- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

Engie (ENXTPA:ENGI) Valuation in Focus After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

Engie (ENXTPA:ENGI) has just caught the market’s eye, with its stock moving amid a period that has been relatively quiet for any one particular trigger. For investors watching the utility giant, the recent price swings might seem like routine market noise, but they also prompt important questions about where the company is headed. Sometimes, an unremarkable trading week can still bring valuation into the spotlight, especially when long-term trends and fundamentals come into play.

Looking at the bigger picture, Engie’s stock climbed 23% over the past year, outpacing many peers in its sector. However, more recently, shares have pulled back, dipping nearly 9% in the past three months and sliding about 5% over the past month. Despite some near-term ebb and flow, long-term momentum has been strong, with gains topping 87% over three years and 136% in five years. This hints that the underlying story remains resilient through cycles and headline events alike.

With such a mix of short-term dips and big-picture strength, is Engie now trading at a discount, or are markets already factoring in any future growth? The next section takes a closer look at whether the valuation lines up with opportunity.

Most Popular Narrative: 15.9% Undervalued

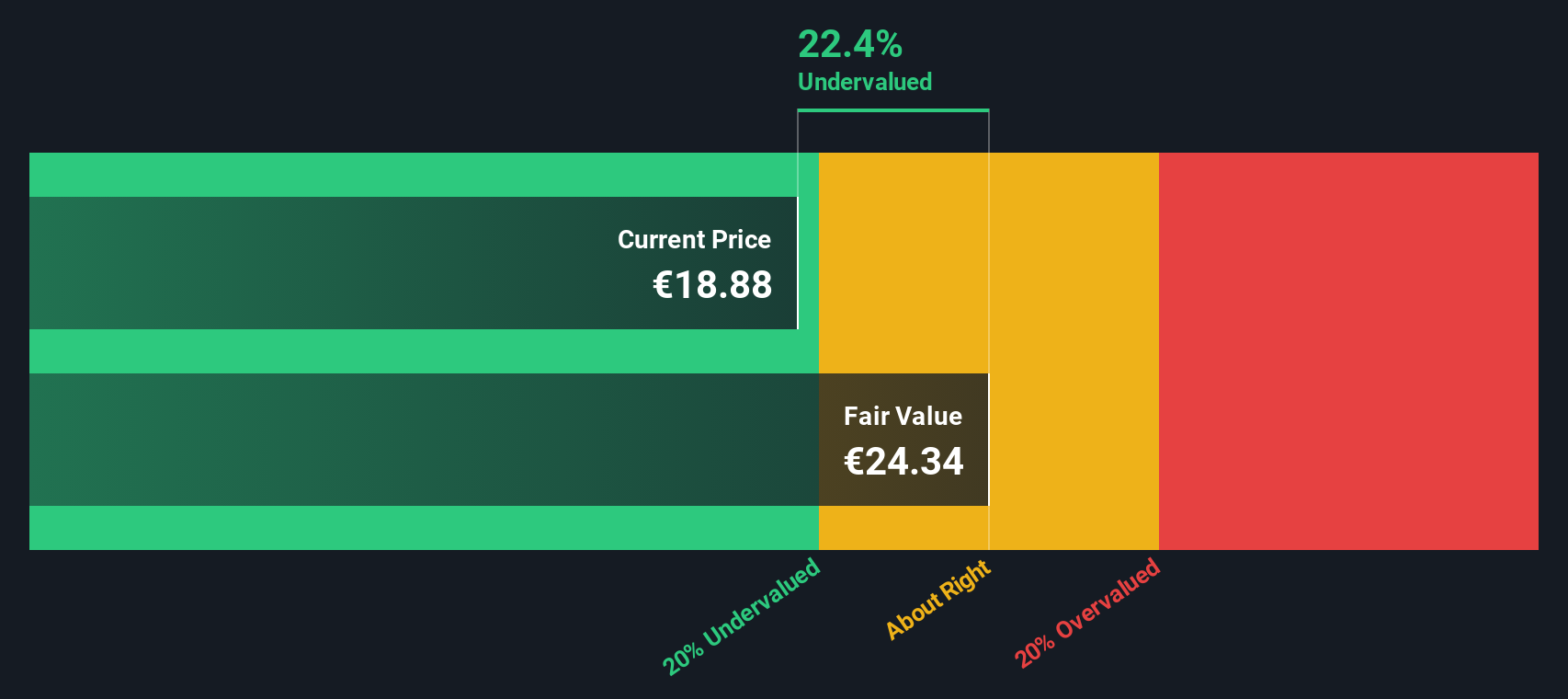

Opinion among analysts is that Engie is currently trading well below its calculated fair value. The narrative suggests that the market could be underestimating the company's growth outlook, despite near-term earnings headwinds and sector volatility.

Strategic expansion in renewables and energy storage, highlighted by nearly 53 GW of installed renewables/BESS capacity and a 118 GW development pipeline diversified across multiple geographies, positions Engie to capture an outsized share of the multi-decade shift to clean energy. This supports sustainable top-line and earnings growth.

Wondering what truly fuels the optimism behind this undervaluation? The narrative hinges on bold expectations for future margins, revenue streams and profit multiples that challenge the recent market mood. Could this be the strategic play that unlocks value as global dynamics shift? Find out what financial assumptions insiders are betting on and why this price target could surprise the market.

Result: Fair Value of €21.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent currency headwinds and project execution setbacks could quickly cool optimism. These factors serve as key risks to the bullish valuation thesis.

Find out about the key risks to this Engie narrative.Another View: SWS DCF Model Reinforces Undervaluation

Looking through the lens of our DCF model, which uses a fundamentally different approach, the conclusion is similar: Engie still shows up as undervalued. But is the SWS DCF catching something others have missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Engie Narrative

If the consensus doesn't quite fit your outlook or you want to craft your own perspective, there's nothing stopping you from exploring the numbers and building your narrative in just a few minutes. Do it your way

A great starting point for your Engie research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investing Opportunities?

Don't just stop at Engie. There are standout stocks in every corner of the market waiting for smart investors to seize the moment. Uncover new ideas now, so you’re never out of the loop when the next breakout happens.

- Jumpstart your search for stocks with exceptional income potential and put your money to work with dividend stocks with yields > 3%.

- Catalyze your portfolio's growth by focusing on tomorrow’s breakthroughs in the world of AI penny stocks.

- Capitalize on value opportunities today by scanning for shares that are priced below their true worth with our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives