- United Kingdom

- /

- Banks

- /

- LSE:BARC

Should Investors Take a Fresh Look at Barclays After 44% Rally and Buyback Announcements?

Reviewed by Bailey Pemberton

If you own Barclays shares or are considering jumping in, you probably want to know if the stock’s last rally is just the beginning, or if things are getting a bit frothy up at these levels. It is no secret that Barclays has been on a tear lately, with the stock up 6.4% over the last month and a staggering 44.4% year-to-date. Long-term holders are sitting on gains of 326.6% over five years, which makes it one of the more eye-catching names in the financial sector. That kind of run always leads to a pressing question: is the share price still attractive, or has most of the value already been realized?

Step back from the headline numbers and you will spot a few key trends helping to fuel that momentum. Broader market optimism for large banks has improved, as investors increasingly favor companies that are able to navigate changing regulatory winds while still finding ways to generate steady profits. Barclays, in particular, appears to be benefiting from a shift in risk perception, with traders now more comfortable paying up for exposure to European banking giants.

Of course, share prices alone never tell the whole story. What really matters is whether Barclays is undervalued relative to its fundamentals and future prospects. When we put Barclays through a series of six classic valuation checks, it comes up as undervalued in four of them. That gives it a value score of 4. But as you will see next, not all valuation methods are created equal, and the best way to cut through the noise is still to come.

Approach 1: Barclays Excess Returns Analysis

The Excess Returns model evaluates a company's ability to generate higher returns on shareholders’ equity compared to the cost of that capital. In essence, it asks whether Barclays is efficiently reinvesting its profits to create lasting value for investors, rather than merely growing for growth’s sake.

For Barclays, the numbers tell a compelling story. The bank’s Book Value stands at £4.41 per share, with analysts projecting a Stable Book Value of £5.30 per share in the future. Expected future earnings per share (EPS) are £0.57, based on the consensus from 11 analysts. The average Return on Equity sits at 10.67%, comfortably above the Cost of Equity of £0.44 per share. This results in an Excess Return of £0.12 per share. These figures suggest Barclays has a meaningful capacity to create value above its funding costs, not just now but on a forward-looking basis as well.

