- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Top Dividend Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty with rate cuts from the ECB and SNB, and anticipation of a Federal Reserve cut, investors are keenly observing how these shifts impact various sectors. While major indices like the Nasdaq have reached new heights, others have seen declines, highlighting the importance of strategic investment choices in such fluctuating times. In this environment, dividend stocks can offer stability and income potential by providing regular payouts even amid market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.05% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.31% | ★★★★★★ |

Click here to see the full list of 1935 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €813.73 million.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the Production and Distribution of Electricity and Gas (€1.24 billion) and as an Electricity Distributor (€302.94 million).

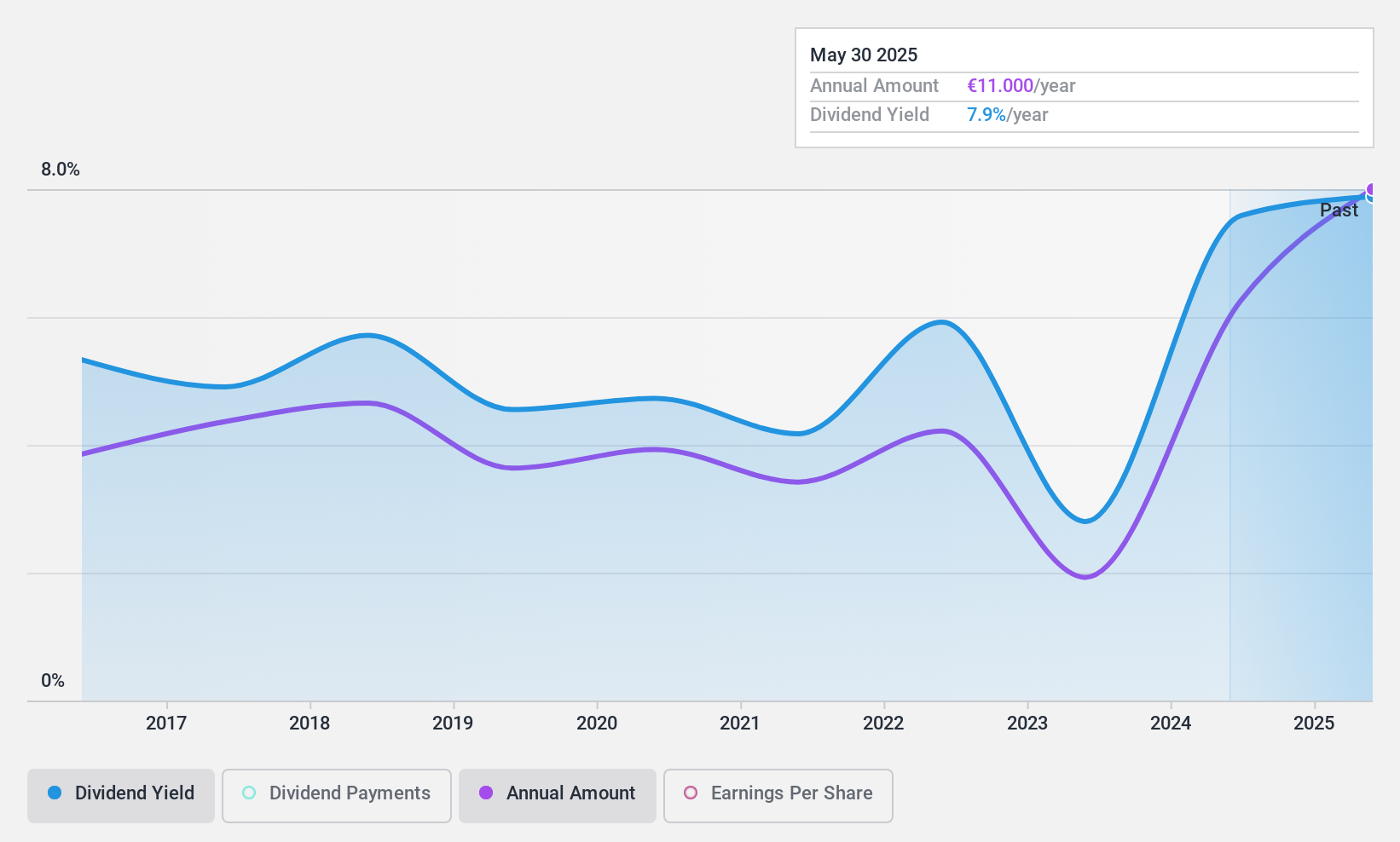

Dividend Yield: 7.6%

Électricité de Strasbourg Société Anonyme's dividend yield of 7.58% places it in the top 25% of French market dividend payers, yet its history shows volatility with unstable payments over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 43.8% and 38.6%, respectively. Recent earnings growth of 96.7% highlights potential for future stability, although past inconsistencies warrant caution for income-focused investors seeking reliability.

- Dive into the specifics of Électricite de Strasbourg Société Anonyme here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Électricite de Strasbourg Société Anonyme is trading behind its estimated value.

BGF retail (KOSE:A282330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BGF Retail Co., Ltd. operates convenience stores in South Korea and has a market cap of ₩1.78 trillion.

Operations: BGF Retail Co., Ltd. generates revenue from its convenience store operations in South Korea, amounting to ₩8.52 billion.

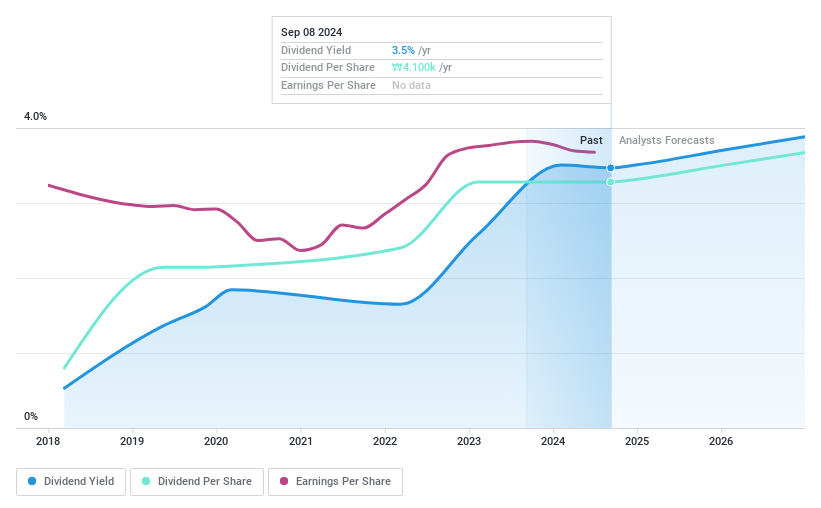

Dividend Yield: 4%

BGF retail's dividend yield of 3.98% ranks it among the top 25% of Korean market dividend payers, supported by stable and growing payments over seven years. The dividends are well-covered with a low payout ratio of 37.2% and a cash payout ratio of 15.7%, indicating sustainability backed by earnings and cash flows. Trading significantly below fair value estimates suggests potential for capital appreciation alongside income generation, though its relatively short dividend history may concern some investors.

- Get an in-depth perspective on BGF retail's performance by reading our dividend report here.

- According our valuation report, there's an indication that BGF retail's share price might be on the cheaper side.

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG specializes in the development of vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle industries globally, with a market cap of €178 million.

Operations: EDAG Engineering Group AG generates its revenue through three primary segments: Vehicle Engineering (€488.72 million), Production Solutions (€280.93 million), and Electrics/Electronics (€102.73 million).

Dividend Yield: 7.7%

EDAG Engineering Group's dividend yield of 7.72% positions it in the top 25% of German market payers, with a payout ratio of 65.1% and a cash payout ratio of 18%, indicating strong coverage by earnings and cash flows. However, its nine-year dividend history is marked by volatility and declining payments, raising concerns about reliability. Recent earnings guidance revision reflects challenging market conditions, impacting investor confidence despite the stock trading below analyst price targets with a P/E ratio of 8.5x.

- Take a closer look at EDAG Engineering Group's potential here in our dividend report.

- Our valuation report unveils the possibility EDAG Engineering Group's shares may be trading at a discount.

Summing It All Up

- Unlock our comprehensive list of 1935 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Outstanding track record with excellent balance sheet and pays a dividend.