- United Kingdom

- /

- Metals and Mining

- /

- AIM:GFM

Discover These 3 Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China and declining commodity prices. Despite these broader market challenges, there remain opportunities for discerning investors to uncover promising small-cap stocks that may be less affected by global economic fluctuations. Identifying such gems requires a focus on companies with strong fundamentals and potential for growth in niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Cohort (AIM:CHRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc operates in defense, security, and related markets across the UK, Germany, Portugal, Africa, the Americas, Asia Pacific, and other European countries with a market cap of £384.10 million.

Operations: Cohort plc generates revenue primarily from its Sensors and Effectors segment (£120.49 million) and Communications and Intelligence segment (£83.38 million).

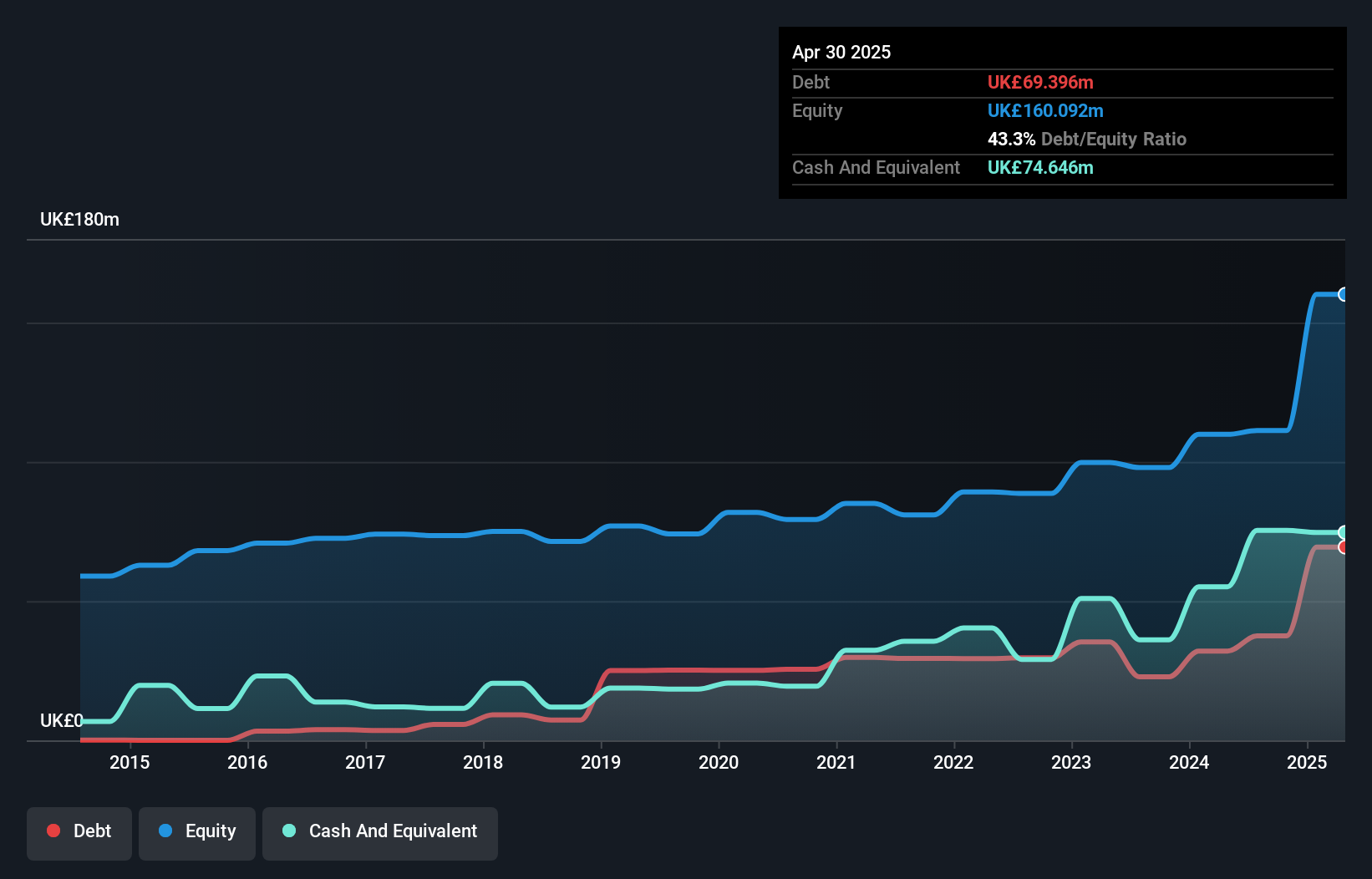

Cohort plc has shown impressive growth, with earnings rising by 34.9% in the past year, outpacing the Aerospace & Defense industry's 14.8%. The company's debt-to-equity ratio improved from 32.5% to 29.2% over five years, and its interest payments are well covered by EBIT at a multiple of 17.5x. Recent developments include a €33 million contract for its subsidiary EID and a recommended final dividend increase to £0.101 per share, reflecting consistent shareholder returns since its IPO in 2006.

- Unlock comprehensive insights into our analysis of Cohort stock in this health report.

Review our historical performance report to gain insights into Cohort's's past performance.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and mining of mineral properties with a market cap of £306.13 million.

Operations: Griffin Mining generates revenue primarily from its Caijiaying Zinc Gold Mine, amounting to $162.25 million. The company has a market cap of £306.13 million.

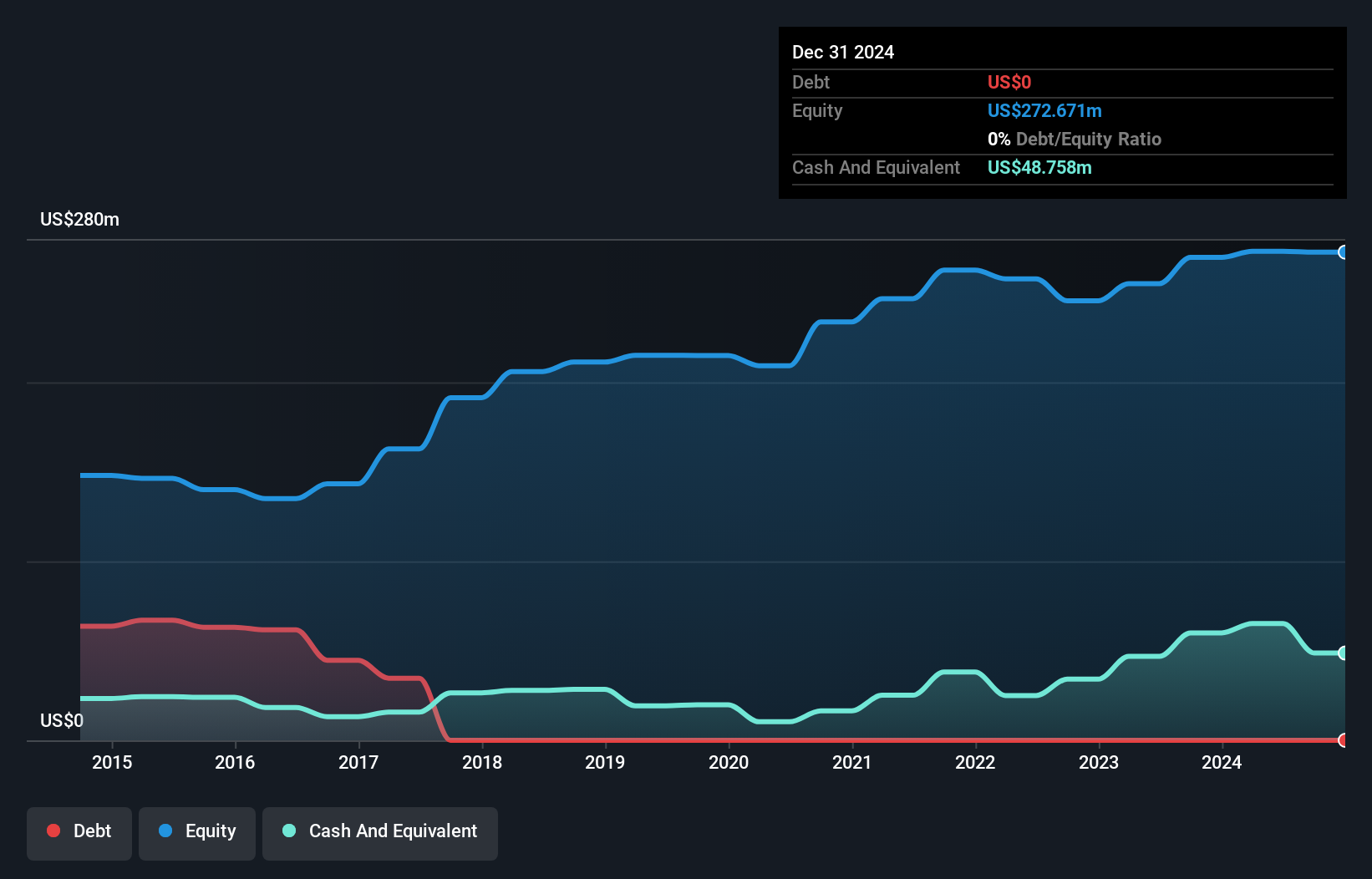

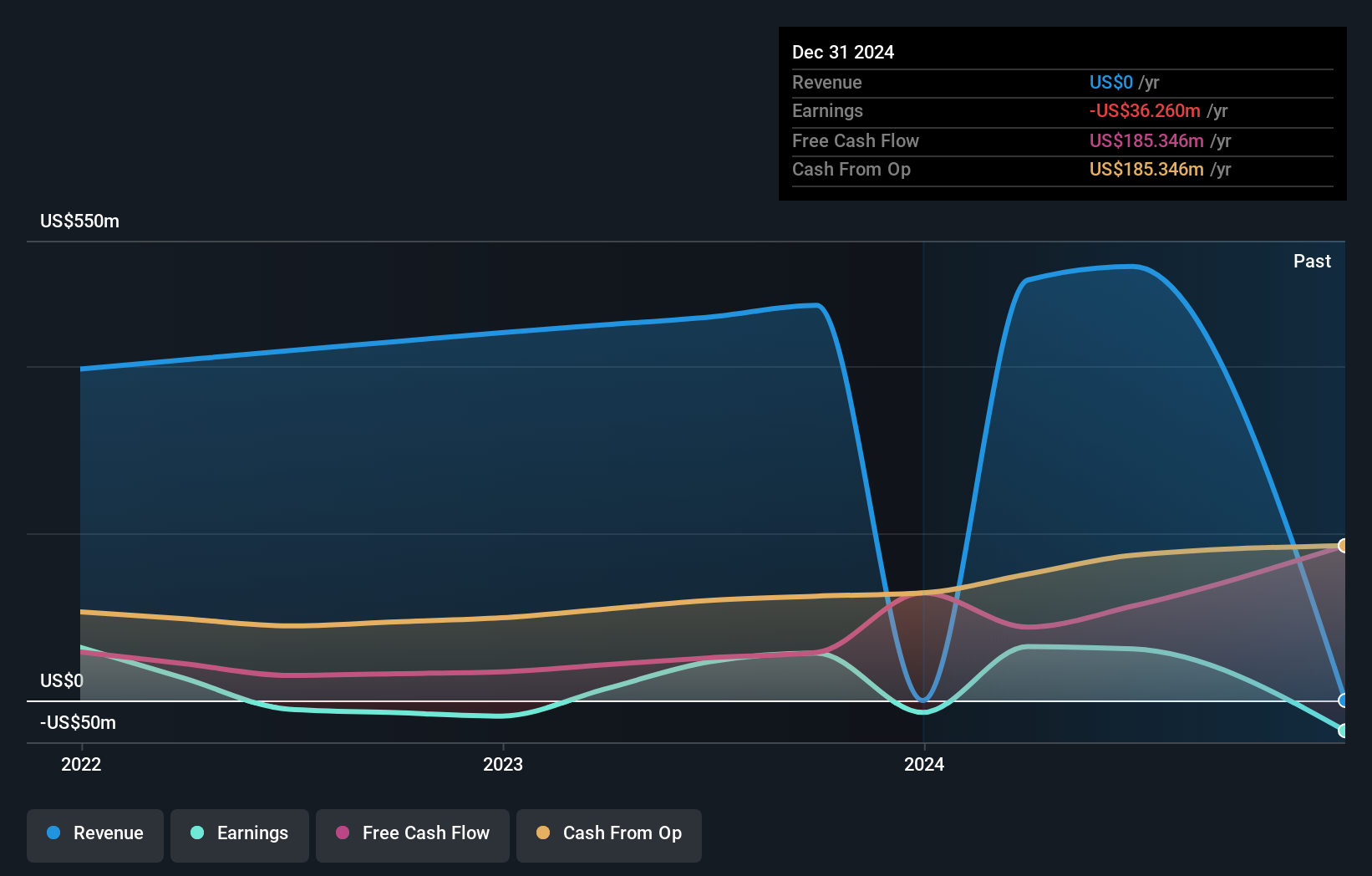

Griffin Mining, a smaller player in the metals and mining sector, reported impressive earnings growth of 116.5% over the past year, outpacing industry peers at 10.3%. The company is debt-free and trades at 62% below its estimated fair value. Recent half-year results showed sales of US$85.75 million compared to US$69.52 million last year, with net income rising to US$11.3 million from US$5.19 million previously. Additionally, Griffin's buyback plan expired on August 25, 2024.

- Click here to discover the nuances of Griffin Mining with our detailed analytical health report.

Assess Griffin Mining's past performance with our detailed historical performance reports.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited, an investment holding company with a market cap of £518.07 million, provides maritime and logistics services in Brazil.

Operations: Ocean Wilsons Holdings generates revenue primarily from its maritime services in Brazil, amounting to $519.35 million.

Ocean Wilsons Holdings has been making waves with its impressive financial performance. Over the past year, earnings surged by 32.7%, outpacing the infrastructure industry's 12% growth. The company's price-to-earnings ratio stands at an attractive 11.2x, below the UK market average of 17x. Additionally, OCN's debt to equity ratio decreased from 42.7% to 38% over five years, and it boasts a significant one-off gain of $28.8M in its latest financial results ending June 2024.

Make It Happen

- Investigate our full lineup of 81 UK Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GFM

Griffin Mining

A mining and investment company, engages in the mining, exploration, and development of mineral properties.

Flawless balance sheet with solid track record.