- United Kingdom

- /

- Machinery

- /

- AIM:LSC

Exploring Andrews Sykes Group And 2 Other Undiscovered Gems In The UK

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat, although it has risen by 6.1% over the past year with earnings projected to grow by 15% annually. In this context, identifying stocks like Andrews Sykes Group and others that offer unique value propositions can be key to uncovering potential opportunities in a steadily advancing market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Globaltrans Investment | 8.54% | 5.28% | 22.11% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that focuses on the hire, sale, and installation of environmental control equipment across the United Kingdom, Europe, the Middle East, Africa, and other international markets with a market capitalization of £215.57 million.

Operations: The company generates revenue primarily through the hire, sale, and installation of environmental control equipment. Its financial performance is influenced by its ability to effectively manage costs associated with these operations. The market capitalization stands at £215.57 million.

Andrews Sykes Group, a UK-based company, showcases intriguing financial characteristics. With no debt on its books now compared to a 6.7% debt-to-equity ratio five years ago, it stands out for its fiscal discipline. Trading at 41.8% below estimated fair value suggests potential undervaluation in the market. Despite negative earnings growth of -4.3% last year against an industry average of -5.6%, the company remains profitable with high-quality earnings and positive free cash flow recorded at £19.44 million in June 2024. Recent announcements include a declared interim dividend totaling £5 million, reflecting stable shareholder returns amidst slight revenue dips.

- Click here and access our complete health analysis report to understand the dynamics of Andrews Sykes Group.

Evaluate Andrews Sykes Group's historical performance by accessing our past performance report.

London Security (AIM:LSC)

Simply Wall St Value Rating: ★★★★★★

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries including the UK and has a market cap of £441.36 million.

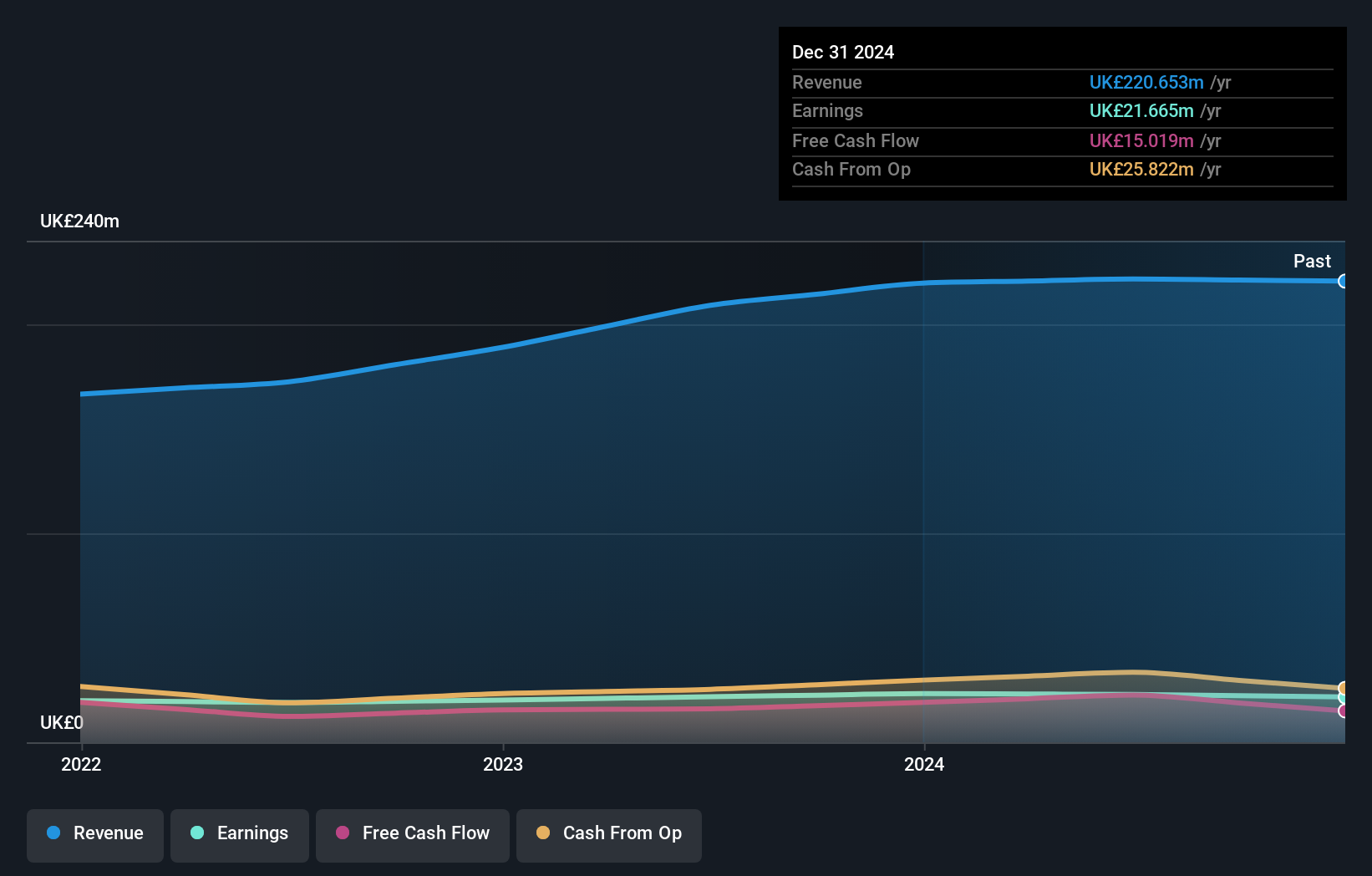

Operations: The primary revenue stream for London Security plc is the provision and maintenance of fire protection and security equipment, generating £221.72 million. The company's net profit margin stands at 13.5%, reflecting its operational efficiency in managing costs related to manufacturing, sales, and rental activities across multiple European markets.

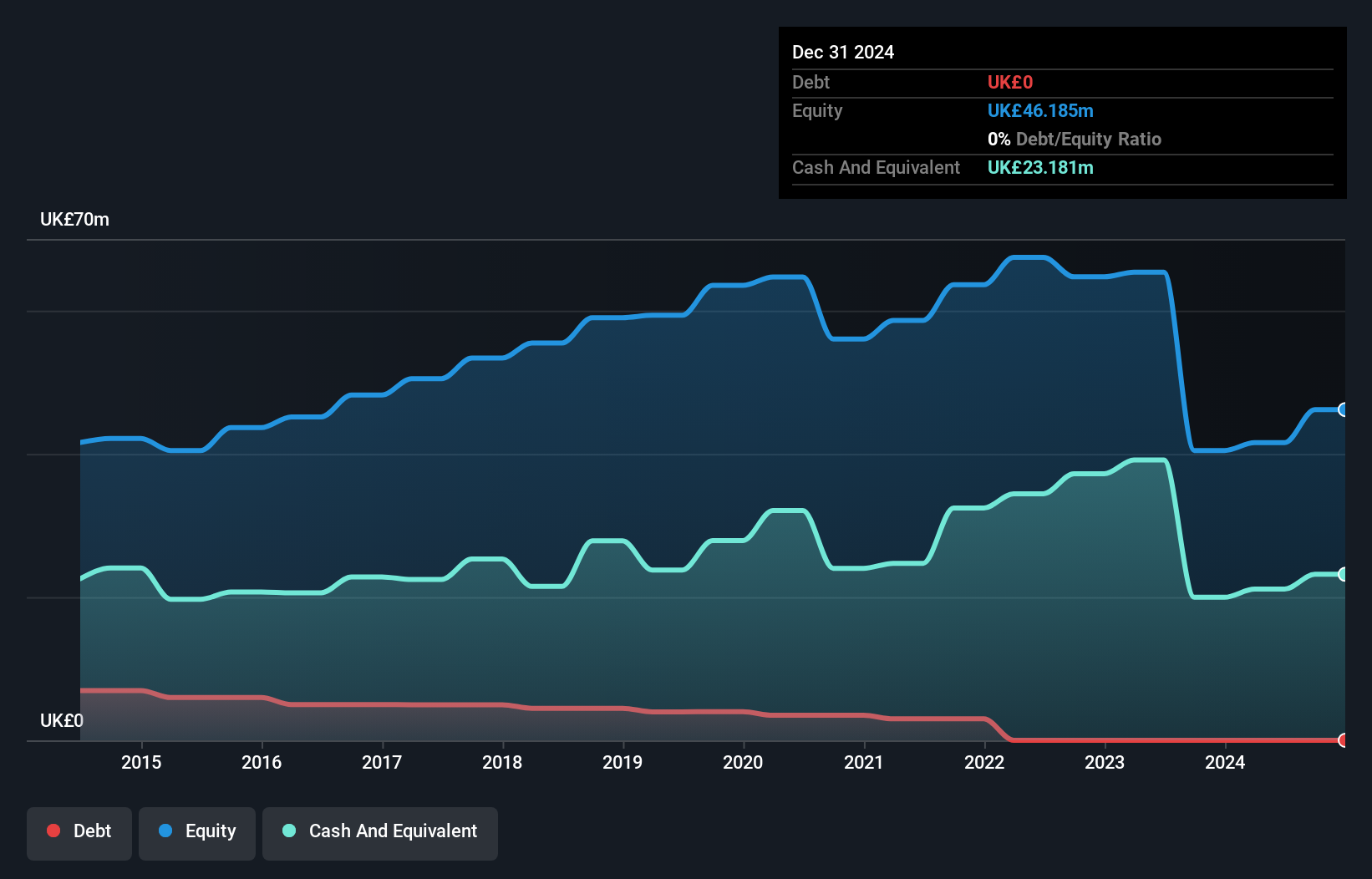

London Security, a smaller player in the UK market, has shown resilience with earnings growth of 5.2% over the past year, outpacing the broader Machinery industry's -4.7%. The company's debt to equity ratio impressively decreased from 7.3 to 0.2 over five years, indicating strong financial health with more cash than total debt. Despite a slight dip in net income to £9.59 million for H1 2024 compared to £9.94 million last year, it trades at a significant discount of 52.5% below estimated fair value, suggesting potential undervaluation and opportunity for investors seeking quality earnings and robust interest coverage.

- Click to explore a detailed breakdown of our findings in London Security's health report.

Review our historical performance report to gain insights into London Security's's past performance.

AO World (LSE:AO.)

Simply Wall St Value Rating: ★★★★★☆

Overview: AO World plc operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market capitalization of £587.13 million.

Operations: The company generates revenue of £1.04 billion through its online retailing of domestic appliances and ancillary services in the UK and Germany.

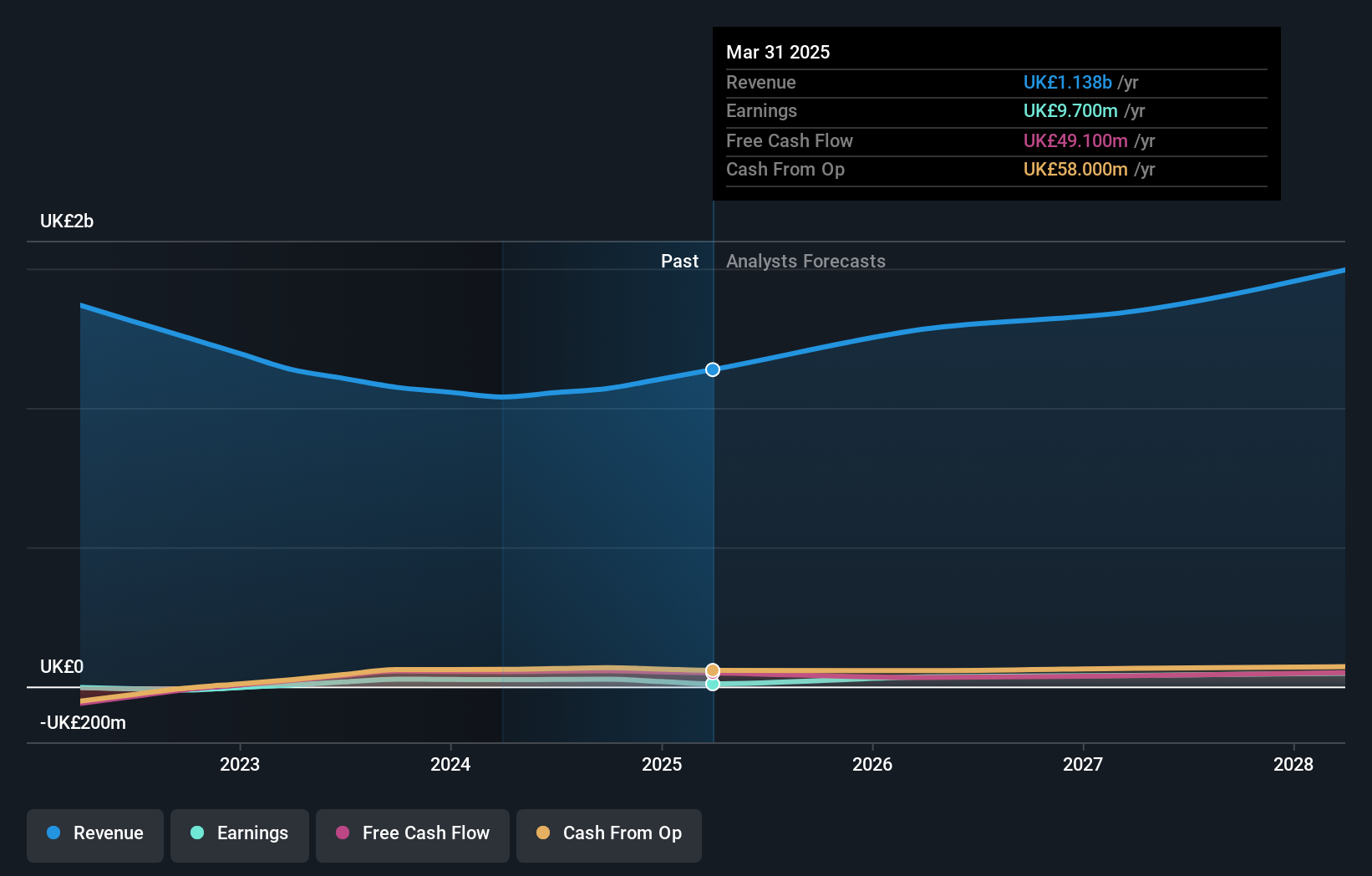

AO World, a nimble player in the UK market, showcases robust financial health with its debt to equity ratio impressively dropping from 37.2% to 1.5% over five years. The company is trading at 17.9% below its estimated fair value, hinting at potential undervaluation. Its earnings growth of 298.4% last year outpaced the Specialty Retail industry average of -3.4%, indicating strong performance relative to peers. With interest payments well covered by EBIT at a multiple of 9.1x and high-quality past earnings, AO World seems poised for continued success in its sector despite competitive pressures.

- Get an in-depth perspective on AO World's performance by reading our health report here.

Explore historical data to track AO World's performance over time in our Past section.

Taking Advantage

- Investigate our full lineup of 76 UK Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LSC

London Security

An investment holding company, manufactures, sells, and rents fire protection equipment in the United Kingdom, Belgium, the Netherlands, Austria, France, Germany, Denmark, and Luxembourg.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives