- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAG

Would Shareholders Who Purchased Paragon Banking Group's (LON:PAG) Stock Year Be Happy With The Share price Today?

Over the last month the Paragon Banking Group PLC (LON:PAG) has been much stronger than before, rebounding by 32%. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 13% in the last year, well below the market return.

View our latest analysis for Paragon Banking Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

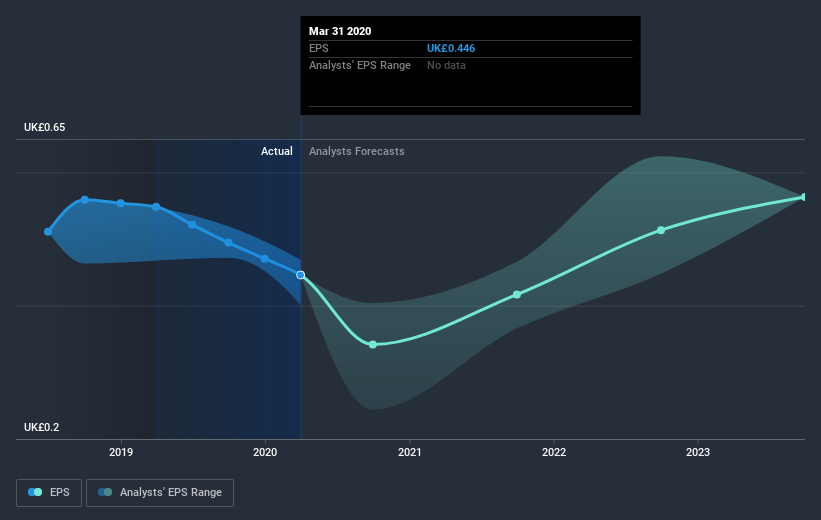

Unhappily, Paragon Banking Group had to report a 19% decline in EPS over the last year. This fall in the EPS is significantly worse than the 13% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Paragon Banking Group's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Paragon Banking Group's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Paragon Banking Group shareholders, and that cash payout explains why its total shareholder loss of 11%, over the last year, isn't as bad as the share price return.

A Different Perspective

We regret to report that Paragon Banking Group shareholders are down 11% for the year. Unfortunately, that's worse than the broader market decline of 5.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Paragon Banking Group better, we need to consider many other factors. For example, we've discovered 1 warning sign for Paragon Banking Group that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Paragon Banking Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:PAG

Paragon Banking Group

Provides financial products and services in the United Kingdom.

Very undervalued with solid track record and pays a dividend.