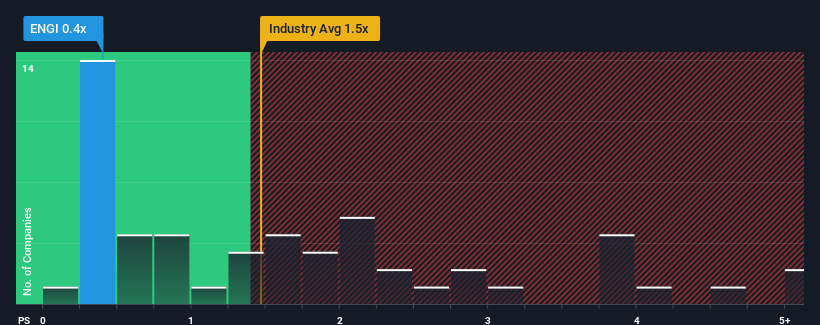

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Integrated Utilities industry in France, you could be forgiven for feeling indifferent about Engie SA's (EPA:ENGI) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Engie

How Has Engie Performed Recently?

Engie certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Engie.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Engie would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The strong recent performance means it was also able to grow revenue by 71% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should bring plunging returns, with revenue decreasing 5.4% per year as estimated by the analysts watching the company. With the rest of the industry predicted to shrink by 0.06% per annum, it's a sub-optimal result.

With this in mind, we find it intriguing that Engie's P/S is similar to its industry peers. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Bottom Line On Engie's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Engie currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. We also have our reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Engie, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Engie, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026