- France

- /

- Specialty Stores

- /

- ENXTPA:SAMS

Top Dividend Stocks On Euronext Paris For September 2024

Reviewed by Simply Wall St

In September 2024, the French stock market saw modest gains, with the CAC 40 Index adding 0.47%, reflecting cautious optimism among investors following the U.S. Federal Reserve's rate cut. Amid this backdrop of economic adjustments and investor sentiment shifts, dividend stocks on Euronext Paris present compelling opportunities for income-focused investors. When considering top dividend stocks, it's important to focus on companies with strong fundamentals and consistent payout histories, especially in times of economic uncertainty and fluctuating monetary policies.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.93% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.31% | ★★★★★★ |

| Arkema (ENXTPA:AKE) | 4.43% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.94% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.69% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.90% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.69% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.91% | ★★★★★☆ |

| Trigano (ENXTPA:TRI) | 3.39% | ★★★★☆☆ |

| Rexel (ENXTPA:RXL) | 4.54% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

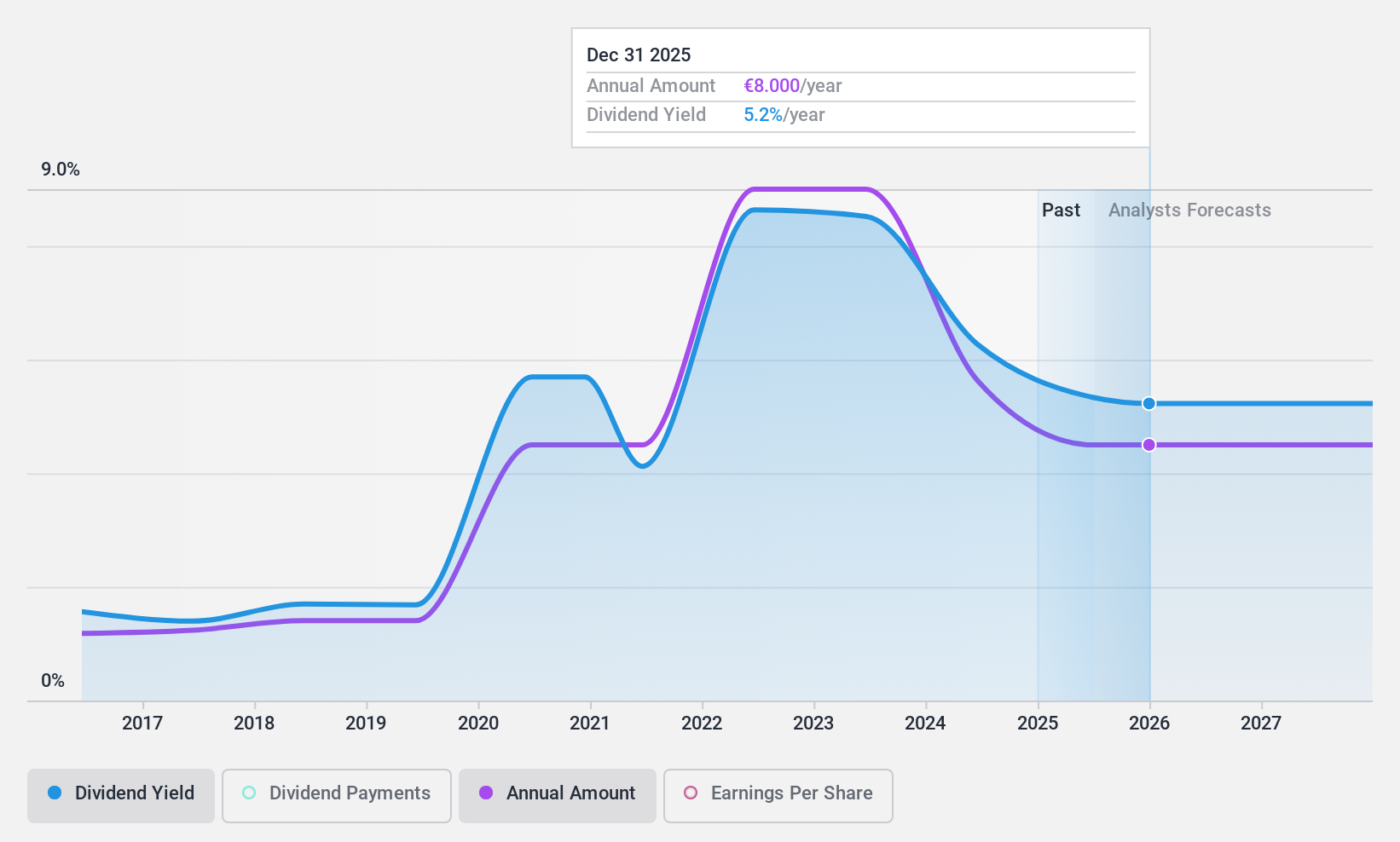

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France and has a market cap of €410.81 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative generates revenue primarily from Proximity Bank (€253.67 million) and Management for Own Account and Miscellaneous (€92.57 million).

Dividend Yield: 4.9%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offers a reliable dividend, with payments growing steadily over the past 10 years. The current yield of 4.87% is slightly below the top tier in France but remains attractive due to its stability and low payout ratio of 17.9%. Despite trading at 61.5% below fair value estimates, recent financial data is outdated, which could affect future dividend sustainability assessments.

- Click here to discover the nuances of Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative with our detailed analytical dividend report.

- Our valuation report here indicates Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative may be undervalued.

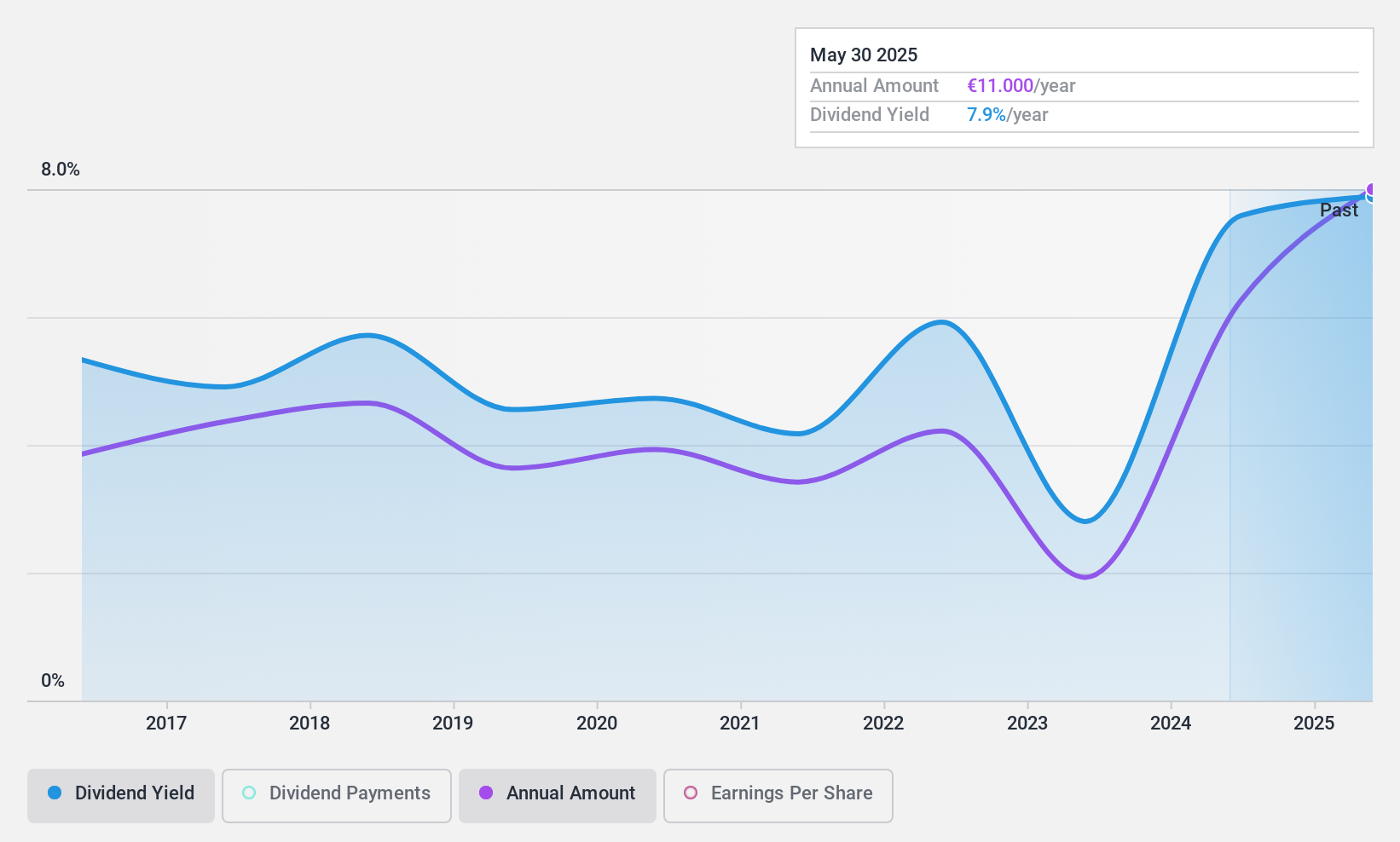

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €770.71 million.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from its Electricity Distributor segment (€288.95 million) and the Production and Distribution of Electricity and Gas segment (€1.40 billion).

Dividend Yield: 8%

Électricité de Strasbourg Société Anonyme's dividend yield of 8% ranks in the top 25% of French dividend payers. However, its dividends are not covered by free cash flows and have been volatile over the past decade. Despite a reasonable payout ratio of 66%, high non-cash earnings raise concerns about sustainability. Trading at 52.8% below estimated fair value, recent earnings growth of 69.9% offers some optimism but does not fully mitigate the risks associated with its dividend reliability.

- Get an in-depth perspective on Électricite de Strasbourg Société Anonyme's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Électricite de Strasbourg Société Anonyme is trading behind its estimated value.

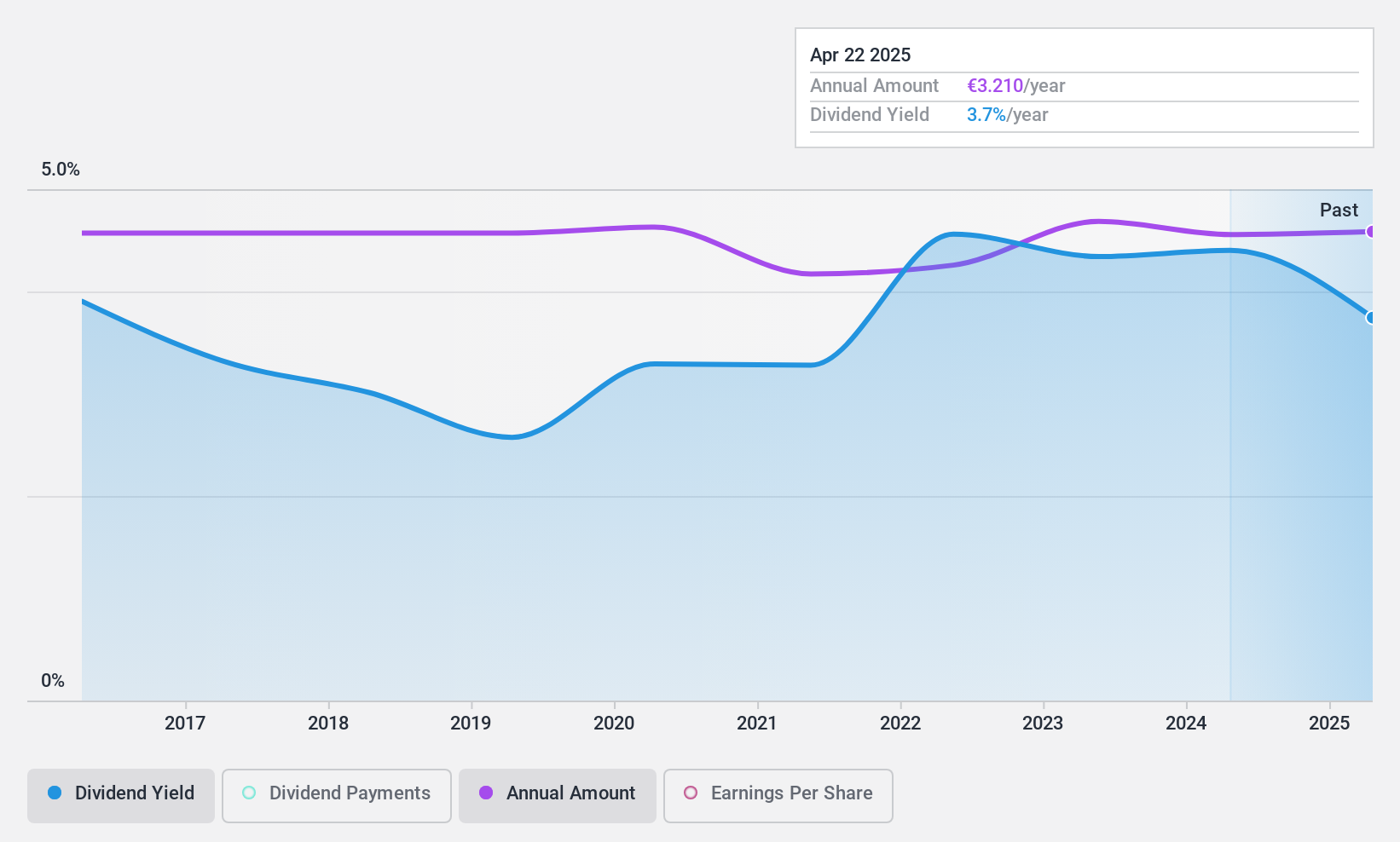

Samse (ENXTPA:SAMS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samse SA distributes building materials and tools in France, with a market cap of €497.05 million.

Operations: Samse SA generates revenue from two main segments: Trading (€1.69 billion) and Do-It-Yourself (€429.36 million).

Dividend Yield: 6.9%

Samse's dividend yield of 6.9% places it in the top 25% of French dividend payers, with dividends well-covered by both earnings (44.8% payout ratio) and cash flows (28% cash payout ratio). However, the company's profit margins have declined from 4.3% to 2.3%, and recent earnings dropped significantly from €41.61 million to €8.18 million year-over-year, raising concerns about dividend sustainability despite a decade-long increase in payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Samse.

- Our comprehensive valuation report raises the possibility that Samse is priced lower than what may be justified by its financials.

Seize The Opportunity

- Explore the 34 names from our Top Euronext Paris Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAMS

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives