- United Kingdom

- /

- Auto Components

- /

- AIM:SCE

Surface Transforms Plc (LON:SCE) Stock's 78% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Surface Transforms Plc (LON:SCE) shareholders that were waiting for something to happen have been dealt a blow with a 78% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 99% share price decline.

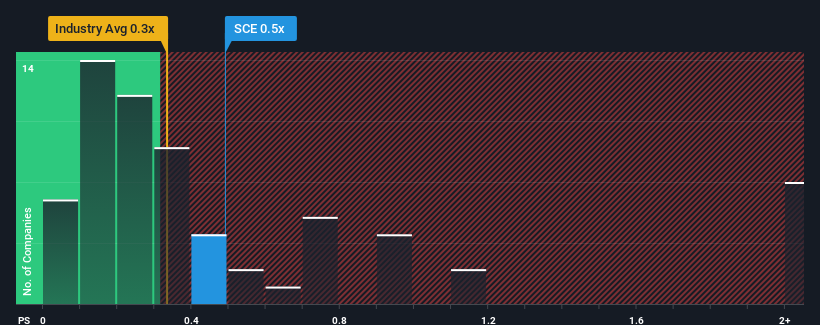

Even after such a large drop in price, there still wouldn't be many who think Surface Transforms' price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in the United Kingdom's Auto Components industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Surface Transforms

What Does Surface Transforms' Recent Performance Look Like?

Recent times have been advantageous for Surface Transforms as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Surface Transforms' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Surface Transforms?

The only time you'd be comfortable seeing a P/S like Surface Transforms' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 63% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 300% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 146% as estimated by the two analysts watching the company. With the industry only predicted to deliver 4.6%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Surface Transforms is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Surface Transforms' P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Surface Transforms looks to be in line with the rest of the Auto Components industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Surface Transforms currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Surface Transforms is showing 5 warning signs in our investment analysis, and 4 of those are significant.

If you're unsure about the strength of Surface Transforms' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SCE

Surface Transforms

Researches, develops, designs, manufactures, and sells carbon ceramic brakes for automotive market in the United Kingdom, Germany, Sweden, Netherlands, rest of Europe, the United States, and internationally.

Slight risk and overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)