- United Kingdom

- /

- Metals and Mining

- /

- LSE:PDL

CT Automotive Group Leads 3 UK Penny Stocks Worth Watching

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China, highlighting the global interconnectedness of economies. In such fluctuating markets, investors often seek opportunities in less conventional areas like penny stocks. Although considered a niche investment category today, penny stocks can offer intriguing prospects when supported by robust financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.585 | £513.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.425 | £276.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.412 | £44.58M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.81 | £299.52M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.80 | £288.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.625 | £130.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £189.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.57 | £78.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Pharos Energy (LSE:PHAR) | £0.209 | £86.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.35 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

CT Automotive Group (AIM:CTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CT Automotive Group plc designs, develops, manufactures, and supplies automotive interior components and kinematic assemblies for automotive brands both in the United Kingdom and internationally, with a market cap of £31.28 million.

Operations: The company generates revenue from two main segments: Tooling, which contributes $11.97 million, and Production, accounting for $107.78 million.

Market Cap: £31.28M

CT Automotive Group plc, with a market cap of £31.28 million, has shown robust financial health and growth potential despite some volatility. The company has become profitable over the past five years, with earnings growing by 35.9% annually and a recent year-over-year increase of 19.7%. Its return on equity is high at 29.2%, and its debt levels are satisfactory, well-covered by operating cash flow. While sales growth may be softer than expected for fiscal year 2025, improvements in gross margin support profitability expectations. However, the management team and board are relatively new to their roles, which could impact strategic continuity.

- Navigate through the intricacies of CT Automotive Group with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into CT Automotive Group's future.

Liontrust Asset Management (LSE:LIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of approximately £231.84 million.

Operations: The company generates revenue primarily from its Investment Management segment, which accounts for £169.79 million.

Market Cap: £231.84M

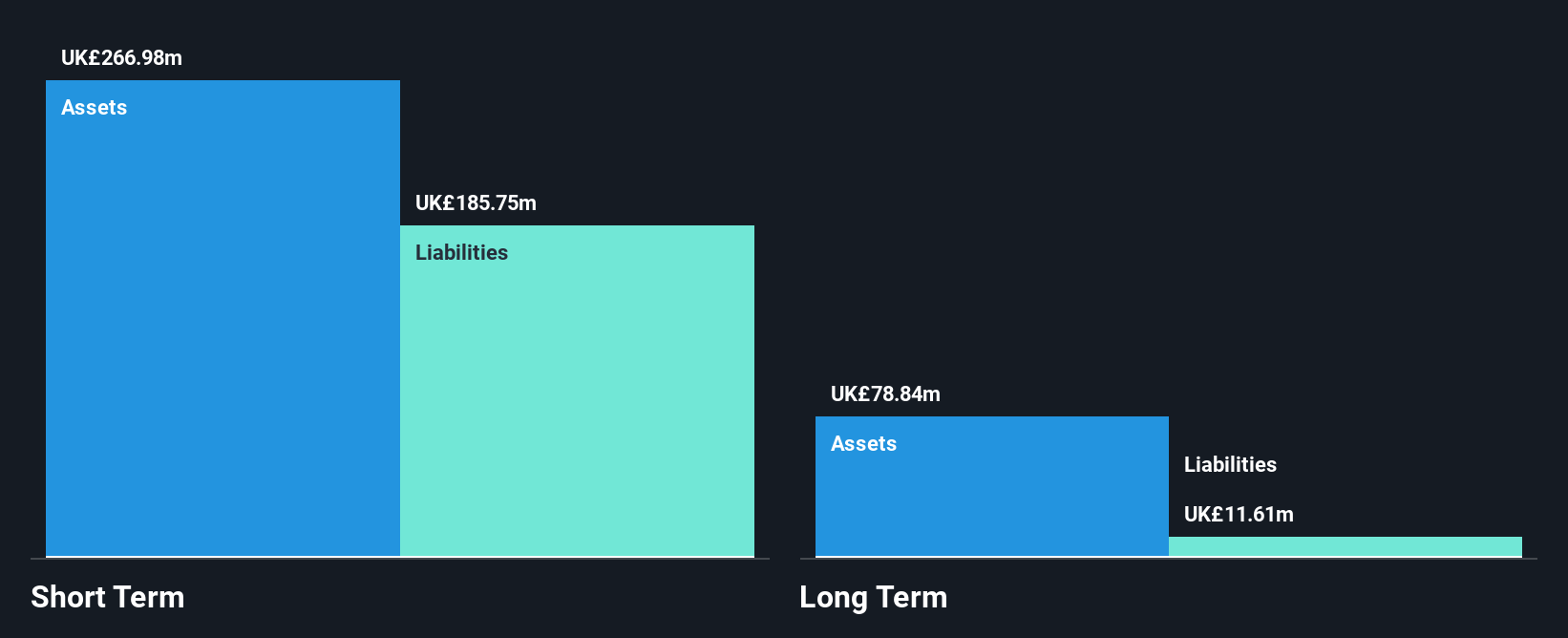

Liontrust Asset Management, with a market cap of £231.84 million, has demonstrated financial resilience by becoming profitable in the past year with net income reaching £16.7 million from a prior loss. Despite a decline in sales to £169.79 million, the company maintains strong liquidity with short-term assets exceeding both long-term and short-term liabilities significantly. The absence of debt further strengthens its financial position, though its return on equity remains low at 12.1%. Recent leadership changes aim to bolster global distribution efforts, while dividends remain consistent at 72 pence per share annually despite coverage concerns by earnings or cash flows.

- Click here and access our complete financial health analysis report to understand the dynamics of Liontrust Asset Management.

- Gain insights into Liontrust Asset Management's future direction by reviewing our growth report.

Petra Diamonds (LSE:PDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Petra Diamonds Limited is involved in the mining, processing, sorting, and sale of rough diamonds in South Africa and Tanzania with a market cap of £34.96 million.

Operations: The company's revenue is primarily derived from its mining operations in South Africa, with $90 million generated from the Finsch mine and $171 million from the Cullinan Mine.

Market Cap: £34.96M

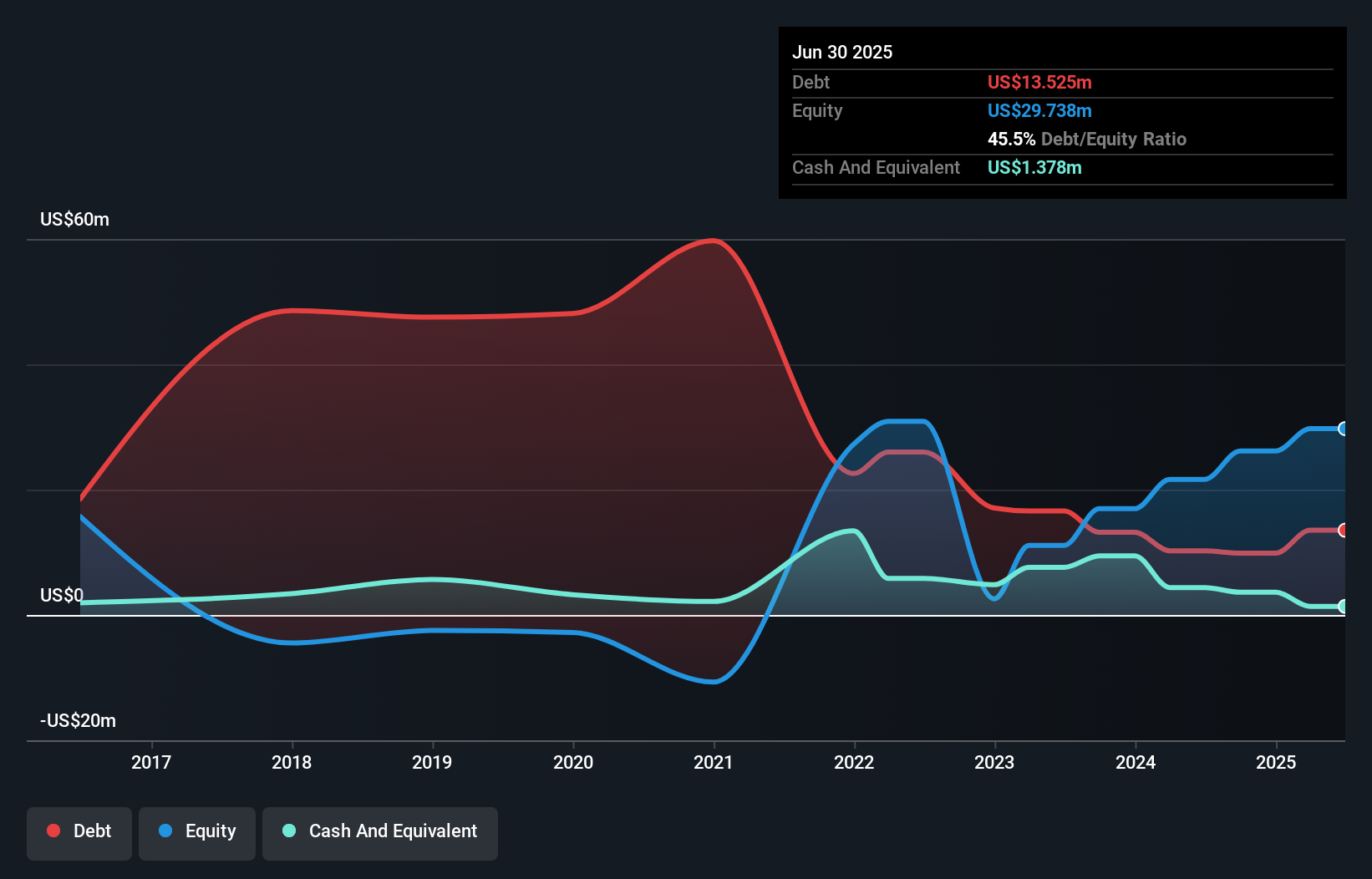

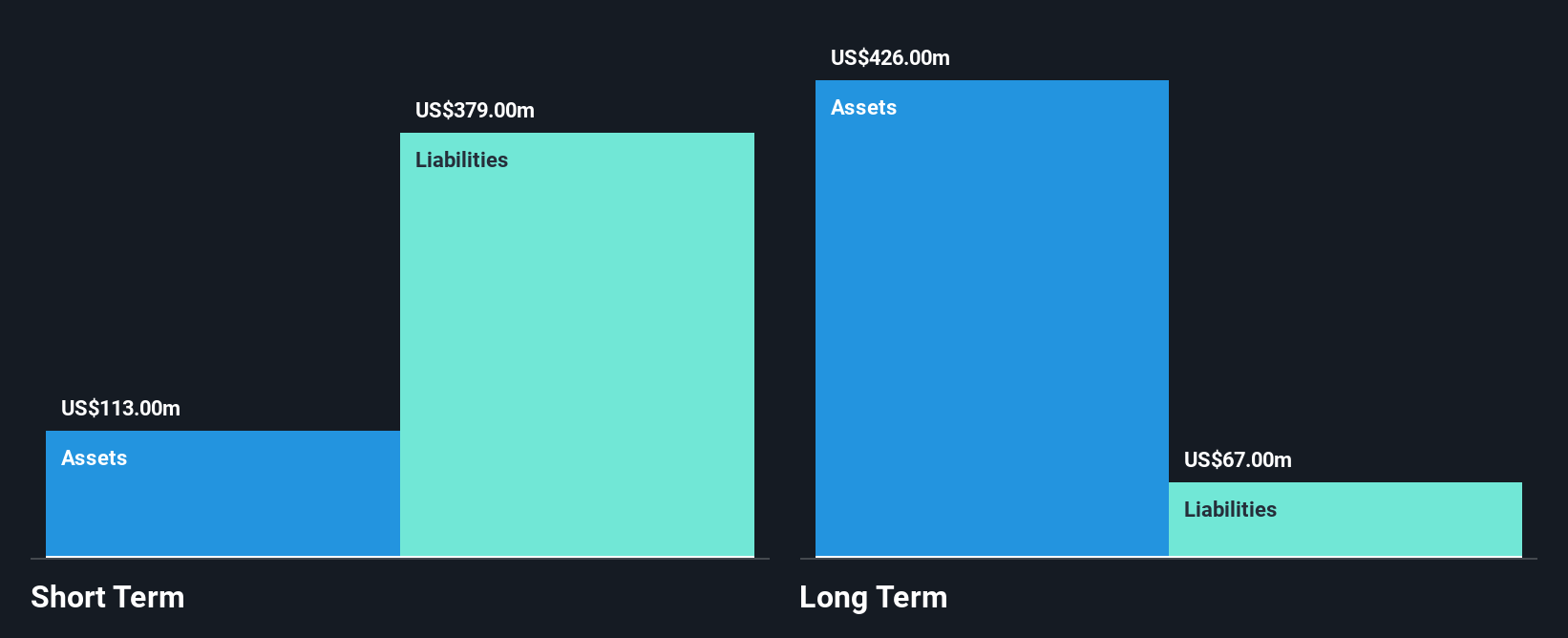

Petra Diamonds Limited, with a market cap of £34.96 million, faces challenges as it remains unprofitable and was recently dropped from the FTSE All-Share Index. Despite generating revenue primarily from its Finsch and Cullinan mines in South Africa, the company struggles with high volatility and short-term liabilities exceeding short-term assets ($179M vs $416M). The debt to equity ratio has improved but remains high at 175.7%. The board's inexperience may impact strategic direction, although a sufficient cash runway for over three years offers some stability amidst these financial hurdles.

- Dive into the specifics of Petra Diamonds here with our thorough balance sheet health report.

- Explore historical data to track Petra Diamonds' performance over time in our past results report.

Key Takeaways

- Click here to access our complete index of 298 UK Penny Stocks.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PDL

Petra Diamonds

Engages in the mining, processing, sorting, and sale of rough diamonds in South Africa and Tanzania.

Good value with reasonable growth potential.

Market Insights

Community Narratives