financial dynamics.

- Jump into the full analysis health report here for a deeper understanding of Epwin Group.

- Gain insights into Epwin Group's outlook and expected performance with our report on the company's earnings estimates.

Serinus Energy (AIM:SENX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Serinus Energy plc, along with its subsidiaries, is involved in the exploration and development of oil and gas properties in Tunisia and Romania, with a market cap of £2.54 million.

Operations: The company's revenue of $16.76 million is generated from its activities in the exploration, development, and production of oil and natural gas.

Market Cap: £2.54M

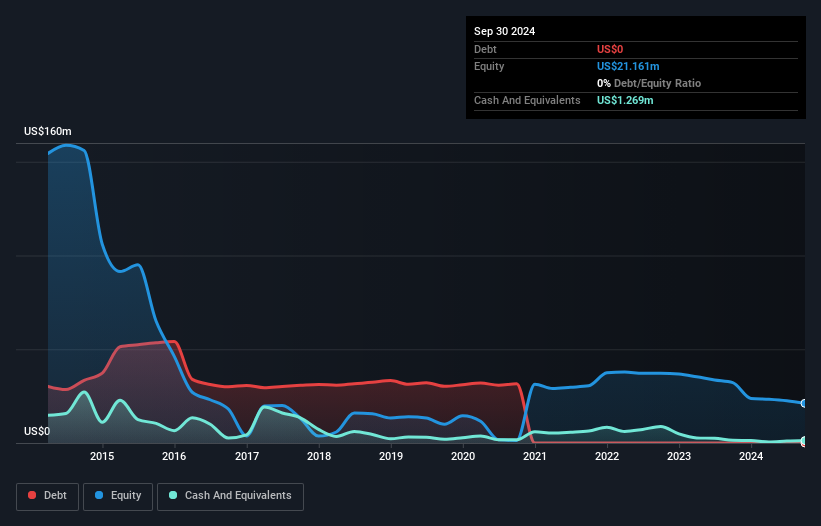

Serinus Energy, with a market cap of £2.54 million, faces challenges as it remains unprofitable despite generating US$16.76 million in revenue from its oil and gas activities. The company has no debt but struggles with covering long-term liabilities, which exceed short-term assets by a significant margin. Recent equity offerings have diluted shareholders but provided additional capital to sustain operations. While earnings have declined over the past five years, recent results show a reduced net loss compared to the previous year. The management team is experienced, and Serinus maintains a cash runway exceeding three years due to positive free cash flow growth.

- Dive into the specifics of Serinus Energy here with our thorough balance sheet health report.

- Gain insights into Serinus Energy's historical outcomes by reviewing our past performance report.

Make It Happen

- Access the full spectrum of 472 UK Penny Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DELT

Deltic Energy

A natural resources investing company, engages in the exploration, evaluation, and development of gas and oil licenses in the Southern and Central North Sea.

Excellent balance sheet moderate.

Market Insights

Community Narratives