- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:CHRT

Undiscovered Gems in the UK Market to Explore This January 2025

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently been influenced by global economic factors, with the FTSE 100 and FTSE 250 indices experiencing slight declines due to weak trade data from China, highlighting the interconnectedness of international economies. Despite these challenges, there remain opportunities within the UK market for investors willing to explore lesser-known stocks that demonstrate resilience and potential growth in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cohort (AIM:CHRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc operates in the defense and security sectors, offering a range of products and services across multiple regions including the UK, Germany, Portugal, Africa, the Americas, Asia Pacific, and other European countries with a market capitalization of £515.09 million.

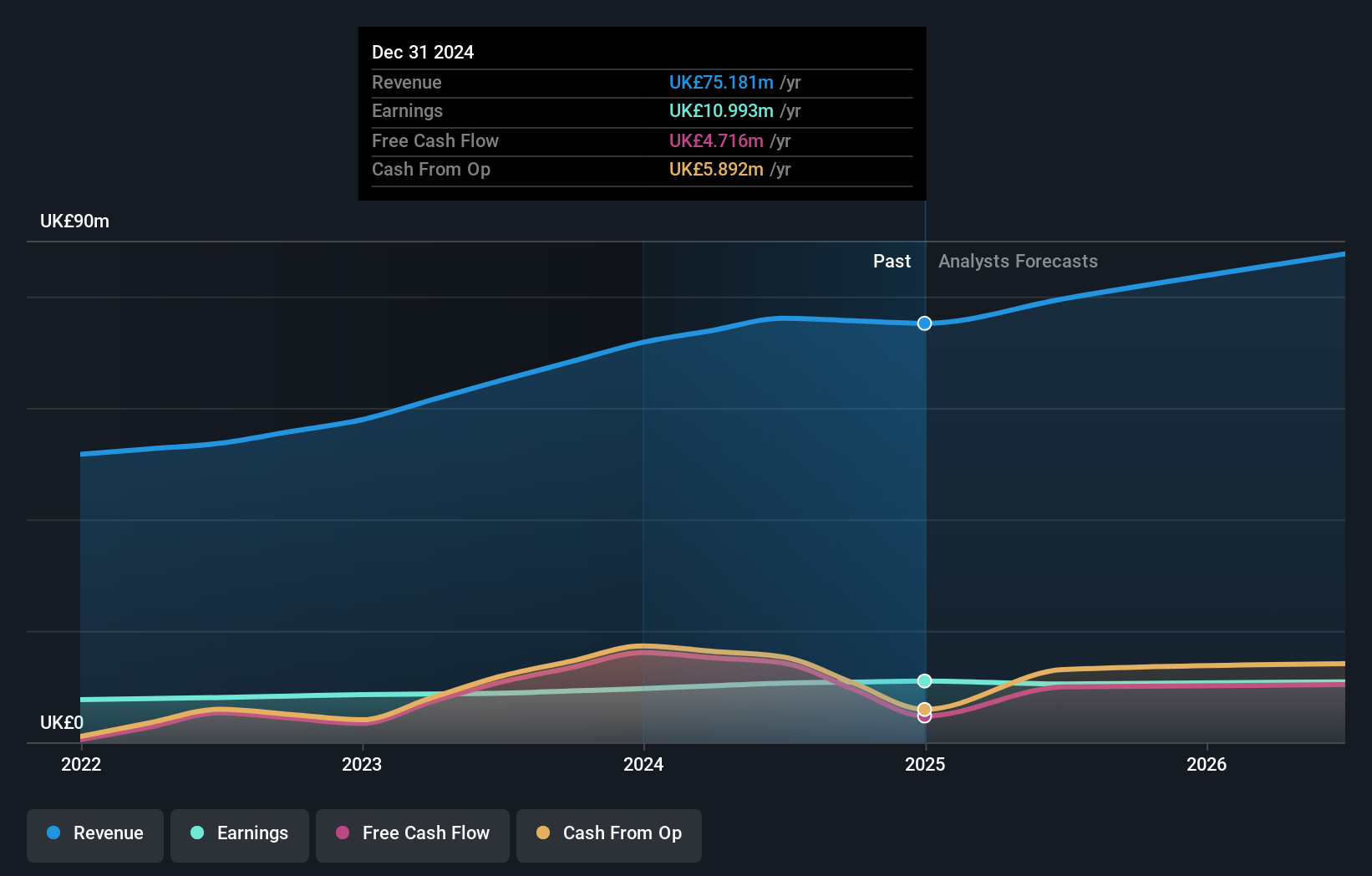

Operations: Cohort plc generates revenue primarily from its Sensors and Effectors segment (£133.68 million) and Communications and Intelligence segment (£94.70 million).

Cohort, a notable player in the Aerospace & Defense industry, has seen impressive earnings growth of 46.4% over the past year, outpacing the industry's 40.1%. Despite a slight increase in shareholder dilution due to recent equity offerings totaling £41 million, Cohort's financial health remains robust with its interest payments well covered by EBIT at 33.8 times. The company's net income for the half-year ended October 2024 was GBP 7.1 million compared to GBP 3.02 million a year ago, reflecting strong operational performance despite forecasts indicating an average annual earnings decline of 1.9% over the next three years.

- Click here and access our complete health analysis report to understand the dynamics of Cohort.

Evaluate Cohort's historical performance by accessing our past performance report.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

Overview: Fonix Plc offers mobile payments and messaging services, as well as managed services for sectors such as media, charity, gaming, and e-mobility in the United Kingdom, with a market cap of £206.08 million.

Operations: Fonix generates revenue primarily from facilitating mobile payments and messaging, amounting to £76.09 million. The company's cost structure impacts its net profit margin, which is a key indicator of profitability trends over time.

