- United Kingdom

- /

- Auto

- /

- LSE:AML

Further weakness as Aston Martin Lagonda Global Holdings (LON:AML) drops 7.5% this week, taking three-year losses to 88%

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Aston Martin Lagonda Global Holdings plc (LON:AML); the share price is down a whopping 96% in the last three years. That would be a disturbing experience. And over the last year the share price fell 64%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 41% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

After losing 7.5% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Aston Martin Lagonda Global Holdings

Given that Aston Martin Lagonda Global Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Aston Martin Lagonda Global Holdings saw its revenue shrink by 0.6% per year. That's not what investors generally want to see. Having said that the 25% annualized share price decline highlights the risk of investing in unprofitable companies. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

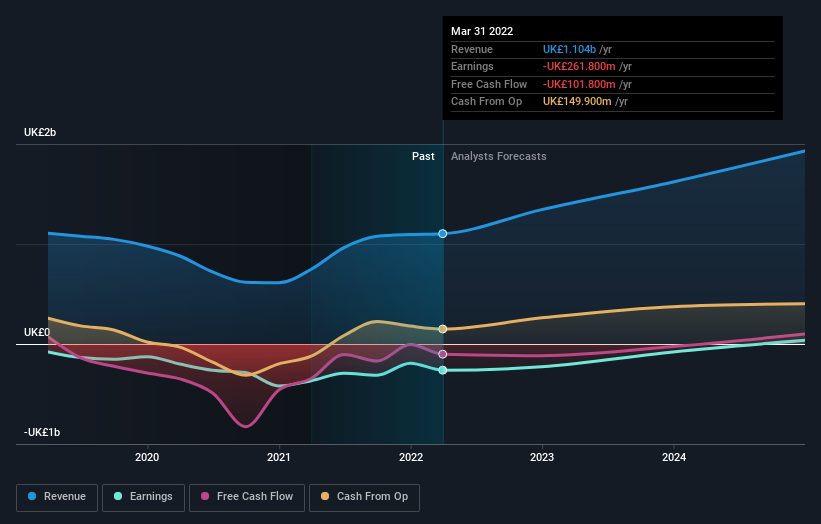

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Aston Martin Lagonda Global Holdings' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Aston Martin Lagonda Global Holdings' TSR, at -88% is higher than its share price return of -96%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

The last twelve months weren't great for Aston Martin Lagonda Global Holdings shares, which cost holders 64%, while the market was up about 0.7%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 23% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Aston Martin Lagonda Global Holdings you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AML

Aston Martin Lagonda Global Holdings

Engages in the design, development, manufacture, and marketing of luxury sports cars in the United Kingdom, the Americas, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives