- United Kingdom

- /

- Oil and Gas

- /

- AIM:YCA

Discover These 3 Undiscovered Gems in the United Kingdom

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced turbulence, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China. Despite these challenges, there are still promising opportunities for investors willing to look beyond the headlines and explore lesser-known stocks that have strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cohort (AIM:CHRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohort plc offers a range of products and services in defense, security, and related markets across multiple regions including the United Kingdom, Germany, Portugal, Africa, the Americas, Asia Pacific, and other European countries with a market cap of £376.82 million.

Operations: Cohort plc generates revenue primarily from its Sensors and Effectors segment (£120.49 million) and Communications and Intelligence segment (£83.38 million).

Cohort plc, a promising player in the Aerospace & Defense industry, has shown robust financial health with high-quality earnings and a debt to equity ratio reduced from 32.5% to 29.2% over five years. Its earnings surged by 34.9%, outpacing the industry's 14.8%. The company reported sales of £202.53 million and net income of £15.32 million for the year ended April 30, 2024, reflecting strong growth and profitability trends that are well above industry norms

- Get an in-depth perspective on Cohort's performance by reading our health report here.

Assess Cohort's past performance with our detailed historical performance reports.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £451.69 million, produces and sells cosmetics through its subsidiaries.

Operations: The company generates revenue primarily from its Own Brand segment (£96.72 million) and a smaller portion from the Close-Out segment (£2.12 million).

Warpaint London, a notable player in the UK’s personal products sector, has shown impressive financial health. The company reported half-year sales of £45.85 million, up from £36.69 million last year, with net income rising to £8.02 million from £4.78 million in the same period. Basic earnings per share increased to 10p from 6p previously. With no debt and strong earnings growth of 106% over the past year, Warpaint London continues to outperform its industry peers significantly.

- Unlock comprehensive insights into our analysis of Warpaint London stock in this health report.

Review our historical performance report to gain insights into Warpaint London's's past performance.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market capitalization of £1.23 billion.

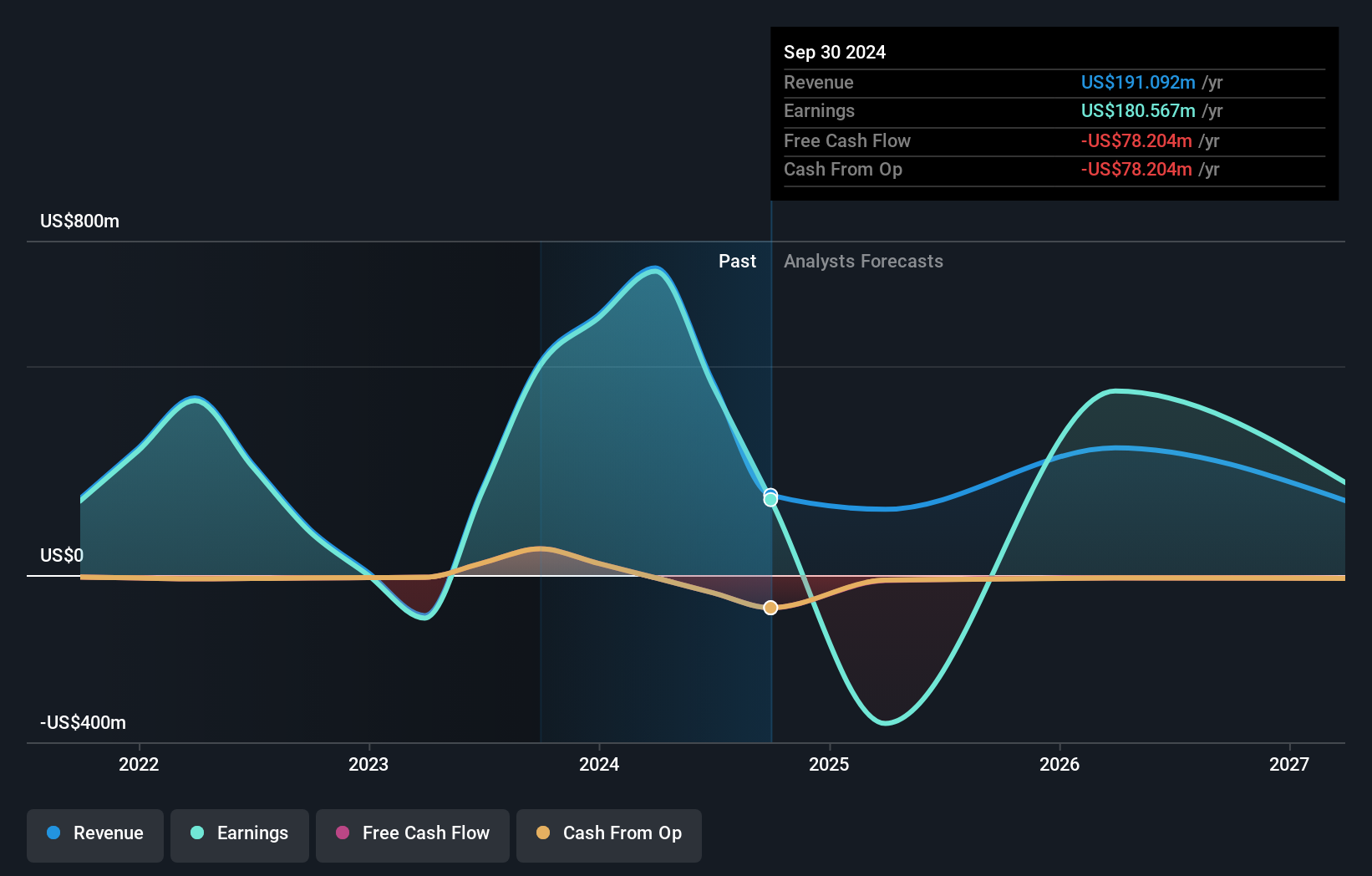

Operations: Yellow Cake plc generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

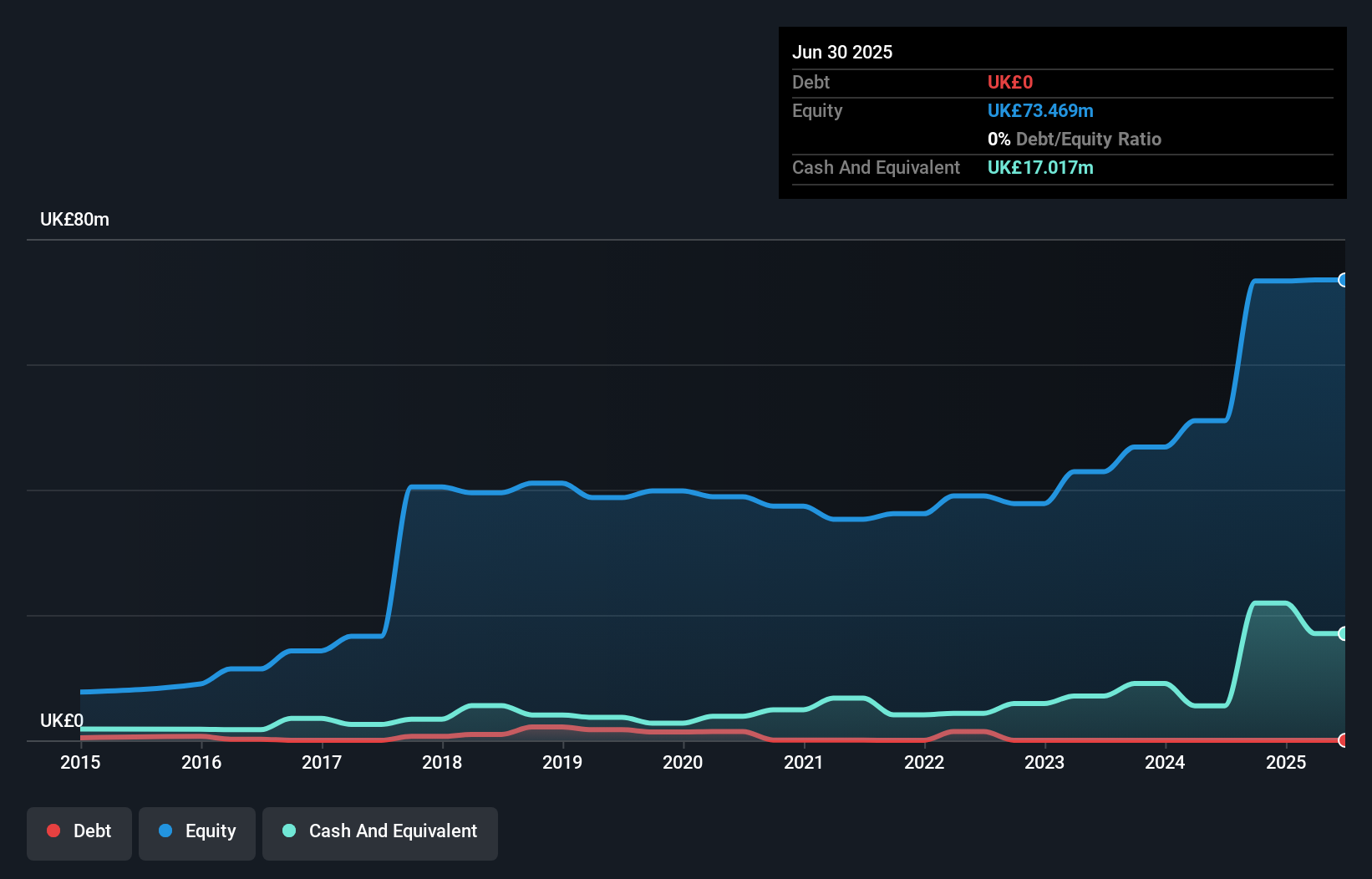

Yellow Cake has emerged as a notable player with impressive financials. The company reported revenue of US$735.02 million for the year ending March 31, 2024, a significant turnaround from negative revenue of US$96.9 million the previous year. Net income soared to US$727.01 million from a net loss of US$102.94 million, reflecting its profitable status this year despite industry challenges (-49.8%). With no debt and a low price-to-earnings ratio (2.3x), it stands out in the UK market (16.7x).

- Click to explore a detailed breakdown of our findings in Yellow Cake's health report.

Understand Yellow Cake's track record by examining our Past report.

Next Steps

- Get an in-depth perspective on all 82 UK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YCA

Flawless balance sheet and fair value.