- United Kingdom

- /

- Oil and Gas

- /

- AIM:YCA

Unveiling 3 Undiscovered Gems In The United Kingdom With Strong Potential

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faltered, closing 0.4 percent lower at 7,527.42 amid weak trade data from China, highlighting the interconnected nature of global markets and their impact on domestic indices. Despite these broader market challenges, there remain promising opportunities within the UK for discerning investors who can identify stocks with strong fundamentals and growth potential. In this article, we will unveil three undiscovered gems in the United Kingdom that exhibit robust potential to thrive even in uncertain economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Cohort (AIM:CHRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc offers a range of products and services in defense, security, and related markets across multiple regions including the UK, Germany, Portugal, Africa, the Americas, Asia Pacific, and other European countries with a market cap of £359.02 million.

Operations: Cohort plc generates revenue primarily from its Sensors and Effectors segment (£120.49 million) and Communications and Intelligence segment (£83.38 million).

Cohort has demonstrated impressive financial health and growth. Over the past year, earnings surged by 34.9%, significantly outpacing the Aerospace & Defense industry's 14.8%. The debt to equity ratio improved from 32.5% to 29.2% over five years, highlighting effective debt management. Additionally, Cohort reported net income of £15.32 million for FY2024 compared to £11.36 million last year and announced a contract worth €33 million with NATO's NCI Agency, bolstering future prospects further.

- Navigate through the intricacies of Cohort with our comprehensive health report here.

Gain insights into Cohort's past trends and performance with our Past report.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £450.91 million, produces and sells cosmetics through its subsidiaries.