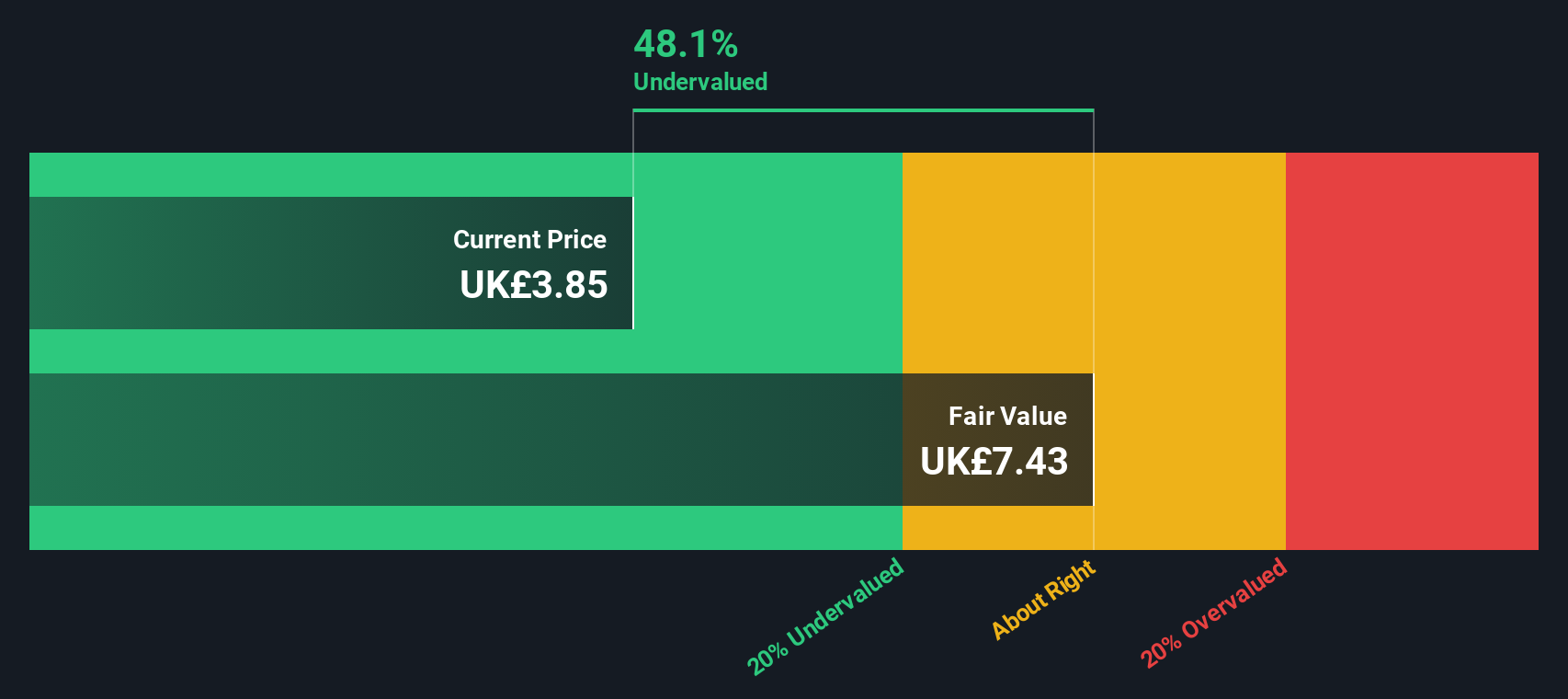

Based on these projections, the intrinsic valuation suggests that Barclays is currently trading at a 48.1% discount compared to its fair value. This strong margin indicates the stock is markedly undervalued at current prices, making it particularly attractive for long-term investors focused on fundamental returns.

Result: UNDERVALUED

Our Excess Returns analysis suggests Barclays is undervalued by 48.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Barclays Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Barclays because it directly relates a company’s share price to its earnings power. Investors favour the PE ratio as it offers a straightforward way to compare the value being offered relative to a company's ability to generate profits.

Determining what constitutes a "normal" or "fair" PE ratio, however, is not always simple. This figure depends on factors such as expected earnings growth, the volatility or stability of the company’s earnings, and the risks inherent in its business model. For Barclays, these dynamics are especially relevant given its large, diversified banking operations in a regulatory-heavy sector.

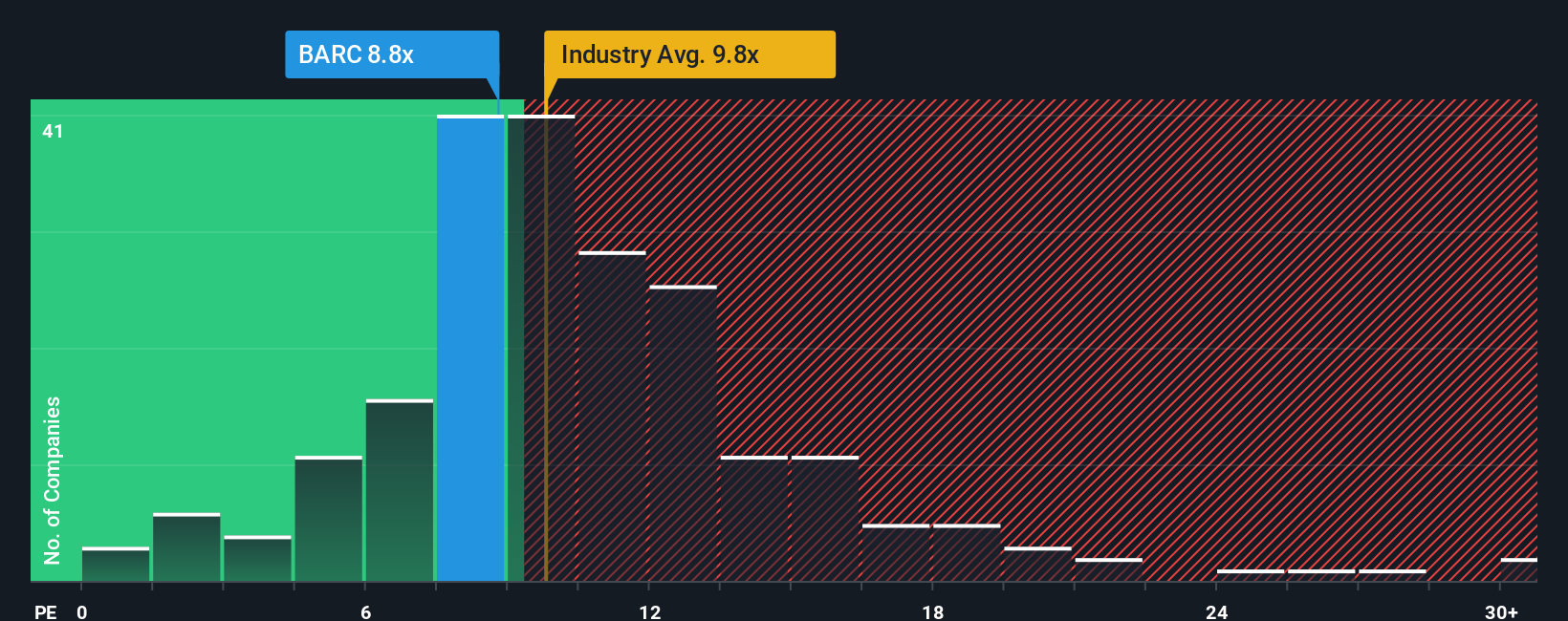

Currently, Barclays trades on a PE ratio of 8.88x. This compares favourably to the average PE of global banking peers at 11.29x, as well as the broader industry average of 10.33x. When Simply Wall St’s proprietary Fair Ratio is applied—which adjusts not just for industry norms, but also for Barclays’ earnings growth prospects, profit margins, market capitalization, and risk—the fair PE is 8.60x. The Fair Ratio stands out as a more comprehensive measure since it incorporates nuances that broad sector or peer comparisons can miss. This allows investors to factor in company-specific strengths and weaknesses.

Comparing the actual PE (8.88x) to the Fair Ratio (8.60x), Barclays is very closely aligned with where its multiple should be. This suggests that, based on earnings, the stock appears fairly valued at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Barclays Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal perspective on a company. It lets you build your own story about where Barclays is headed by connecting your assumptions about future earnings, revenue growth, and profit margins directly to an estimated fair value.

Rather than just relying on a single valuation formula, Narratives allow you to link Barclays' unique business developments, risks, and industry changes to actual financial forecasts. This ultimately helps you decide if the current share price offers opportunity. On Simply Wall St’s platform, Narratives are easy to create and track within the Community page, empowering millions of investors to make confident decisions with minimal effort.

Narratives give you the tools to compare your personalized fair value—shaped by your view of the company’s story—to the current share price, so you know exactly when it may be time to buy, hold, or sell. Best of all, each Narrative always stays fresh, dynamically updating as soon as new news or earnings reports come in.

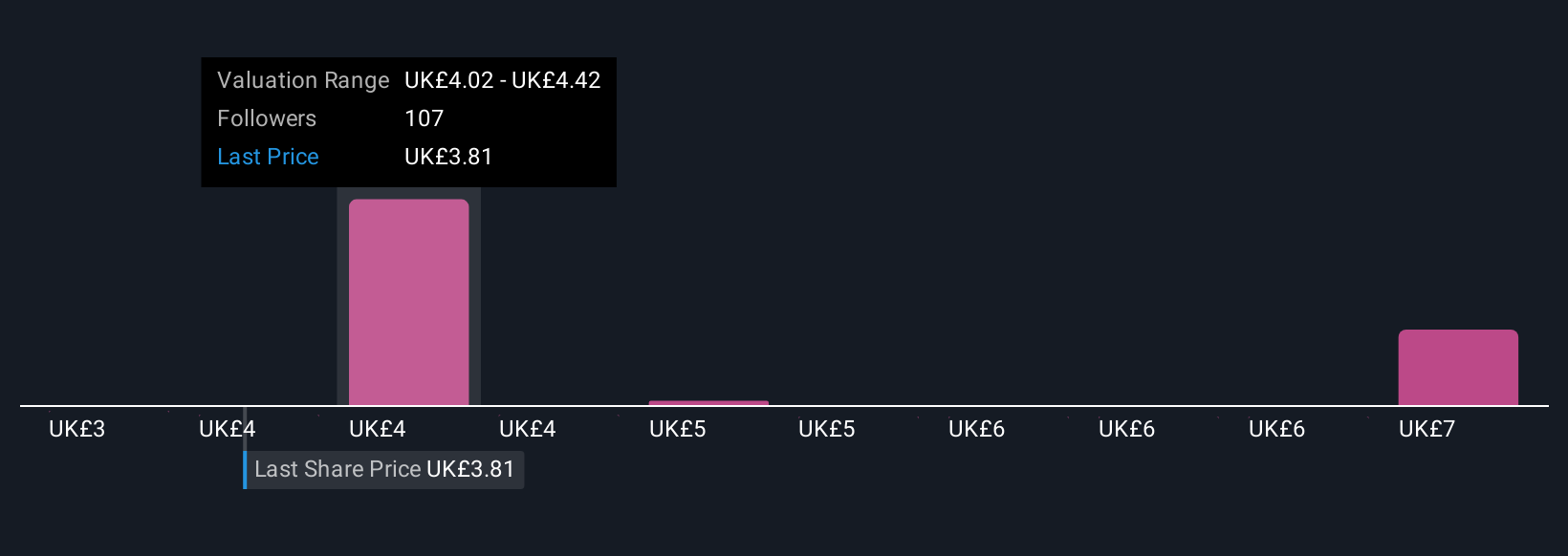

For example, some investors see future earnings for Barclays as high as £7.9 billion, valuing shares at up to £4.55, while the most cautious see earnings closer to £6.1 billion and a price target of £3.06. With Narratives, you can test both bullish and bearish scenarios side by side and decide what story you believe.

Do you think there's more to the story for Barclays? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barclays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BARC

Barclays

Provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives