- United Kingdom

- /

- Banks

- /

- LSE:LLOY

Lloyds Banking Group (LSE:LLOY) leverages "Invest Wise" to boost youth engagement despite cost pressures.

Reviewed by Simply Wall St

Lloyds Banking Group (LSE:LLOY) is experiencing a period of both innovation and challenge. Recent developments include a robust financial performance and strategic initiatives like "Invest Wise," which have broadened its customer base, while rising operating costs and competitive pressures present hurdles. In the discussion that follows, we will explore Lloyds' financial health, strategic growth initiatives, market vulnerabilities, and competitive pressures to provide a comprehensive overview of the company's current business situation.

See the full analysis report here for a deeper understanding of Lloyds Banking Group.

Innovative Factors Supporting Lloyds Banking Group

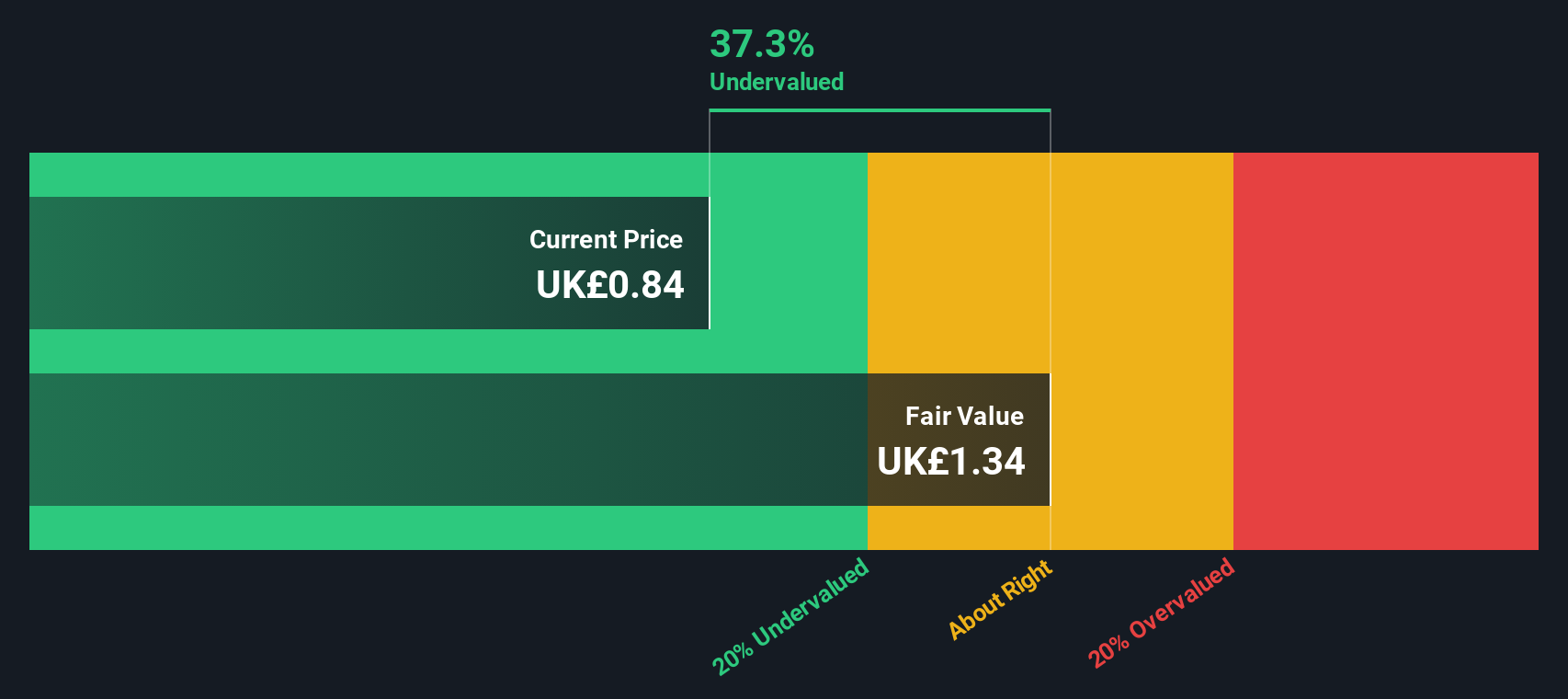

In the latest earnings call, Charles Nunn, CEO, highlighted the financial performance achieved in the first half of the year, aligning with full-year expectations. The bank's strategic initiatives, such as the launch of "Invest Wise," have attracted a younger demographic, doubling its customer base in this segment. Lloyds Banking Group's commitment to customer engagement is evident in its 19% share of cash ISA flows, which facilitated £6 billion in tax-free savings. William Chalmers, CFO, noted strong capital generation of 87 basis points, with a notable 47 basis points in Q2. The bank's financial health is further supported by its appropriate level of bad loans at 1.6% and primarily low-risk funding sources. Despite being considered expensive with a Price-To-Earnings Ratio of 8x compared to peers and the European Banks industry, it is trading significantly below its estimated fair value of £1.21.

Vulnerabilities Impacting Lloyds Banking Group

Challenges persist as net income was impacted by increased operating lease depreciation, as noted by William Chalmers. Operating costs rose by 7% year-on-year, which aligns with expectations but puts pressure on profitability. The bank's earnings growth, although strong at 19.5% over the past year, is forecasted to slow to 5.2% annually, underperforming the UK market's 14.2% growth. Additionally, Lloyds' Return on Equity remains low at 11.3%, indicating room for improvement. The bank's Price-To-Earnings Ratio of 8x also suggests it is expensive compared to the peer average of 7.9x and the European Banks industry average of 7.5x.

Emerging Markets Or Trends for Lloyds Banking Group

The bank is poised to capitalize on sustainable financing opportunities, having provided £38 billion since 2022. Charles Nunn emphasized the focus on supporting a low-carbon economy, presenting new growth avenues. Digital leadership remains a priority, with strategic initiatives expected to generate an additional £0.7 billion in revenue by year-end. Lloyds' recent participation in high-profile conferences, such as the CogX Leadership Summit on AI, underscores its commitment to innovation and market expansion. These initiatives align with the bank's strategy to deepen customer relationships and enhance its market position.

Competitive Pressures and Market Risks Facing Lloyds Banking Group

Economic factors, including the anticipated bank base rate cut, pose challenges for Lloyds Banking Group, as highlighted by William Chalmers. The competitive environment requires ongoing vigilance to maintain market share. Regulatory changes and operational risks, such as the cost equilibrium between internal combustion and electric vehicle engines, add complexity to the bank's strategic planning. Despite these threats, Lloyds' disciplined approach to capital efficiency and its focus on sustainable growth initiatives position it to navigate these challenges effectively.

To gain deeper insights into Lloyds Banking Group's historical performance, explore our detailed analysis of past performance. To dive deeper into how Lloyds Banking Group's valuation metrics are shaping its market position, check out our detailed analysis of Lloyds Banking Group's Valuation.Conclusion

Lloyds Banking Group's strategic initiatives, such as "Invest Wise," have successfully attracted a younger demographic, enhancing customer engagement and financial performance, as evidenced by its significant share of cash ISA flows. However, challenges like rising operating costs and a projected slowdown in earnings growth to 5.2% annually, compared to the UK market's 14.2%, indicate potential pressure on future profitability. The bank's focus on sustainable financing and digital leadership presents promising growth opportunities, yet it must navigate economic and regulatory challenges, including the anticipated bank base rate cut. While the bank's Price-To-Earnings Ratio of 8x suggests it is expensive relative to peers and the European Banks industry, its trading price remains significantly below its estimated fair value of £1.21, indicating potential for long-term appreciation if it successfully capitalizes on emerging trends and manages competitive pressures effectively.

Key Takeaways

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial services in the United Kingdom and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives