The Amiad Water Systems (LON:AFS) Share Price Has Gained 79% And Shareholders Are Hoping For More

By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. For example, the Amiad Water Systems Ltd. (LON:AFS) share price is up 79% in the last three years, clearly besting the market return of around 6.2% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 2.8%.

View our latest analysis for Amiad Water Systems

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, Amiad Water Systems failed to grow earnings per share, which fell 32% (annualized). This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

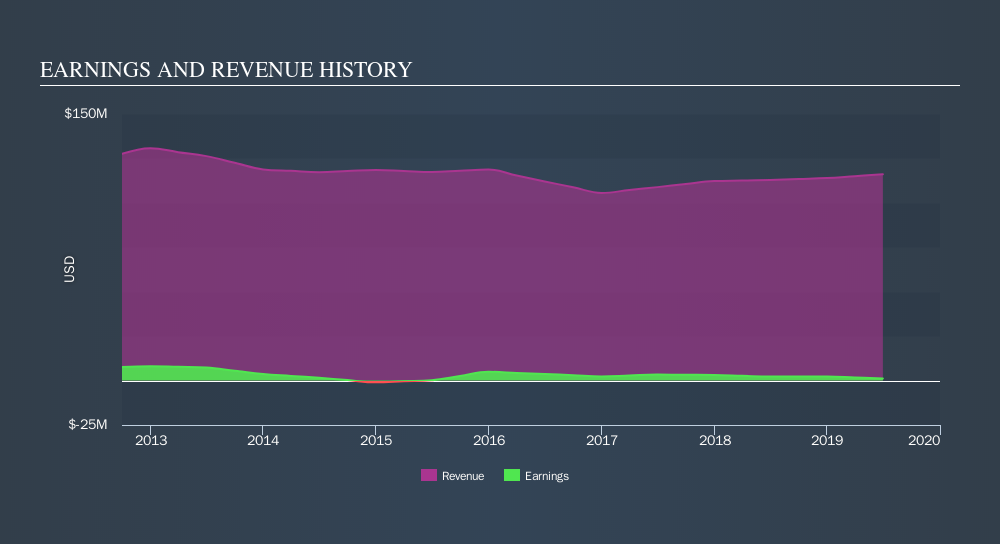

We severely doubt anyone is particularly impressed with the modest 2.3% three-year revenue growth rate. While we don't have an obvious theory to explain the share price rise, a closer look at the data might be enlightening.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Amiad Water Systems stock, you should check out this FREE detailed report on its balance sheet.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. In some ways, TSR is a better measure of how well an investment has performed. Amiad Water Systems's TSR over the last 3 years is 85%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

Amiad Water Systems shareholders have received returns of 2.8% over twelve months, which isn't far from the general market return. We should note here that the five-year TSR is more impressive, at 2.9% per year. Although the share price growth has slowed, the longer term story points to a business well worth watching. Before forming an opinion on Amiad Water Systems you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives