- United Kingdom

- /

- Building

- /

- AIM:EPWN

3 Dividend Stocks In UK Yielding Up To 6.3%

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, though it is up 5.3% over the past year with earnings expected to grow by 14% per annum over the next few years. In this context, identifying dividend stocks that offer stable yields and potential for growth can be particularly rewarding for investors seeking reliable income streams.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| OSB Group (LSE:OSB) | 8.36% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.27% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.42% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.93% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.70% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.54% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.75% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.36% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.41% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, rest of Europe, and internationally, with a market cap of £142.79 million.

Operations: Epwin Group's revenue segments include £233.30 million from Extrusion and Moulding and £130.40 million from Fabrication and Distribution.

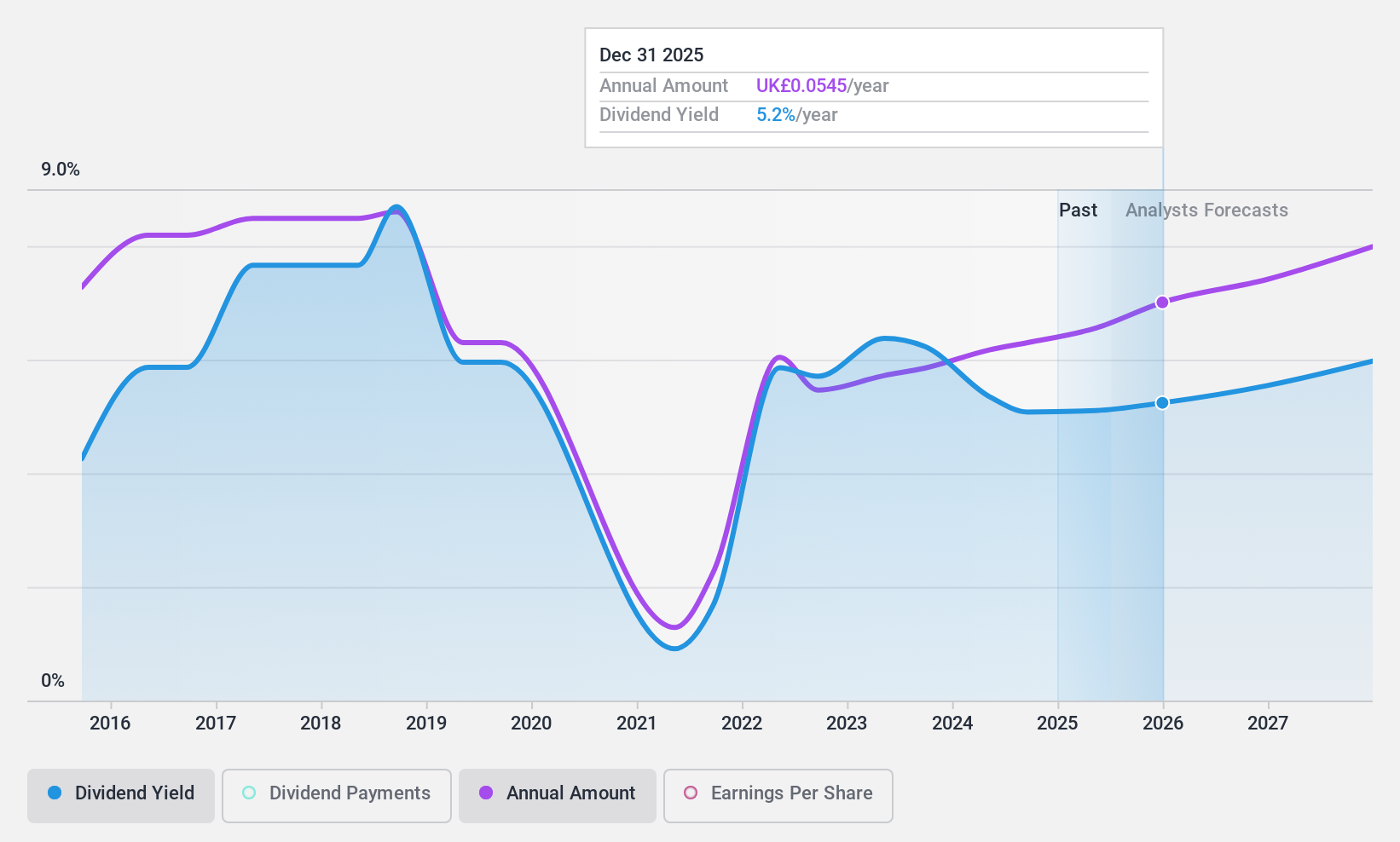

Dividend Yield: 4.7%

Epwin Group has increased its interim dividend by 5% to 2.10 pence per share, reflecting a steady rise in payouts despite a slight dip in sales and net income for the first half of 2024. The company's recent buyback of 5.9 million shares for £4.9 million indicates strong capital management. Although the dividend yield is below top-tier UK payers, dividends are well-covered by earnings and cash flows, with a payout ratio of 77.5%.

- Dive into the specifics of Epwin Group here with our thorough dividend report.

- Our valuation report here indicates Epwin Group may be overvalued.

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc is a UK-based retailer specializing in homewares, with a market cap of approximately £2.50 billion.

Operations: Dunelm Group plc generates £1.71 billion in revenue from the retail of homewares in the United Kingdom.

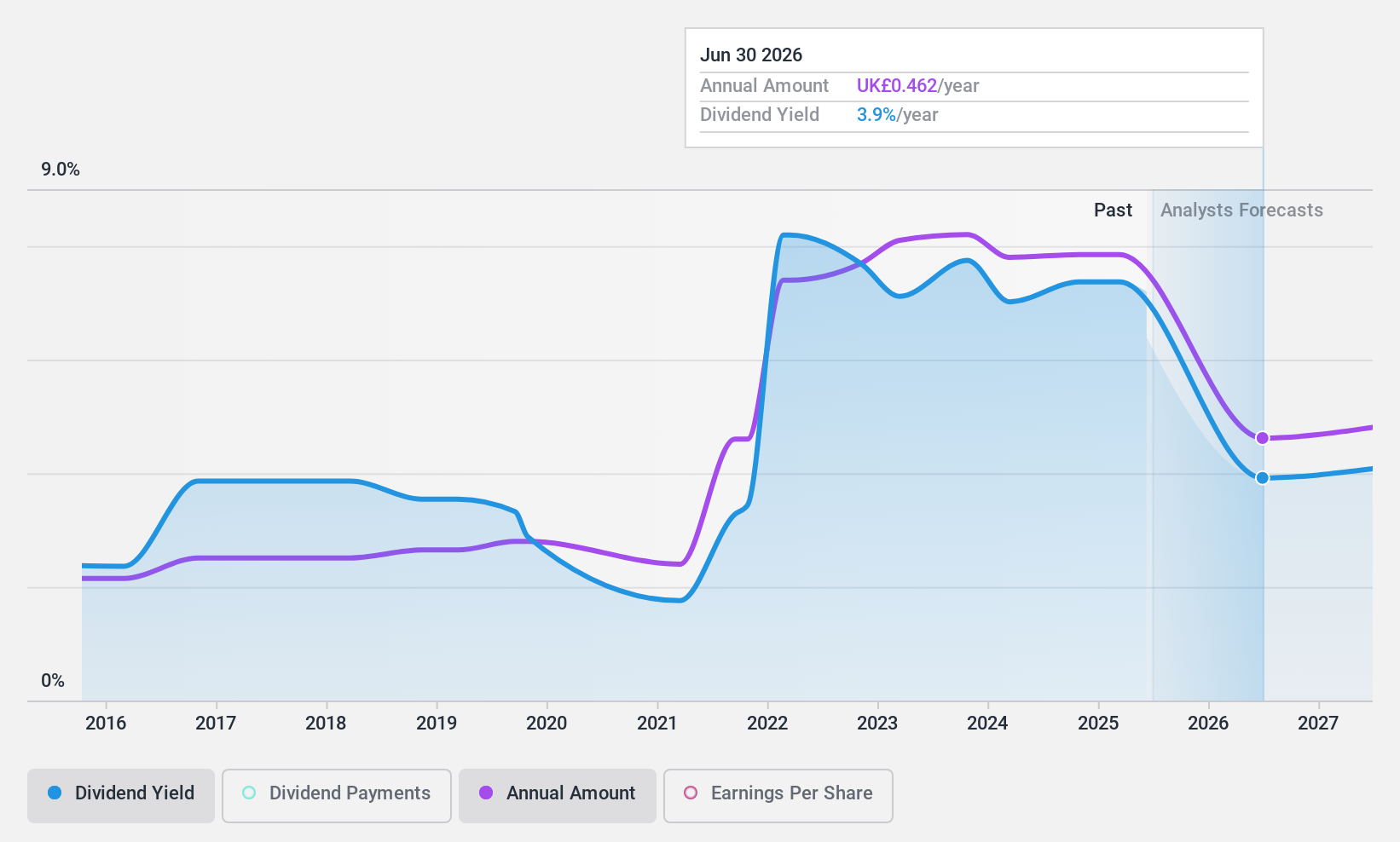

Dividend Yield: 6.4%

Dunelm Group's recent earnings report showed stable sales growth to £1.71 billion, with net income slightly down to £151.2 million. The company proposed a final dividend of 27.5 pence per share, bringing the annual dividend to 43.5 pence per share, a modest increase from last year and covered by both earnings (58.2% payout ratio) and cash flows (79.4% cash payout ratio). Despite past volatility in dividends, current payouts are well-supported and yield is among the top 25% in the UK market.

- Get an in-depth perspective on Dunelm Group's performance by reading our dividend report here.

- The analysis detailed in our Dunelm Group valuation report hints at an deflated share price compared to its estimated value.

Man Group (LSE:EMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Man Group Limited is a publicly owned investment manager with a market cap of £2.49 billion.

Operations: Man Group Limited generates $1.40 billion from its Investment Management Business.

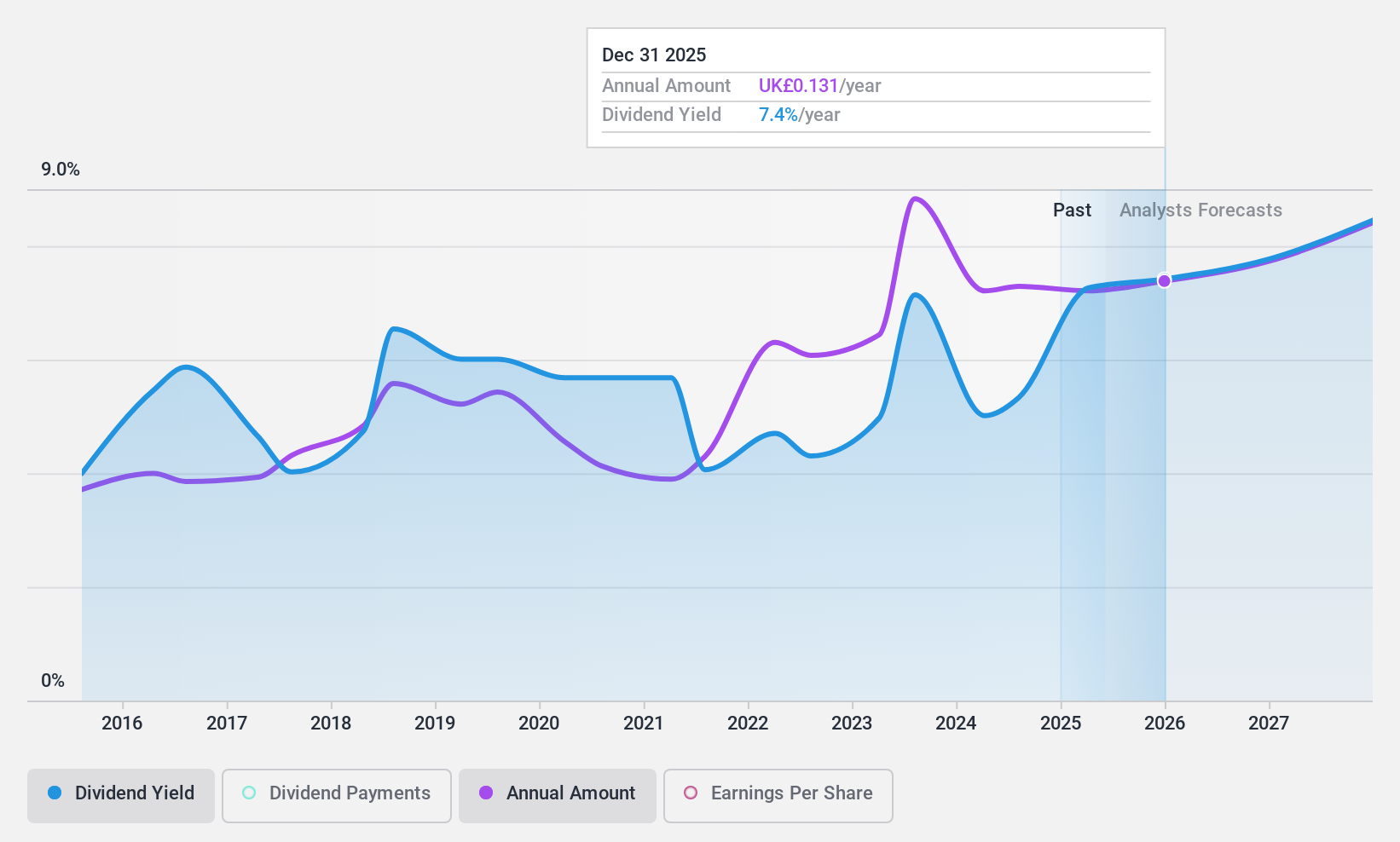

Dividend Yield: 5.7%

Man Group's dividend payments are well-covered by earnings (60.3% payout ratio) and cash flows (48% cash payout ratio). Despite a history of volatile dividends, the current yield is in the top 25% of UK dividend payers. Recent strategic appointments, including Emma Holden as Chief People Officer and Paco Ybarra as a non-executive director, aim to strengthen governance and operational efficiency. The company also completed a share buyback worth £31 million, enhancing shareholder value.

- Click here and access our complete dividend analysis report to understand the dynamics of Man Group.

- Upon reviewing our latest valuation report, Man Group's share price might be too pessimistic.

Taking Advantage

- Delve into our full catalog of 61 Top UK Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epwin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EPWN

Epwin Group

Manufactures and sells building products in the United Kingdom, rest of Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.