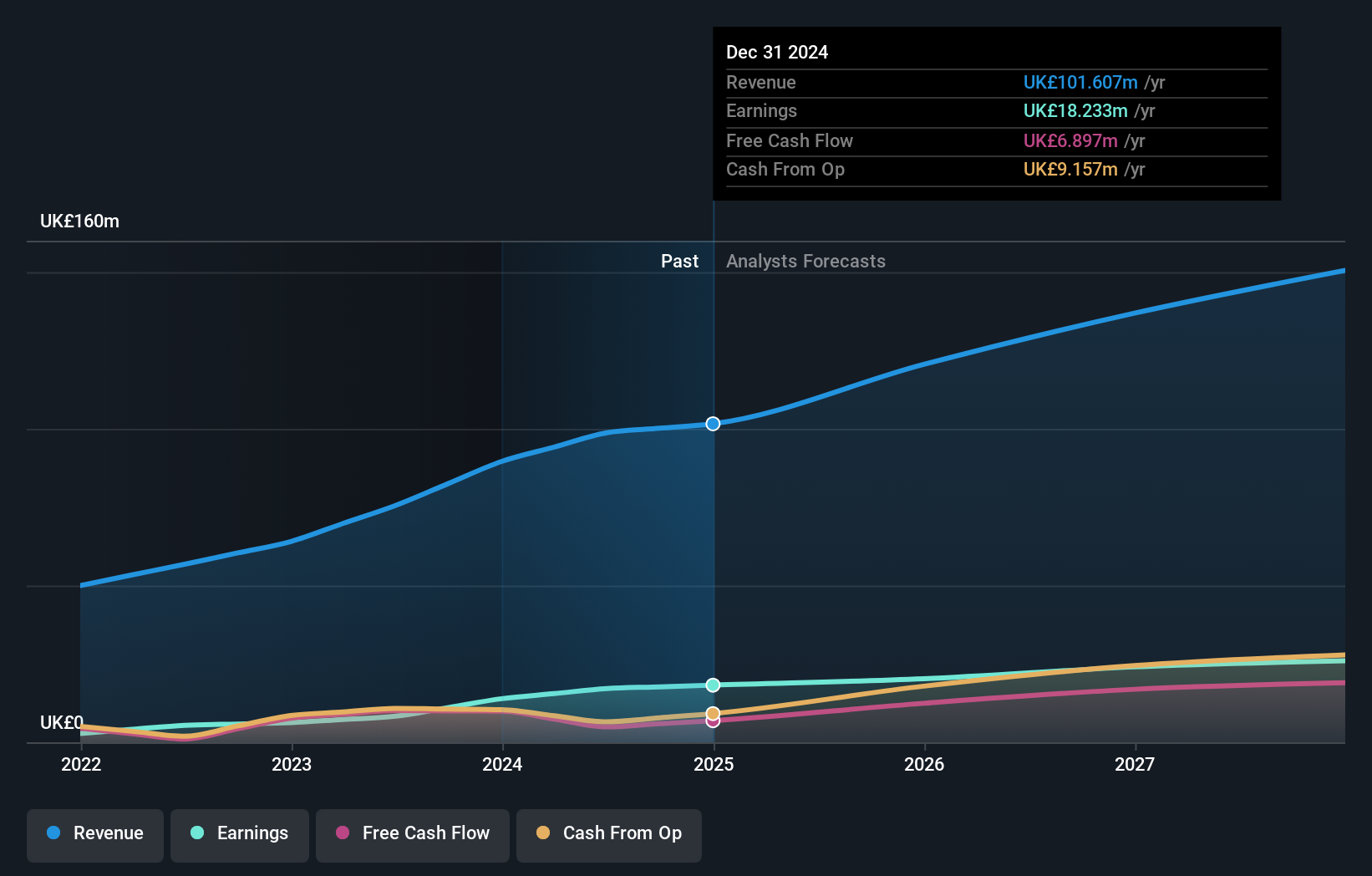

Operations: The company generates revenue primarily from its Own Brand segment (£96.72 million) and a smaller portion from Close-Out sales (£2.12 million). The net profit margin stands at 10%.

Warpaint London has shown impressive growth with earnings surging 106.1% over the past year, outpacing the Personal Products industry. The company is debt-free, a significant improvement from a 4.4% debt to equity ratio five years ago. Recent half-year results reported GBP 45.85 million in sales and GBP 8.02 million net income, up from GBP 36.69 million and GBP 4.78 million respectively last year. Additionally, Warpaint declared an increased interim dividend of 3.5 pence per share for November payment.

- Click here to discover the nuances of Warpaint London with our detailed analytical health report.

Explore historical data to track Warpaint London's performance over time in our Past section.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

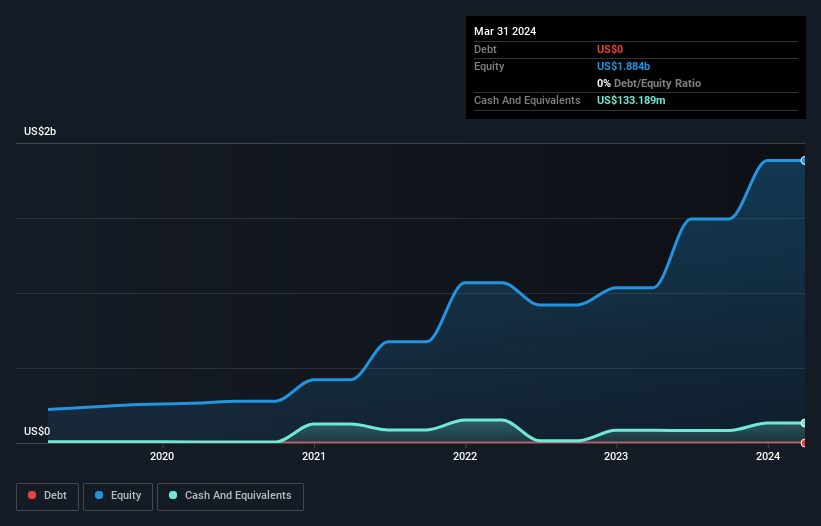

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.24 billion.

Operations: Yellow Cake plc generates revenue primarily from holding U3O8 for long-term capital appreciation, valued at $735.02 million.

Yellow Cake, a uranium-focused company, has shown impressive financial performance recently. The firm reported revenue of US$735.02 million for the full year ending March 31, 2024, compared to negative revenue of US$96.9 million the previous year. Net income surged to US$727.01 million from a net loss of US$102.94 million last year, indicating a significant turnaround. With a price-to-earnings ratio of 2.3x and no debt over the past five years, Yellow Cake presents an intriguing investment prospect despite forecasts suggesting earnings may decline by an average of 91% annually over the next three years due to industry volatility.

- Unlock comprehensive insights into our analysis of Yellow Cake stock in this health report.

Understand Yellow Cake's track record by examining our Past report.

Key Takeaways

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 77 more companies for you to explore.Click here to unveil our expertly curated list of 80 UK Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YCA

Flawless balance sheet and fair value.