Fonix, a nimble player in the UK market, showcases impressive financial health with no debt over the past five years and earnings growth of 20.7% last year, outpacing its industry peers by nearly double. The company has consistently generated positive free cash flow, reaching £16.08M as of December 2023. Fonix also boasts high-quality earnings and recently proposed a dividend increase to 5.70 pence per share for shareholders in November 2024. With an annual forecasted growth rate of 2.24%, Fonix's robust performance and strategic dividend decisions suggest potential for steady future returns.

- Unlock comprehensive insights into our analysis of Fonix stock in this health report.

Understand Fonix's track record by examining our Past report.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited is an investment holding company that provides maritime and logistics services in Brazil, with a market cap of £459.72 million.

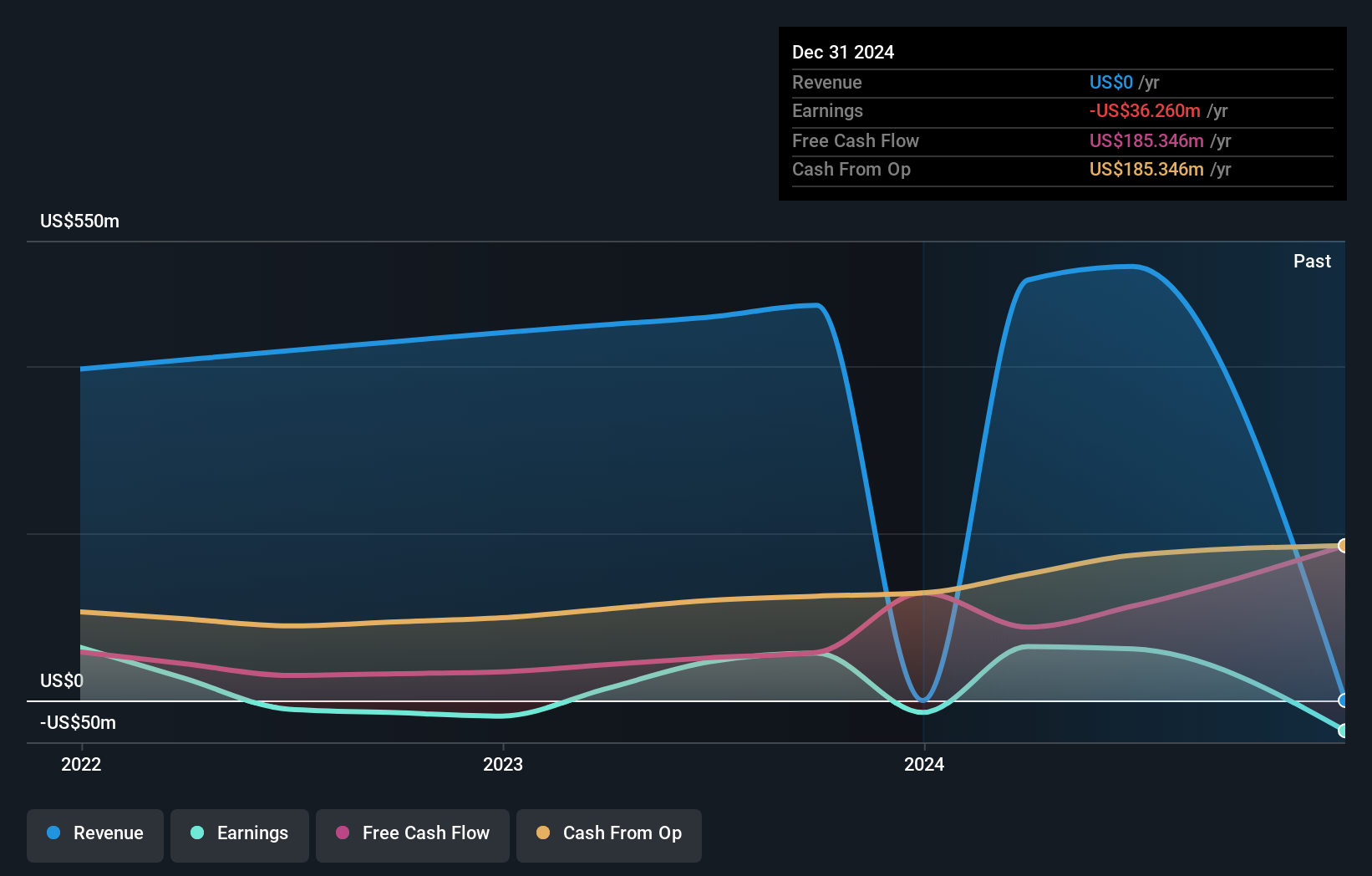

Operations: Ocean Wilsons Holdings generates revenue primarily from its maritime services in Brazil, amounting to $519.35 million.

Ocean Wilsons Holdings, a niche player in the UK market, has shown promising financial health with its debt to equity ratio improving from 42.7% to 38% over five years. The company's earnings surged by 32.7% last year, outpacing the infrastructure sector's growth of 9.9%. It also boasts a favorable price-to-earnings ratio of 9.1x compared to the broader UK market's average of 15.7x, suggesting potential undervaluation. A significant one-off gain of US$28M influenced recent results, yet free cash flow remains positive and interest payments are well-covered at 4.6 times EBIT, indicating robust operational efficiency and financial stability moving forward.

- Dive into the specifics of Ocean Wilsons Holdings here with our thorough health report.

Explore historical data to track Ocean Wilsons Holdings' performance over time in our Past section.

Turning Ideas Into Actions

- Reveal the 63 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CHRT

Cohort

Provides a various products and services in defense, security, and related markets in the United Kingdom, Germany, Portugal, Africa, North and South America, and the Asia Pacific and Africa, and other European countries.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives